I could use some help answering this with the attached spreadsheet:

Glassman Company acculated the following data for 2019:

| Milling Department manufacturing |

$484,000 |

| Finishing Department manufacturing overhead | $260,000 |

| Machine hours used | |

| Milling Department | 10,000 |

| Finishing Deparment | 2000 |

| Labor hours used | |

| Milling Department | 1000 |

| Finishing Department | 1000 |

Assume that manufacturing overhead for Glassman Company above consisted of the following activities and costs:

| Setup (1000 setup hours) | $288,000 |

| Production scheduling (400 batches) | $60,000 |

| Production engineering (60 change orders) | $180,000 |

| Supervision (2000 direct labor hours) | $56,000 |

| Machine maintenance (12,000 machine hours) | $168,000 |

| Total activity costs | $752,000 |

The following additional data were provided for Job 845:

| Direct materials costs | $7000 |

| Direct labor cost (5 milling direct labor hours; 35 finishing direct labor house) | $1000 |

| Setup hours | 5 hours |

| Production scheduling | 1 batch |

| Machine hours used (25 milling machine hours; 5 finishing machine hours) | 30 hours |

| Product engineering | 3 change orders |

Problems:

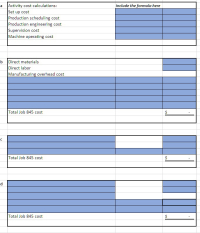

a) Calculate the cost per unit of activity driver for each activity cost category.

b) Calculate the cost of Job 845 using ABC to assign overhead costs.

c) Calculate the cost of Job 845 using the company-wide overhead rate based on machine hours calculated.

d) Calculate the cost of Job 845 using a machine hour departmental overhead rate for the Milling Department and a direct labor hour overhead rate for the Finishing Department.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

- Strong Company applies overhead based on machine hours. At the beginning of 2018, the company estimated that manufacturing overhead would be OMR 120,000, and machine hours would total 15,000. By 2018 year-end, actual overhead totaled OMR 140,000, and actual machine hours were 20,000. On the basis of this information, the 2018 predetermined overhead rate was:arrow_forward.arrow_forwardThe following is a summary of costs related to a month of manufacturing products: Direct Materials and Direct Labor = $225,000.00 Indirect Materials, Indirect Labor, and other actual FOH costs = $30,000.00 FOH costs applied to WIP during the month = $17,000.00 From the following, select the journal entry used to record the FOH applied to production during the month. Group of answer choices a) Debit FOH 17,000 and Credit WIP 17,000 b) Debit WIP 30,000 and Credit FOH 30,000 c) Debit FOH 30,000 and Credit Accounts Payable 30,000 d) Debit WIP 17,000 and Credit FOH 17,000arrow_forward

- How do I determine the cost of one unit each of SW100 and SG150, assuming a company wide overhead rate is used based on total machine hours? Round rate to two decimal places.arrow_forwardcalculate unit costs and create cost reconcilliationarrow_forwardChecker Inc. produces automobile bumpers. Overhead is applied on the basis of machine hours required for cutting and fabricating. A predetermined overhead application rate of $12.70 per machine hour was established for 2019. Required: If 9,000 machine hours were expected to be used during 2019, how much overhead was expected to be incurred? Actual overhead incurred during 2019 totaled $121,650, and 9,100 machine hours were used during 2019. Calculate the amount of over- or underapplied overhead for 2019. (Input the amount as positive value.) Whether the overapplied or underapplied overhead for the year is normally transferred to cost of goods sold in the income statement?arrow_forward

- The Sanding Department of Quik Furniture Company has the following production and manufacturing cost data for March 2020, the first month of operation.Production: 7,100 units finished and transferred out; 3,000 units started that are 100% complete as to materials and 20% complete as to conversion costs.Manufacturing costs: Materials $40,400; labor $20,600; overhead $39,460.Prepare a production cost report. (Round unit costs to 2 decimal places, e.g. 2.25 and other answers to 0 decimal places, e.g. 125.)arrow_forward5) Hakan&Ahmet Manufacturing Company uses applied overhead rate for allocating its manufacturing overhead to its products. The following information is estimated for the upcoming year of 2024: BUDGETED COSTS AND ESTIMATED ACTIVITY LEVELS Budgeted MOH Budgeted Direct Materals Cost Budgeted Direct Labor Cost Estimated Direct Labor Hours Estimated Machine Hours AMOUNTS and HOURS $ 720,000 $ 600,000 $ 480,000 72,000 dlh 120,000 mh At the end of the first week of January 2024, the company completed only one job order. Actual costs and actual usage of dlh and mh for this unit were as follows: Job Order Direct Material Cost ($) 100 GRS-34 Direct Labor Direct Labor Cost ($) 150 Hours 15 Machine Hours 30 Q1) Calculate a predetermined manufacturing overhead rate (applied overhead rate) by using each of the cost drivers of "direct materials cost", "direct labor hours", "direct labor costs" and "machine hours". Q2) By using each of these rates, calculate the unit cost of this job order.arrow_forwardThe Welding Department of Concord Company has the following production and manufacturing cost data for February 2020. All materials are added at the beginning of the process. Manufacturing Costs Production Data Beginning work in process Beginning work in process 15,100 units, 1/10 complete Materials $18,100 Units transferred out 55,400 Conversion costs 14,960 $33,060 Units started 51,300 Materials 237,540 Ending work in process 11,000 units, 1/5 complete Labor 67,900 Overhead 89,940 Prepare a production cost report for the Welding Department for the month of February. (Round unit costs to 2 decimal places, e.g. 2.25 and all other answers to 0 decimal places, e.g. 1,225.)arrow_forward

- Provide answers along with the calculation.arrow_forwardOriole Company provided the following information from its accounting records for 2019: Expected production 100000 labor hours Actual production 96000 labor hours Budgeted overhead $2100000 Actual overhead $1840000 How much is the overhead application rate if Oriole Company bases it on direct labor hours? $21.00 per hour $19.17 per hour $21.88 per hour $18.40 per hourarrow_forwardThe Assembly Department of the Long-Distance Golf Club Super Driver Company, has the following production and cost data at the end of March, 2021. Production: 12,600 units started into production; 11,500 units transferred out and 1,100 units 100% completed as to materials and 70% completed as to conversion costs. Manufacturing Costs: Materials added at beginning of process, $49,750; Labor, $61,550; Overhead $32,440. Instructions Prepare a Production Cost Report for the Company for the month of March 2021.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education