FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

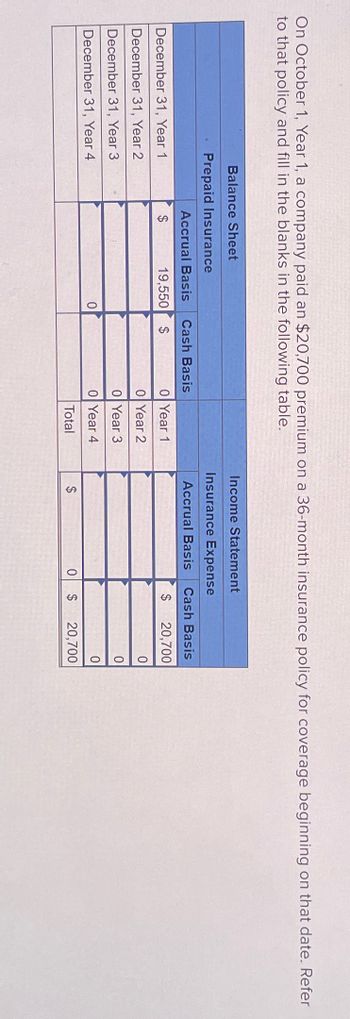

Transcribed Image Text:On October 1, Year 1, a company paid an $20,700 premium on a 36-month insurance policy for coverage beginning on that date. Refer

to that policy and fill in the blanks in the following table.

Balance Sheet

Prepaid Insurance

December 31, Year 1

December 31, Year 2

December 31, Year 3

December 31, Year 4

Accrual Basis

$

Cash Basis

19,550 $

0

0 Year 1

0 Year 2

0 Year 3

0 Year 4

Total

Income Statement

Insurance Expense

Accrual Basis Cash Basis

$ 20,700

$

0 $

0

0

20,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following are transactions of Leduc Company: 2023 Dec.11 Accepted a $16,000, 6%, 60-day note dated this day in granting Fred Calhoun a time extension on his past-due account. Made an adjusting entry to record the accrued interest on the Fred Calhoun note. Closed the Interest income account. 31 31 2021 Jan. 10 Feb. 10 Mar. 5 29 May 7 June 9 Aug. 8 11 31 Oct. 12 Nov.19 Discounted the Fred Calhoun note at the bank at 7%. The Fred Calhoun note was dishonoured. Paid the bank the maturity value of the note plus a $30 fee. Accepted a $5,500, 5.5%, 60-day note dated this day in granting a time extension on the past-due account of Donna Reed. Discounted the Donna Reed note at the bank at 7.5%. The Donna Reed note had been received by the bank and paid by Donna Reed. Accepted a $7,750, 60-day, 5% note dated this day in granting a time extension on the past-due account of Jack Miller. Received payment of the maturity value of the Jack Miller note. Accepted an $9,000, 60-day, 5% note dated this…arrow_forwardC The following transactions for Carleton Company ocured during January 2020: 1. Purchase two-year insurance policy for cash, $8,400 4. Paid Utilities bill recieved in December 2019, $450. 9. Peformed service account, $1,200 16. Paid Bi-monhly salary to employees, $2, 700 21. Recieved $800 from a costumer on account. 25. Recieved $600 from Janaury 9 transaction. 30, Prepared the adjusting entry for insurnace from Janaury 1 Transaction. 30. Accrued wages of $2,750. Required: show the amount on revenue and expense recognized for each transaction under both accrual basis and cash basis of accounting by completing the charts below. ACCRUAL BASIS Date Revenue Expenses CASH BASIS Date Revenue Expensesarrow_forwardOn August 1, 2018 Risky Ventures paid $2,400 for insurance coverage for twelve months of coverage beginning August 1. On December 31, Risky Ventures will report what dollar amount related to insurance on the income statement? $______arrow_forward

- On September 1, Year 1, West Company borrowed $34,000 from Valley Bank. West agreed to pay interest annually at the rate of 9% per year. The note issued by West carried an 18-month term. West Company has a calendar year-end. What is the amount of interest expense that will be reported on West's income statement for Year 1? Multiple Choice O O $-0- $1,020 $306 $765arrow_forwardmn.9arrow_forwardRequlred Informatlon [The following Information apples to the questions displayed below.] A company makes the payment of a one-year Insurance premlum of $4,248 on March 1, 2019. b-1. Use the horizontal model to show the amount of Insurance premlum "used" that month. (Use amounts with + for Increases and amounts with – for decreases.) Balance Sheet Liabilities Income Statement + Stockholders' Equity - Net Income Revenues Expenses Assetsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education