Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I don't need ai answer general accounting question

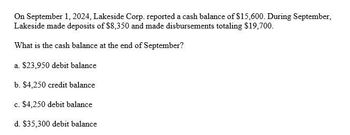

Transcribed Image Text:On September 1, 2024, Lakeside Corp. reported a cash balance of $15,600. During September,

Lakeside made deposits of $8,350 and made disbursements totaling $19,700.

What is the cash balance at the end of September?

a. $23,950 debit balance

b. $4,250 credit balance

c. $4,250 debit balance

d. $35,300 debit balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the cash balance at the end of July?arrow_forwardOn July 31, 2025, Cullumber Company had a cash balance per books of $6,250.00. The statement from Dakota State Bank on that date showed a balance of $7,800.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. 2. 3. 4. 5. 6. (a) The bank service charge for July was $20.00. The bank collected $1,630.00 from a customer for Cullumber Company through electronic funds transfer. The July 31 receipts of $1,308.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. Company check No. 2480 issued to L. Taylor, a creditor, for $394.00 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $349.00. Checks outstanding on July 31 totaled $1,979.10. On July 31, the bank statement showed an NSF charge of $685.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the bank reconciliation as of July 31. (List…arrow_forwardMCQarrow_forward

- The cash account of Waterway Co. showed a ledger balance of $18,781.68 on June 30, 2025. The bank statement as of that date showed a balance of $19,920. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. There were bank service charges for June of $120. A bank memo stated that Bao Dai's note for $5,760 and interest of $172.80 had been collected on June 29, and the bank had made a charge of $26.40 on the collection. (No entry had been made on Waterway's books when Bao Dai's note was sent to the bank for collection.) 3. Receipts for June 30 for $16,272 were not deposited until July 2. 4. Checks outstanding on June 30 totaled $10,253.04. 5. 6. The bank had charged the Waterway Co.'s account for a customer's uncollectible check amounting to $1,215.36 on June 29. A customer's check for $432 (as payment on the customer's Accounts Receivable) had been entered as $288 in the cash receipts journal by Waterway on June 15. 7. Check no. 742 in the amount…arrow_forwardA company reported the following information: Accounts receivable, December 31, 2023: $122,000 Accounts receivable, December 31, 2022: $113,000 Sales (all on credit) for 2023: $850,000 Accounts receivable, December 31, 2023 $122,000 Accounts receivable, December 31, 2022 113,000 Sales (all on credit) for 2023 850,000 How much cash was collected from customers during 2023?arrow_forwardThe cash account of Sheffield Co. showed a ledger balance of $7,088.13 on June 30, 2020. The bank statement as of that date showed a balance of $7,470. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. 3. 4. 5. 6. 7. (a) There were bank service charges for June of $45. A bank memo stated that Bao Dai's note for $2,160 and interest of $64.80 had been collected on June 29, and the bank had made a charge of $9.90 on the collection. (No entry had been made on Sheffield's books when Bao Dai's note was sent to the bank for collection.) Receipts for June 30 for $6,102 were not deposited until July 2. Checks outstanding on June 30 totaled $3,844.89. The bank had charged the Sheffield Co.'s account for a customer's uncollectible check amounting to $455.76 on June 29. A customer's check for $162 (as payment on the customer's Accounts Receivable) had been entered as $108 in the cash receipts journal by Sheffield on June 15. Check no. 742 in the amount…arrow_forward

- Question: How much is the total cash received from the financing of receivables? Round off to the nearest whole number.arrow_forwardBelow is information about Lisa Ltd’s cash position for the month of June 2019. 1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May. 2. The cash receipts journal showed total cash receipts of $292,704 for June. 3. The cash payments journal showed total cash payments of $265,074 for June. 4. The June bank statement reported a bank balance of $41,184 on 30 June. 5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70, and no. 3462, $410. 6. Cash receipts of $10,090 for 30 June were not included in the June bank statement. 7. Included on the bank statement were: a dishonored cheque is written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120 Required: a) Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for June. b) Post from cash…arrow_forwardBelow is information about Lisa Ltd’s cash position for the month of June 2019.1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.2. The cash receipts journal showed total cash receipts of $292,704 for June.3. The cash payments journal showed total cash payments of $265,074 for June.4. The June bank statement reported a bank balance of $41,184 on 30 June.5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 and no. 3462, $410.6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.7. Included on the bank statement were: a dishonoured cheque written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120Required:a) Update the cash receipts and cash payments journals by adding the necessary adjustments andcalculate the total cash receipts and cash payments for June. b) Post from cash receipts and cash…arrow_forward

- Below is information about Lisa Ltd’s cash position for the month of June 2019.1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.2. The cash receipts journal showed total cash receipts of $292,704 for June.3. The cash payments journal showed total cash payments of $265,074 for June.4. The June bank statement reported a bank balance of $41,184 on 30 June.5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 andno. 3462, $410.6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.7. Included on the bank statement were: a dishonoured cheque written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120Required:a) Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for June. b) Post from cash receipts and cash…arrow_forwardOn July 31, 2020, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $25. 2. The bank collected $1,520 for Keeds Company through electronic funds transfer. 3. The July 31 receipts of $1,193.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $384 that cleared the bank in July was incorrectly entered as a cash payment on July 10 for $348. 5. Checks outstanding on July 31 totaled $1,860.10. 6. On July 31, the bank statement showed an NSF charge of $575 for a check received by the company from W. Krueger, a customer, on account. Instructions a. Prepare the bank reconciliation as of July 31. b. Prepare the necessary adjusting entries at…arrow_forwardOn July 31, 2022, Metlock Company had a cash balance per books of $6,280.00. The statement from Dakota State Bank on that date showed a balance of $7,830.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $22.00. 2. The bank collected $1,660.00 for Metlock through electronic funds transfer. 3. The July 31 cash receipts of $1,336.30 were not included in the bank statement for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. 5. Company check No. 2480 issued to L. Taylor, a creditor, for $364.00 that cleared the bank in July was incorrectly recorded as a cash payment on July 10 for $346.00. Checks outstanding on July 31 totaled $1,982.10. 6. On July 31, the bank statement showed an NSF charge of $715.00 for a check received by the company from W. Krueger, a customer, on account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning