Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

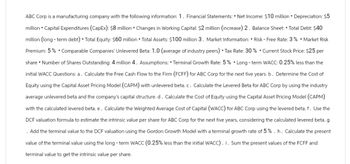

Transcribed Image Text:ABC Corp is a manufacturing company with the following information: 1. Financial Statements: • Net Income: $10 million • Depreciation: $5

million • Capital Expenditures (CapEx): $8 million • Changes in Working Capital: $2 million (increase) 2. Balance Sheet: Total Debt: $40

million (long-term debt). Total Equity: $60 million • Total Assets: $100 million 3. Market Information: • Risk - Free Rate: 3% • Market Risk

Premium: 5%. Comparable Companies' Unlevered Beta: 1.0 (average of industry peers) • Tax Rate: 30% . Current Stock Price: $25 per

share • Number of Shares Outstanding: 4 million 4. Assumptions: • Terminal Growth Rate: 5%. Long-term WACC: 0.25% less than the

initial WACC Questions: a. Calculate the Free Cash Flow to the Firm (FCFF) for ABC Corp for the next five years. b. Determine the Cost of

Equity using the Capital Asset Pricing Model (CAPM) with unlevered beta.c. Calculate the Levered Beta for ABC Corp by using the industry

average unlevered beta and the company's capital structure. d. Calculate the Cost of Equity using the Capital Asset Pricing Model (CAPM)

with the calculated levered beta. e. Calculate the Weighted Average Cost of Capital (WACC) for ABC Corp using the levered beta. f. Use the

DCF valuation formula to estimate the intrinsic value per share for ABC Corp for the next five years, considering the calculated levered beta. g

. Add the terminal value to the DCF valuation using the Gordon Growth Model with a terminal growth rate of 5%. h. Calculate the present

value of the terminal value using the long - term WACC (0.25% less than the initial WACC). i. Sum the present values of the FCFF and

terminal value to get the intrinsic value per share.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Weighted average cost of capital A. The capital for investment of Executive Consultants, Inc. is as follows: Sources of capital Capital Debt (corporate bonds) $4,100,000 Prefferent shares $2,200,000 Common shares $2,800,000 B. To generate the $ 4.1 million of corporate bond capital, they issued bonds at $ 965 par value, with an annual coupon of $ 100 for the next 10 years, with a flotation cost of $ 10 per bond.C. The issue of preferred shares has a cost of $ 5 per share and will pay a dividend of 10% of its par value of $ 110 per preferred share.D. The risk-free rate is 3.45% and the market return is 11.25%. The company's beta coefficient is 1.23.E. Executive Consultants, Inc. has a tax liability of 35%.Problems:You must submit the procedure and all the calculations.1. Determine the capital structure of Executive Consultants, Inc.2. Calculate the cost of debt after taxes.3. Calculate the cost of preferred equity.arrow_forwardI need help solving FCFE and Cash Flow per Share. See below and advise. All in MM. Exploration Expense: -12.8 Asset Retirement Obligation Accretion: -6.0 Depreciation, Depletion and Amortization: -378.9 Working Capital (Increase) / Decrease: (30.0) Capital Expenditures: 156.1 Net Debt: -11.0 Number of Shares Outstanding: 251arrow_forwardNeed all three partsarrow_forward

- Integrative-Optimal capital structure Medallion Cooling Systems, Inc., has total assets of $10,200,000, EBIT of $2,000,000, and preferred dividends of $197,000 and is taxed at a rate of 40%. In an effort to determine the optimal capital structure, the firm has assembled data on the cost of debt, the number of shares of common stock for various levels of indebtedness, and the overall required return on investment: Capital structure debt ratio 0% 15 30 45 60 Debt Ratio EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends EPS Profits available to common stockholders # shares outstanding a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po EPS/r, and the earnings per share calculated in part (a) to calculate a price per share for each level of indebtedness. c. Choose the optimal capital structure. Justify your choice. a. Calculate earnings per share for each level of indebtedness. Calculate the EPS below: (Round to the nearest dollar.…arrow_forwardHere are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): Book-Value Balance Sheet $ 35 65 $ 100 Net working capital Long-term assets Market-Value Net working capital Long-term assets Balance $ 35 190 $225 Debt Equity Sheet Debt a. PV tax shield b. WACC c. New value of the firm Equity $ 40 60 $ 100 Assume that MM's theory holds except for taxes. There is no growth, and the $40 of debt is expected to be permanent. Assume a 21% corporate tax rate. $ 40 185 $ 225 a. How much of the firm's value is accounted for by the debt-generated tax shield? Note: Enter your answer In million rounded to 2 decimal places. b. What is United Frypan's after-tax WACC if "Debt = 6.9% and Equity = 16.1% ? Note: Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of 5 years. What will be the new…arrow_forwardUse the following information to answer this question. Total assets Total current liabilities Total expenses Total liabilities Total revenues Tax rate $150,000 105,000 70,000 110,000 80,000 40% After -tax cost of capital 12% Invested capital is defined as total assets less total liabilities. (round your answers te one decimal ) Capital turnover equal O A) 53.3% B) 2 OC) 6.7% D) 28.6%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education