Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

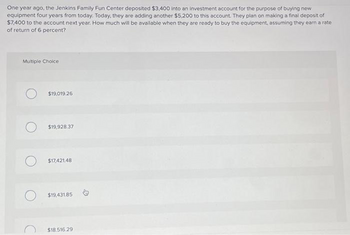

Transcribed Image Text:One year ago, the Jenkins Family Fun Center deposited $3,400 into an investment account for the purpose of buying new

equipment four years from today. Today, they are adding another $5,200 to this account. They plan on making a final deposit of

$7,400 to the account next year. How much will be available when they are ready to buy the equipment, assuming they earn a rate

of return of 6 percent?

Multiple Choice

$19,019.26

$19,928.37

$17,421.48

$19,431.85

$18.516.29

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- "If you purchase a car from a certain dealership, you expect to have four free oil changes per year during the five years you keep the car. Each oil change would normally cost you $22.58. If you save your money in a mutual fund earning 2.16% per quarter, how much are the oil changes worth to you at the time you buy the car?" A 210.61 B 426.79 C 563.06 D 593.46 E 842.56arrow_forward"If you purchase a car from a certain dealership, you expect to have four free oil changes per year during the five years you keep the car. Each oil change would normally cost you $26.49. If you save your money in a mutual fund earning 3.94% per quarter, how much are the oil changes worth to you at the time you buy the car?" A 786.62 (B) 478.04 986.57 D) 138.72 (E) 981.99arrow_forwardPlease show all work for 5 & 6arrow_forward

- HR wants to offer a Country Club membership for a group of employees that will cost the company $10,000 dollars a year. They will begin annually starting one year from now. 1. What amount must be invested today at 8.0% compounded annually to fund the scholarship program in perpetuity? 2. Given the current economic climate the CEO has lowered the initial investment amount you had available to $100,000, how much do you now have for the Country Club membership program?arrow_forwardYou want to have $10,500 saved 8 years from now. How much less can you deposit today to reach this goal if you can earn 7 percent rather than 5 percent on your savings? Multiple Choice $1,007.94 $995.72 $1,023.90 $1,036.34arrow_forwardAccumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $145,000. Inflation is expected to cause this price to increase at 4% per year over the 25 years before C. L. Donovan retires. If Donovan earns 9% on his investments, ow large must an equal, end-of-year deposit must be to provide the cash needed to buy the home 25 years from now? The equal, annual end-of-year deposit to be made each year into the account is $ (Round to the nearest cent.)arrow_forward

- 3. A village has six residents, each of whom has accumulated savings of $100. Each villager can use this money either to buy a government bond that pays 15% per year. Or they can buy a llama, send it onto the commons to graze and then sell it after one year. The price the villager gets for selling the llama depends on quality of fleece it grows. The quality of fleece depends on how many llamas are grazing. At the end of the year the villager will have $115 if they buy the bond or $109-$122 if they buy the llama depending on how many llamas are purchased Number of Llamas 1 2 3 4 5 6 Price per Llama 122 118 116 114 112 109 a. If each villager decides individually how to invest, how many llamas will be sent onto the commons and what will be the net village income? b. What is the socially optimal number of llamas for this village? c. The village committee votes to auction the right to graze the llamas to the highest bidder. How much will the grazing right sell for? What will be the net…arrow_forwardProblem 04.045 - Effort to save money for early retirement In an effort to save money for early retirement, an environmental engineering colleague plans to deposit $1300 per month, starting one month from now, into a fixed rate account that pays 8% per year compounded annually. How much will be in the account at the end of 16.00 years? At the end of 16.00 years, the account will be $ 500068arrow_forwardYou want to create an endowment income of $35,000 per year for Oxtordshire Charity, but the Tirst payment will not be made until the 4th year's time. a. If you can earn a return of 8% APR on your investment, and if the payment is made on a monthly basis, calculate how much to invest now? $5,133,086.81 B. $4,133,086.81 $5,233,086.81 $4,233,086.81 $5,250,000.81arrow_forward

- WITH SOLUTION PLS Suppose you make an annual contribution of P8,698 each year to a college fund for a niece. He is 6 years now, and you will start next year and make the last deposit when he is 18. The fund is a money market account earning 5.29% per year. What will it be worth immediately after the last deposit?arrow_forwardplease answer only last reuriement You are a young personal financial adviser. Molly, one of your clients approached you for consultation about her plan to save aside $450,000 for her child’s higher education in United States 15 years from now. Molly has a saving of $120,000 and is considering different alternative options: Investment 1: Investing that $120,000 in a saving account for 15 years. There are two banks for her choice. Bank A pays a rate of return of 8.5% annually, compounding semi-annually. Bank B pays a rate of return of 8.45 annually, compounding quarterly. Investment 2: Putting exactly an equal amount of money into ANZ Investment Fund at the end of each month for 15 years to get 330 000 she still shorts of now. The fund is offering a rate of return 7% per year, compounding monthly. Required: a) Identify which Bank should Molly choose in Investment 1 by computing the effective annual interest rate (EAR)? b) Calculate the amount of money Molly would accumulate…arrow_forwardSolve it with a complete solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education