Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

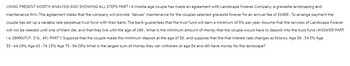

Transcribed Image Text:USING PRESENT WORTH ANALYSIS AND SHOWING ALL STEPS PARTI A middle age couple has made an agreement with Landscape Forever Company, a gravesite landscaping and

maintenance firm. The agreement states that the company will provide "deluxe" maintenance for the couples selected gravesite forever for an annual fee of $1000. To arrange payment the

couple has set up a variable rate perpetual trust fund with their bank. The bank guarantees that the trust fund will earn a minimum of 5% per year. Assume that the services of Landscape Forever

will not be needed until one of them die, and that they live until the age of 100. What is the minimum amount of money that the couple would have to deposit into the trust fund (ANSWER PART

I is 20000 (P/F, 5%, 49) PART II Suppose that the couple made this minimum deposit at the age of 50, and suppose that the that interest rate changes as follows. Age 50 - 54 5% Age

55-64 10% Age 65-74 15% Age 75 - 84 20% What is the largest sum of money they can withdraw at age 84 and still have money for the landscape?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Sheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $195,000 in 18 years. Assuming that the Cooper-Fowler family could obtain a return of 5 percent, how much would they need to invest annually to reach their goal? Use Appendix A-3 or the Garman/Forgue companion website. Round your answer to the nearest dollar. Round Future Value of a Series of Equal Amounts in intermediate calculations to four decimal places.arrow_forwardSOLVE TO HAND LEGIBLE; When a father dies, he leaves his children an inheritance of $3,000,000.00. When the father dies, his children are 5,8,9,12 and 15 years old. Each of the children must receive exactly the same amount of money when they turn 18. The money is deposited in a trust that pays 16% annually, convertible every 8 months: How much money will each of the children receive?arrow_forwardBradley set up a fund that would pay his family 3500 at the beginning of every month, in perpetuity.What was size of the investment in the fund if it was earning 5.50% compounded semi-annually?arrow_forward

- Your grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $10,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit$200,000 (rounded to the nearest whole dollar) so that you can fund the scholarship forever, assuming that the account will earn 6.00% per annum every year.arrow_forwardGeorge Jefferson established a trust fund that provides $172, 500 in scholarships each year for worthy students. The trust fund earns a 3 percent rate of return. How much money did Mr. Jefferson contribute to the fund assuming that only the interest income is distributed?arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- . James decided to fund a school in Orange County in perpetuity. The first payment will be made three years from today (at the end of year three) and will be $5,320. Each year after that, the school will receive payment from James annually. The payment will increase at a rate of 3% per year after the first payment. If the annual interest rate is 9%, what is the present value of this endowment?arrow_forwardIn a family members will, they would like to establish a perpetual trust to provide for the maintenance of a school's learning lab. If the annual maintenance is fixed at $12,500 per year and the trust can earn 5% interest, how much money must be set aside in the trust?arrow_forwardSam wants to donate $1,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of j4-3.81% p.a. effective and the first scholarship will be first awarded 2.5 years after the date of the donation. (b) Assume that the fund's earnings rate rate has changed from 4-3.81% p.a. to j4-3.56% p.a. one year before the first scholarship payment. How much does Sam need to add to the fund at that time (one year before the first scholarship payment) to ensure that scholarship amount will be unchanged (rounded to two decimal places)? Question 9Answer a. 78309.64 b. 74276.05 C. 71226.96 d. 75395.75arrow_forward

- Mike wants to donate $5,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of 4.47% p.a. compounded half-yearly (2=4.47% p.a.) and the first scholarship will be first awarded 3.5 years after the date of the donation. (b) Assume that two years after the donation, Mike needs to withdraw $1,000,000 from the fund and use the remaining amount to provide an annual scholarship in perpetuity. The time of the first scholarship will be unchanged (3.5 years after the date of the donation). What is the new annual scholarship amount (rounded to two decimal places)? a. 101959.37 O b. 206197.54 O c. 203631.53 O d. 207511.86arrow_forwardTHIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you would like to make a donation to your university. This donation will go into the school's endowment pool and the returns generated from the donation will support the salary of a new professor in the business school on a perpetual basis. The university expects to earn returns of 5.5% on its endowment pool. You may assume that any distributions to support the salary will be made annually. Part A) You can make a donation today (t=0) in the amount of $2,500,000. The first cash flow distribution from your donation to cover the professor's salary will take place in one year (at t=1). Which of the following is closest to the annual salary payment that can be made as a result of your donation? A. $137,500 B. $454,545 C. $2,500,000 D. $100,000 Part B) After further discussions, the university determines that the employment agreement with the new professor will call for annual salary increases of 2%. Given this…arrow_forwardPlease step by step answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education