Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

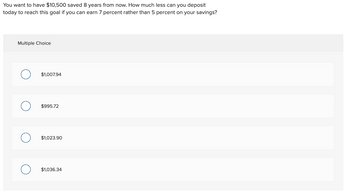

Transcribed Image Text:You want to have $10,500 saved 8 years from now. How much less can you deposit

today to reach this goal if you can earn 7 percent rather than 5 percent on your savings?

Multiple Choice

$1,007.94

$995.72

$1,023.90

$1,036.34

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Annuity: Problem 7 You want to be able to set up a scholraship fund that will last forever and you feel that you can earn 4.5% compounded quarterly. How much money do you have to deposit today in order to be able to provide 2 scholarships of $2000 each?arrow_forwardRequired: Finance homework help 5. An investment you are considering is expected to make payments annually forever. The amount of the next payment is expected to be $4.75. Each subsequent payment is expected to increase by 2.9%. Assume that today you buy this investment for $80. What interest rate should you expect to earn annually?arrow_forwardYou are scheduled to receive $40,000 in two years. When you receive it, you will invest it for 6 more years at 7 percent per year. How much will you have in 8 years? Multiple Choice $45,837.07 $63,030.67 $57,027.75 $68,727.45 $60,029.21arrow_forward

- Fifth Fourth National Bank has a savings program which will guarantee you $14,500 in 11 years if you deposit $95 permonth. What APR is the bank offering you on this savings plan?Multiple ChoiceA. 2,40%B. 2.60% C. 2.87%D. 2.89%E. 2.97%arrow_forwardMultiple Choice Assume you are investing $100 today in a savings account. Which one of the following terms refers to the total value of this investment one year from now? о O O Future value Present value Principal amount Discounted value Invested principal 5 Saved Help Save & Exit 8 Submitarrow_forwardHow much can you live on each month with this retirement plan if you are retiring in 38 years? Monthly savings 731 Amount you have reaty today to invest 10,965 Pre - retirement interest rate you can earn 11% post - retirement interest rate yo can earn 6% When you retire, you'll spend 200,000 for a trip around the world You plan to live 30 years after retirement and leave 2 million$ to your children. Monthly living allowance:arrow_forward

- What will be the value of your saving in 4 years with an interest rate of 10% if you invest $120 today, $220 in two years and withdraw $60 in year 4? Select one: a.$441.88 b.$259.08 c.$381.89 d.$541.02arrow_forwardYou’ve invested your savings at 8% and been able to accumulate $500,000. If you withdraw $50,000 at the end of every year, how long until the balance has been reduced to zero? a. 20.91 years b. 10.00 years c. 18.49 years d. 13.91 years e. 7.63 yearsarrow_forwardYou expect to save $1,000 at the end of every year for 8 years. During the first 3 years, your savings will earn 4%, compounded semi-annually. During the last 5 years, your savings will earn 5%, compounded monthly. How much money will you have after 8 years? Round to the nearest dollar. Select one: a. $9,412 b. $9,546 c. $8,661 d. $9,876arrow_forward

- You want to retire with $400 000 in the bank and you are able to earn 6% compounded quarterly for the next 25 years. How much money do you have to invest today in order to achieve your goal? Select one: a. $90 251.77 b. $90 201.77 c. $90 001.78 d. $90 251.78 e. $90 001.77arrow_forwardVijay shiyalarrow_forwardYou are going to deposit $3,500 in an account that pays .61 percent interest per quarter. How much will you have in 7 years? Multiple Choice $4,124.57 $4,154.34 $4,143.38 $4,149.73 ☐ $4,175.05arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education