FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

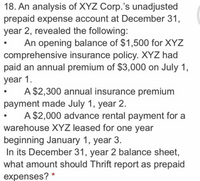

Transcribed Image Text:18. An analysis of XYZ Corp.'s unadjusted

prepaid expense account at December 31,

year 2, revealed the following:

An opening balance of $1,500 for XYZ

comprehensive insurance policy. XYZ had

paid an annual premium of $3,000 on July 1,

year 1.

A $2,300 annual insurance premium

payment made July 1, year 2.

A $2,000 advance rental payment for a

warehouse XYZ leased for one year

beginning January 1, year 3.

In its December 31, year 2 balance sheet,

what amount should Thrift report as prepaid

expenses? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K Cheap Inc. borrowed $95,000 on October 1 by signing a note payable to Scotiabank. The interest expense for each month is $554. The loan agreement requires Cheap Inc. to pay interest on December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. 2. Post all three entries to the Interest Receivable account. You need not take the balance of the account at the end of each month. 3. Record the receipt of three months' interest at December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. (Record debits first, then credits. Enter explanations on the last line.) Start by making the adjusting entry to accrue monthly interest revenue for October. Date Oct Journal Entry Accounts and Explanation Debit Creditarrow_forwardThe transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November 1, 2019 Coe borrowed $25,000 at 6 percent for 6 months. The entry to record the November 1 borrowing transaction would include a: A. Credit to notes payable for $750 B. Credit to notes payable for $24,250 C. Debit to cash for $24,250 D. Debit to cash for $25,000arrow_forwardSubject : Accountingarrow_forward

- journalize the following entries on the books of the borrower. Assume a 360-day year. January 1 Aggie Co. purchased merchandise on account from Low Co. for $40,000. January 30 Aggie Co. issued a 60-day, 6% note for $40,000 March 29 Aggie Co. paid the amount due at maturity Date Account Title Debit Credit Jan 1 Jan 30 March 29arrow_forwardFollowing are transactions of Danica Company. Dec. 13 Accepted a $18,000, 45-day, 10% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note.arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forward

- At 1 July 20X2 the receivables allowance of Q was $18,000. During the year ended 30 June 20X3 debts totalling $14,600 were written off. The receivables allowance required was to be $16,000 as at 30 June 20X3. What amount should appear in Q's statement of profit or loss for receivables expense for the year ended 30 June 20X3arrow_forwardExplain within calculationarrow_forwardRequired information [The following information applies to the questions displayed below.] Tyrell Co. entered into the following transactions involving short-term liabilities. Year 1 Apr. 20 Purchased $36,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $1,000 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. note to Locust at the maturity date. Paid the amount due on the Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $33,000 cash fro Fargo Bank by signing a 60-day, 7%, $33,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _____?_ Paid the amount due on the note to Fargo Bank at the maturity date. Required: 1. Determine the maturity date for each of the three notes described. Maturity date Locust NBR Bank Fargo Bankarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education