Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

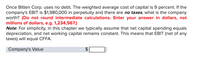

Transcribed Image Text:Once Bitten Corp. uses no debt. The weighted average cost of capital is 9 percent. If the

company's EBIT is $1,980,000 in perpetuity and there are no taxes, what is the company

worth? (Do not round intermediate calculations. Enter your answer in dollars, not

millions of dollars, e.g. 1,234,567.)

Note: For simplicity, in this chapter we typically assume that net capital spending equals

depreciation, and net working capital remains constant. This means that EBIT (net of any

taxes) will equal CFFA.

Company's Value

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- To illustrate the effects of financial leverage for PizzaPalace’s management, consider two hypothetical firms: Firm U (which uses no debt financing) and Firm L (which uses $4,000 of 8% interest rate debt). Both firms have $20,000 in net operating capital, a 25% tax rate, and an expected EBIT of $2,400. (1) Construct partial income statements, which start with EBIT, for the two firms. (2) Calculate NOPAT, ROIC, and ROE for both firms. (3) What does this example illustrate about the impact of financial leverage on ROE? (4) Why did leverage increase ROE in this example?arrow_forwardF. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: Market Debt-to Equity Ratio (D/S) 0.00 0.1111 0.2500 0.4286 0.6667 Market Equity-to- Value Ratio (ws) 1.0 0.90 6.0% 6.4 0.80 7.0 8.2 0.70 0.60 10.0 F. Pierce uses the CAPM to estimate its cost of common equity, rs, and at the time of the analaysis the risk-free rate is 6%, the market risk premium is 8%, and the company's tax rate is 25%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has no debt) is 0.7. Based on this information, what is the firm's optimal capital structure, and what would be the weighted average cost of capital at the optimal capital structure? Do not round intermediate calculations. Round your answers to two…arrow_forwardB.F. Pierce & Company is considering changing its capital structure. The company currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: 8.66% 9.21% 8.83% Market Debt-to- Value Ratio 9.07% (WD) 0.00 0.20 0.40 0.60 0.80 Market Equity-to- Value Ratio (WE) 1.00 0.80 0.60 0.40 0.20 Market Debt-to- Equity Ratio (D/E) 0.00 0.25 0.67 1.50 4.00 Before-Tax Cost of Debt (rD) 5.00% The company uses the CAPM to estimate its cost of common equity. Currently the risk-free rate is 4%, the market risk premium is 6%, and the company's tax rate is 25%. The company estimates that its beta now (which is unlevered because it currently has no debt) is 0.8. Based on this information, what is the firm's weighted average cost of capital at its optimal capital structure? 6.00% 7.00% 8.00% 9.00%arrow_forward

- Do not provide solution in imge format. and also do not provide plagarised content otherwise i dislike. Consider a firm with an EBIT of $865,000. The firm finances its assets with $2,650,000 debt (costing 7.9 percent and is all tax deductible) and 550,000 shares of stock selling at $6.00 per share. To reduce the firm's risk associated with this financial leverage, the firm is considering reducing its debt by $1,000,000 by selling an additional 350,000 shares of stock. The firm's tax rate is 21 percent. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $865,000. Calculate the change in the firm's EPS from this change in capital structure. Note: Do not round intermediate calculations and round your final answers to 2 decimal places. EPS before EPS after Differencearrow_forward(Related to Checkpoint 4.1) (Liquidity analysis) Airspot Motors, Inc. has $2,517,200 in current assets and $868,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other current assets and current liabilities remain constant)? Airspot Motors, Inc. could add up to $ in inventories. (Round to the nearest dollar.)arrow_forwardVijayarrow_forward

- Please see image to solve for question.arrow_forwardhartman motors has $32 million in assets, which were financed with $8 million of debt and $24 million in equity. Hartman's beta is currently 1.6, and its tax rate is 30%. Use the Hamada equation to find Hartman's unlevered beta, bu. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardReynolds Construction's current value of operations is $750 million based on the free cash flow valuation model. Its balance sheet shows $50 million of short-term investments that are unrelated to operations, and $300 million of total debt. What is the best estimate for the firm's value of equity, in millions?.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education