FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

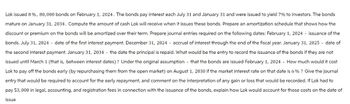

Transcribed Image Text:Lok issued 8%, 80, 000 bonds on February 1, 2024. The bonds pay interest each July 31 and January 31 and were issued to yield 7% to investors. The bonds

mature on January 31, 2034. Compute the amount of cash Lok will receive when it issues these bonds. Prepare an amortization schedule that shows how the

discount or premium on the bonds will be amortized over their term. Prepare journal entries required on the following dates: February 1, 2024 issuance of the

bonds. July 31, 2024 date of the first interest payment. December 31, 2024 accrual of interest through the end of the fiscal year. January 31, 2025 - date of

the second interest payment. January 31, 2034 the date the principal is repaid. What would be the entry to record the issuance of the bonds if they are not

issued until March 1 (that is, between interest dates)? Under the original assumption that the bonds are issued February 1, 2024 How much would it cost

Lok to pay off the bonds early (by repurchasing them from the open market) on August 1, 2030 if the market interest rate on that date is 6% ? Give the journal

entry that would be required to account for the early repayment, and comment on the interpretation of any gain or loss that would be recorded. If Lok had to

pay $3,000 in legal, accounting, and registration fees in connection with the issuance of the bonds, explain how Lok would account for those costs on the date of

issue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need unique and correct answer. Don't try to copy from anywhere. Do not give answer in image formet and hand writingarrow_forwardAssume that a bond is issued with the following characteristics: Date of bonds: January 1, 2023; maturity date: Dec. 31, 2027; face value: $200,000; Coupon interest rate: 10 percent paid semiannually; market interest rate: 12 percent; issue price: $185,280; bond discount is amortized using the effective interest method of amortization. What is the amount of bond discount amortization for the June 30, 2023, adjusting entry? A) $559 B) $1,117 C) $10,000 D) $11,117arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward

- no adjustment has yet been made for accrued interest receivable on a bond receivable for the year ended december 31 2023. regular interest payments are made on february 28,may 31. august 31 and november 30 with interest revenue being recorded at the time of payment. the balance of the bond receivable is $240,000 and the annual interest rate is 10%. the balance of the interest receivable account is $2000 which is unchanged from the previous year. discuss how the above should be treated in the financial statements for the year ended december 31 2023, with explanations workings and journal entriesarrow_forwardLopez Plastics Co. (LPC) issued callable bonds on January 1, 2021. LPC's accountant has projected the following amortizatic schedule from issuance until maturity: Cash Effective Decrease in Date Outstanding interest interest balance balance 1/1/2021 24 207,020 6/30/2021 2$ 7,000 $4 6,211 24 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 12/31/2023 7,000 6,085 915 201,913 943 200,971 6/30/2024 7,000 6,057 971 200,000 7,000 6,029 12/31/2024 LPC issued the bonds:arrow_forwardSheridan Inc. is building a new hockey arena at a cost of $2,150,000. It received a down payment of $430,000 from local businesses to support the project, and now needs to borrow $1,720,000 to complete the project. It therefore decides to issue $1,720,000 of 10- year, 10.5% bonds. These bonds were issued on January 1, 2023, and pay interest annually on each January 1. The bonds yield 10.5% to the investor and have an effective interest rate to the issuer of 10.40530%. (There is an increased effective interest rate due to the capitalization of the bond issue costs.) Any additional funds that are needed to complete the project will be obtained from local businesses. Sheridan paid and capitalized $43,000 in bond issuance costs related to the bond issue. Sheridan prepares financial statements in accordance with IFRS.arrow_forward

- Requ a. Using the present value tables in Chapter 6, calculate the proceeds (issue price) of Learned, Inc.'s, bonds on January 1, 2013, assuming that the bonds were sold to provide a market rate of return to the investor. b. Assume instead that the proceeds were $93,000,000. Use the horizontal model (or write the journal entry) to record the payment of semiannual interest and the related premium amortization on June 30, 2013, assuming that the premium of $3,000,000 is amortized on a straight-line basis. o 0ompound interest methodarrow_forwardRevise your worksheet assumptions as indicated below and then answer the questions that folllow: Face amount Stated rate Number of years Market rate Ⓒ Discount O Premium Required: 1. Was the bond issued at a discount or a premium? Date $3,050,000 2. Complete the first four rows of the amortization schedule. (Round your answers to 2 decimal places.) June 30, 2021 December 31, 2021 June 30, 2022 December 31, 2022 8% 10 9% Cash Paid Interest Change in Carrying Expense Value Carrying Valuearrow_forwardI forgot how to get the, interest expense. How can I solve this part ? What do I need to multiply?arrow_forward

- An accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardLopez Plastics Company (LPC) issued callable bonds on January 1, 2024. LPC's accountant has projected the following amortization schedule from issuance until maturity: Date Cash interest Effective interest Decrease in balance Outstanding balance 1/1/2024 $207,020 6/30/2024 $7,000 $6,211 $789 206,230 12/31/2024 7,000 6,187 813 205,417 6/30/2025 7,000 6,163 837 204,580 12/31/2025 7,000 6,137 863 203,717 6/30/2026 7,000 6,112 888 202,829 12/31/2026 7,000 6,085 915 201,913 6/30/2027 7,000 6,057 943 200,971 12/31/2027 7,000 6,029 971 200,000 What is the annual effective interest rate on the bonds?arrow_forwardOn June 1, 2023, JetCom Inventors Inc. issued a $540,000, 12%, three-year bond. Interest is to be paid semiannually beginning December 1, 2023.Required:a. Calculate the issue price of the bond assuming a market interest rate of 13%. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) - 32400 b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) - ? Part 1Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.)a. Issuance of the bonds on June 1, 2023b. Payment of interest on December 1, 2023c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2024d. Payment of interest on June 1, 2024Assume JetCom Inventors Inc. has a January 31 year-end. Part 2Show how the bonds will appear on the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education