Chemistry

10th Edition

ISBN: 9781305957404

Author: Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCoste

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

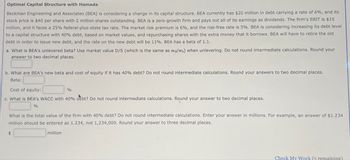

Transcribed Image Text:Optimal Capital Structure with Hamada

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 6%, and its

stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm's EBIT is $15

million, and it faces a 25% federal-plus-state tax rate. The market risk premium is 6%, and the risk-free rate is 5%. BEA is considering increasing its debt level

to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old

debt in order to issue new debt, and the rate on the new debt will be 11%. BEA has a beta of 1.1.

a. What is BEA's unlevered beta? Use market value D/S (which is the same as wd/ws) when unlevering. Do not round intermediate calculations. Round your

answer to two decimal places.

b. What are BEA's new beta and cost of equity if it has 40% debt? Do not round intermediate calculations. Round your answers to two decimal places.

Beta:

Cost of equity:

%

c. What is BEA's WACC with 40% debt? Do not round intermediate calculations. Round your answer to two decimal places.

%

What is the total value of the firm with 40% debt? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1.234

million should be entered as 1.234, not 1,234,000. Round your answer to three decimal places.

million

Check My Work (5 remaining)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $14 per share 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 11.5 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Current share price $ 166.17arrow_forwardhe partnership of Winn, Xie, Yang, and Zed has the following balance sheet: Cash $ 35,000 Liabilities $ 47,000 Other assets 241,000 Winn, capital (50% of profits and losses) 65,000 Xie, capital (30%) 84,000 Yang, capital (10%) 45,000 35,000 Zed, capital (10%) Zed is personally insolvent, and one of his creditors is considering suing the partnership for the $4,000 that is currently owed. The creditor realizes that this litigation could result in partnership liquidation and does not wish to force such an extreme action unless Zed is reasonably sure of obtaining at least $4,000 from the liquidation. Determine the amount for which the partnership must sell the other assets to ensure that Zed receives $4,000 from the liquidation. Liquidation expenses are expected to be $20,000. (Do not round intermediate calculations.) Minimum Amount:arrow_forwardvonconstant Growth Stock valuation Reizenstein Technologies (RT) has just developed a solar panel capable of generating 200% more electricity than any solar panel currently on the market. As a result, RT is expected to experience a 20% annual growth rate for the next 5 years. By the end of 5 years, other firms will have developed comparable technology, and RT's growth rate will slow to 5% per year indefinitely. Stockholders require a return of 10% on RT's stock. The most recent annual dividend (D), which was paid yesterday, was $2.95 per share. a. Calculate RT's expected dividends for = 1, 2, 3, 4, and r = 5. Do not round intermediate calculations. Round your answers to the nearest cent. D₁ = $ D₂ = $ D₂ = $ D₁ = $ D₁ = $ b. Calculate the estimated intrinsic value of the stock today, widehat(P), Proceed by finding the present value of the dividends expected at 1,1 = 2,1 = 3,1 = 4, and 5 plus the present value of the stock price that should exist at = 5, widehat(P). The widehat(P) stock…arrow_forward

- In 1999, Amazon Inc. is considering launching a new e -commerce business specializing in cloud computing services. The project is tentatively named Amazon Web Services (henceforth "AWS"). To assess the feasibility of AWS, Amazon's CFO has identified Oracle Corp. (NYSE: ORCL) as a somparable firm that has a similar business risk and estimated the following information: Oracle has equity and debt worth $20 billion and $40 billion, respectively. Oracle's equity beta and debt beta are estimated at 1.8 and 0.1, respectively. Oracle's marginal tax rate is estimated at 25%. Amazon CFO is trying to determine the weighted average cost of capital for AWS. He believes that Amazon's cost of debt will apply to AWS's debt financing. The CFO's estimate of the CAPM beta of AWS's debt is 0.2. AWS is expected to maintain a target leverage ratio of 50% ( equivalently, debt/equity = 1) and to face a marginal tax rate of 20% in the foreseeable future. Assume that the tisk - free rate is 3% and the market…arrow_forwardAdvance Financial Management You have just been hired by Internal Business Machines Corporation ( IBM ) in their capital budgeting division. Your first assignment is to determine the free cash flows and net present value ( NPV ) of a proposed new type of tablet computer similar in size to an iPad but with the operating power of a high - end desktop system. Development of the new system will initially require an initial capital expenditure equal to 1 0 % of IBM's Property, Plant and Equipment ( PPE ) at the end of the latest fiscal year ( December 2 0 2 3 ) for which data is available. The project will then require an additional investment equal to 1 0 % of the initial investment after the first year of the project, a 5 % increase after the second year, and a 1 % increase after the third, fourth and fifth years. The product is expected to have a life of five years. First - year revenues for the new product are expected to be 3 % of IBM's total revenue for the…arrow_forwardQuestion 5 Complete Marked out of 5.00 Flag question Amazon Corporation has 10 million shares of common stock outstanding, 270,000 shares of 4% $100 par value preferred stock outstanding, and 149,000 7.50% semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $94 per share and has a beta of 1.40, the preferred stock currently sells for $92 per share, and the bonds have 10 years to maturity and sell for 125% of par. The market risk premium is 9.6%, T-bills are yielding 5%, and Amazon's Corporate tax is 38%. a) What is the firms market value of Capital? (2Marks) b) Calculate WACC (Weighted Average Cost of Capital)? (3Marks)arrow_forward

- Finch, Incorporated, is debating whether to convert its all-equity capital structure to one that is 30 percent debt. Currently, there are 13,000 shares outstanding, and the price per share is $43. EBIT is expected to remain at $72,800 per year forever. The interest rate on new debt is 6.5 percent, and there are no taxes. a. Allison, a shareholder of the firm, owns 200 shares of stock. What is her cash flow under the current capital structure, assuming the firm has a dividend payout rate of 100 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. What will Allison's cash flow be under the proposed capital structure of the firm? Assume she keeps all 200 of her shares. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Assume that Allison unlevers her shares and re- creates the original capital structure. What is her cash flow now? (Do not round intermediate calculations and round…arrow_forwardDiscutez de l'hypothèse des marchés efficaces (EMH) et de ses implications pour les investisseurs et les marchés financiers. Expliquez les trois formes d'EMH et donnez des exemples de chaque forme. Comment l'hypothèse d'efficience du marché affecte - t -elle les stratégies d'investissement?arrow_forward] Christine and Bradley invested equal amounts of money in a business. A year later, Christine withdrew $1,400 making the ratio of their investments 2:5. How much money did each of them invest in the beginning? Round to the nearest cent Aarrow_forward

- QNO2 Senior management of Bayside Biotechtronics is considering two mutually exclusive investment projects. The projected net cash flows for projects A and B are summarized in Table If the discount rate (cost of capital) is expected to be 12%, which project should be undertaken? Net Cash Flows (CFt) for Projects A and B Project B -$19,000 6,000 6,000 6,000 Year, t 0 1 2 3 4 5 Project A -$25,000 7,000 8,000 9,000 9,000 5,000 6,000 6,000arrow_forwardcould you please help me with the major product or products for the following reaction?arrow_forwardMethane (CH4) is burned with air (79% N2 and 21% O2 by volume) at atmospheric pressure. The molar analysis of the flue gas yields CO, %3D 10.00%, O2 = 2.41%, C0= 0.52%, and N2 = 87.07%. Balance the combustion %3D equation and determine the mass air-fuel ratio, the of stoichiomet- percentage ric air, and the of excess air. percentagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

ChemistryChemistryISBN:9781305957404Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCostePublisher:Cengage Learning

ChemistryChemistryISBN:9781305957404Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCostePublisher:Cengage Learning ChemistryChemistryISBN:9781259911156Author:Raymond Chang Dr., Jason Overby ProfessorPublisher:McGraw-Hill Education

ChemistryChemistryISBN:9781259911156Author:Raymond Chang Dr., Jason Overby ProfessorPublisher:McGraw-Hill Education Principles of Instrumental AnalysisChemistryISBN:9781305577213Author:Douglas A. Skoog, F. James Holler, Stanley R. CrouchPublisher:Cengage Learning

Principles of Instrumental AnalysisChemistryISBN:9781305577213Author:Douglas A. Skoog, F. James Holler, Stanley R. CrouchPublisher:Cengage Learning Organic ChemistryChemistryISBN:9780078021558Author:Janice Gorzynski Smith Dr.Publisher:McGraw-Hill Education

Organic ChemistryChemistryISBN:9780078021558Author:Janice Gorzynski Smith Dr.Publisher:McGraw-Hill Education Chemistry: Principles and ReactionsChemistryISBN:9781305079373Author:William L. Masterton, Cecile N. HurleyPublisher:Cengage Learning

Chemistry: Principles and ReactionsChemistryISBN:9781305079373Author:William L. Masterton, Cecile N. HurleyPublisher:Cengage Learning Elementary Principles of Chemical Processes, Bind...ChemistryISBN:9781118431221Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. BullardPublisher:WILEY

Elementary Principles of Chemical Processes, Bind...ChemistryISBN:9781118431221Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. BullardPublisher:WILEY

Chemistry

Chemistry

ISBN:9781305957404

Author:Steven S. Zumdahl, Susan A. Zumdahl, Donald J. DeCoste

Publisher:Cengage Learning

Chemistry

Chemistry

ISBN:9781259911156

Author:Raymond Chang Dr., Jason Overby Professor

Publisher:McGraw-Hill Education

Principles of Instrumental Analysis

Chemistry

ISBN:9781305577213

Author:Douglas A. Skoog, F. James Holler, Stanley R. Crouch

Publisher:Cengage Learning

Organic Chemistry

Chemistry

ISBN:9780078021558

Author:Janice Gorzynski Smith Dr.

Publisher:McGraw-Hill Education

Chemistry: Principles and Reactions

Chemistry

ISBN:9781305079373

Author:William L. Masterton, Cecile N. Hurley

Publisher:Cengage Learning

Elementary Principles of Chemical Processes, Bind...

Chemistry

ISBN:9781118431221

Author:Richard M. Felder, Ronald W. Rousseau, Lisa G. Bullard

Publisher:WILEY