FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

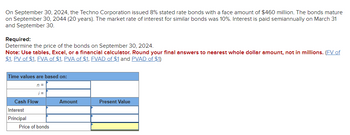

Transcribed Image Text:On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $460 million. The bonds mature

on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31

and September 30.

Required:

Determine the price of the bonds on September 30, 2024.

Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount, not in millions. (FV of

$1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Time values are based on:

n =

i=

Cash Flow

Interest

Principal

Price of bonds

Amount

Present Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 July 2022 Bombo Ltd issues $2 million in six-year bonds that pay interest every six months at a coupon rate of 8 per cent. At the time of issuing the securities, the market requires a rate of return of 6 per cent. Interest expense is determined using the effective-interest method. (PV tables are available at the end of this exam). Required Determine the issue price. Provide the journal entries at the dates below by showing relevant calculations in a table form. (i) 1 July 2022arrow_forwardi need the answer quicklyarrow_forwardplease step by step answer.arrow_forward

- The Bradford Company issued 12% bonds, dated January 1, with a face amount of $92 million on January 1, 2024. The bonds mature on December 31, 2033 (10 years). For bonds of similar risk and maturity, the market yield is 14%. Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. to 4. Prepare the journal entries to record their issuance by The Bradford Company on January 1, 2024, interest on June 30, 2024 (at the effective rate) and interest on December 31, 2024 (at the effective rate). Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardOn January 1, 2024, Blossom issued $6,300,000, 10% bonds. Interest is payable semi-annually on June 30 and December 31. The bonds mature on January 1, 2034. The bonds are sold to yield 12%. Click here to view factor table. (a) Calculate the issue price of the bonds. (Round factor values calculations to 5 decimal places, e.g. 2.55555 and finel answer to 0 decimal places, e.g. 25,000.) Issue price of bond Save for Later Attempts: 0 of 1 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A company has just issued (2024 1st Jan) a $100000 ten-year bond. The bonds pay 10% per annum. Coupons are paid every 31st December of each year. The yield to maturity at issue was 9%. The company uses the effective interest rate to amortize any discounts or premiums on bonds. Identify which accounts should reflect the events that take place this first year(2024) and the amounts for all 3 financial statements ( balance sheet, Income statement, statement of cashflows)arrow_forwardTushar Ad explanationarrow_forwardWhen Patey Pontoons issued 8% bonds on January 1, 2024, with a face amount of $700,000, the market yield for bonds of similar risk and maturity was 9% The bonds mature December 31, 2027 (4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2024. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2024? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1. PVA of $1.…arrow_forward

- Lok issued 8%, 80, 000 bonds on February 1, 2024. The bonds pay interest each July 31 and January 31 and were issued to yield 7% to investors. The bonds mature on January 31, 2034. Compute the amount of cash Lok will receive when it issues these bonds. Prepare an amortization schedule that shows how the discount or premium on the bonds will be amortized over their term. Prepare journal entries required on the following dates: February 1, 2024 issuance of the bonds. July 31, 2024 date of the first interest payment. December 31, 2024 accrual of interest through the end of the fiscal year. January 31, 2025 - date of the second interest payment. January 31, 2034 the date the principal is repaid. What would be the entry to record the issuance of the bonds if they are not issued until March 1 (that is, between interest dates)? Under the original assumption that the bonds are issued February 1, 2024 How much would it cost Lok to pay off the bonds early (by repurchasing them from the open…arrow_forwardi need the answer quicklyarrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education