ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

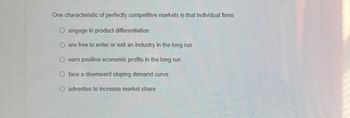

Transcribed Image Text:One characteristic of perfectly competitive markets is that individual firms

O engage in product differentiation

Oare free to enter or exit an industry in the long run

O earn positive economic profits in the long run

O face a downward sloping demand curve

O advertise to increase market share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Refer to Figure K.. If there were four identical firms in this competitive industry, which of the following price-quantity combinations would be on the market supply curve? Point A B C D (A) A and C only B) Bonly C) B and D only D) A only Price (Dollars) 4 4 Quantity (Units) 16 32 32 6 6 8 64 64arrow_forwardCosts and revenue per case 50% a $14 $12 $22 $16 $13 Question 6 Costs and revenue 22 24 30 30 @ 300 The perfectly competitive price would be: MR 22 24 30 3 ATC Demand Quantly (cases) ATC Demand Quantity In the above graph, the firm would earn: $0 in economic profit and break even $44 economic profit $88 economic profit $22 economic loss $44 economic lossarrow_forwardA Quantity Demanded Figure 1 Quantity Demanded Figure 2 For a perfectly competitive firm, which line or lines represent the firm's demand and marginal revenue curves lines B and C respectively in figure 2 lines A and C respectively in figure 2 lines A and B respectively in figue 1 line B only in figure 1 Price, Marginal o Revenue, Total Revenue B. Price, Marginal o Revenue, Total Revenuearrow_forward

- Economic theory would suggest that the profitability of an industry would be O inversely related to the number of firms competing in the industry. O unrelated to the number of firms competing in the industry. O zero in the long run, regardless of market structure. O directly related to the number of firms competing in the industry.arrow_forwardDue to an increase in the price of a competitor's product, the demand for a firm's product increases sharply. How is this most likely to affect the firm's marginal revenue and marginal cost? OA. Both marginal revenue and marginal cost will increase. OB. Marginal revenue will increase but marginal cost will decrease. OC. Marginal revenue will increase but marginal cost will not change. OD. Both marginal revenue and marginal cost will not be affected. OE Marginal revenue will not change but marginal cost will increase.arrow_forwardplease answer allarrow_forward

- Hi hlo Expert Hand written solution is not allowed.arrow_forwardThe perceived demand curve for the is Select the correct answer below: O perfectly competitive firm; also the market demand curve O perfectly competitive firm; downward sloping O monopolist; upward sloping O monopolist; also the market demand curvearrow_forwardProfit is the incentive that drives our market economy. Firms make production, pricing, andhiring decisions based on their quest for profit. But what happens when a firm discoversthat it can make dramatically higher profits by stopping production altogether? In December2000, due to wild swings in the market for electricity, Kaiser Aluminium faced just such adecision.Kaiser Aluminium had contracted with Bonneville power for all of its electricity needs andfound itself in the unique position of being an electricity consumer and, potentially, anelectricity reseller. By December 2000, Kaiser faced a difficult decision of continuing itscurrent aluminium production and profit levels, or closing the plant to dramatically increaseits profit by simply reselling its electricity.When making production decisions, firms must consider both their costs and revenues. Oneimportant concern for many firms is utility costs. In 1996, Kaiser Aluminium Corporation inSpokane, Washington, entered into a…arrow_forward

- Firm MC ATC 0 Industry S The graphs suggest that in the long run, assuming no changes in the given information O the firm is in long run equilibrium earning zero economic profit so no entry or exit will take place. O buyers will leave the market. some firms will exit from this market. O new firms will be attracted into the market.arrow_forwardWhich of the following is not a characteristic of a perfectly competitive market structure? O All firms sell identical products. O There are restrictions on exit of firms. O There are a very large number of firms that are small compared to the market. O There are no restrictions to entry by new firms.arrow_forwardOscar is one of many farmers growing soybeans in the upper Midwest under purely competitive market conditions. The demand curve for Oscar's soybeans O lies above his marginal revenue curve. O is downward sloping O is perfectly inelastic O coincides with Oscar's marginal revenue curve. 21 P Gtv MacBook Pro F8 F9 吕0 S0 F3 F6 F7 F4 F5 * %23arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education