FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

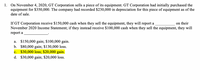

Transcribed Image Text:### Example: Sale of Equipment and Reporting Gains or Losses

On November 4, 2020, GT Corporation sells a piece of its equipment. GT Corporation had initially purchased the equipment for $350,000. The company had recorded $230,000 in depreciation for this piece of equipment as of the date of sale.

**Scenario Analysis:**

1. **If GT Corporation receives $150,000 cash when they sell the equipment, they will report a _________ on their November 2020 Income Statement.**

2. **If they instead receive $100,000 cash when they sell the equipment, they will report a _________.**

**Answer Choices:**

- a. $150,000 gain; $100,000 gain.

- b. $80,000 gain; $130,000 loss.

- c. $30,000 loss; $20,000 gain. *(Highlighted Option)*

- d. $30,000 gain; $20,000 loss.

**Correct Analysis:**

- Receiving $150,000 in cash results in a $30,000 loss.

- Receiving $100,000 in cash results in a $20,000 gain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2021, STS Inc. acquires a piece of equipment at $230,000 to manufacture product A. It paid $4,000 for shipping and $3,500 for installation of the equipment. Testing fees amounted to $4,500. The company was able to sell some of the output produced during the testing for $600. It also had to repair one part of the equipment that was damaged during the testing, which cost $1,000. The equipment’s useful life is 10 years or 400,000 units of product A. Its residual value is $35,000. It produced 800 units in 2021, 3,000 units in 2022 and 4,500 units in 2023. The units of production method is to be used for depreciation. Required Calculate the equipment total cost at acquisition. The equipment was sold on December 31, 2023 for $230,000 cash. Prepare the journal entry to record the sale.arrow_forwardOn July 15, 2024, Cottonwood Industries sold a patent and equipment to Roquemore Corporation for $770,000 and $335,000, respectively. On the date of the sale, the book value of the patent was $130,000, and the book value of the equipment was $412,000 (cost of $572,000 less accumulated depreciation of $160,000). Prepare the journal entries to record the sales of the patent and equipment. Record the sale of the patent for $770,000. On the date of the sale, the book value of the patent was $130,000. Record the sale of the equipment for $335,000. On the date of the sale, the book value of the equipment was $412,000 (cost of $572,000 less accumulated depreciation of $160,000).arrow_forwardJanus Corporation purchased major pieces of manufacturing equipment on January 1, 2020 for a total of $42 million. Janus uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2022, the book value of the equipment was $36 million and its tax basis was $26 million. At December 31, 2023, the book value of the equipment was $34 million and its tax basis was $19 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2023 was $50 million.Required:1. Prepare the appropriate journal entry to record Janus’s 2023 income taxes. Assume an income tax rate of 25%.2. What is Janus’s 2023 after-tax net income?arrow_forward

- Kingbird Corp. sells idle machinery to Enyart Company on July 1, 2020, for $46,000. Kingbird agrees to repurchase this equipment from Enyart on June 30, 2021, for a price of $49,680 (an imputed interest rate of 8%). (a) Prepare the journal entry for Kingbird for the transfer of the asset to Enyart on July 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardOn January 1, 2020, Coronado Industries purchased a machine costing $346000. The machine is in the MACRS 5-year recovery class for tax purposes and has an estimated $71000 salvage value at the end of its economic life. It's based on half year convention.Assuming the company uses the general MACRS approach, the amount of MACRS deduction for tax purposes for the year 2020 isarrow_forwardAt the beginning of 2021, Pharoah Co. purchased an asset for $1400000 with an estimated useful life of 5 years and an estimated salvage value of $142000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pharoah Co's tax rate is 20% for 2021 and all future years. At the end of 2021, which of the following deferred tax accounts and balances is reported on Pharoah's balance sheet? Account Deferred tax liability Deferred tax liability Deferred tax asset Balance $61680 $50320 $61680arrow_forward

- 1. MadDog Inc. owns equipment for which it paid $85 million. At the end of 2020, it had accumulated depreciation on the equipment of $15 million. Due to adverse economic conditions, MadDog's management determined that it should assess whether an impairment loss should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $55 million, and the equipment's fair value at that point is $40 million. a. Under these circumstances, determine if MadDog should record an impairment loss and if yes, in what amount. Clearly indicate the steps that led to your conclusion. b. Make the necessary journal entry to record the impairment loss. If you determined that no entry is necessary, write "No entry". c. How would your answer change if the estimated undiscounted future cash flows to be provided by the equipment total $85 million instead of $55 million?arrow_forwardZara corporation decided to exchange its old machine that costs $100,000 with a new one. On January 1, 2020, the company exchanged the old machine for a new one paying $15,000 cash and giving the old machine. On the date of exchange the old machine had an accumulated depreciation of $60,000 and fair value of $80,000. As a result of the exchange the company recognized: * O Gain $40,000 Gain $20,000 O Loss $45,000 O Loss $65,000 No gain or Lss Back Next Page 11 of 12arrow_forwardOn January 1, 2025, Oriole Co. sells land for which it had paid $707,400 to Sargent Company, receiving in return Sargent's zero- interest-bearing note for $1,000,000 payable in 5 years. What entry would Oriole make to record the sale, assuming that Oriole frequently sells similar items of land for a cash sales price of $651,000? (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Jan. 1 Notes Receivable Discount on Notes Receivable Debit Creditarrow_forward

- ABC Limited located in a country which has capital gains tax, conducted the following transactions: Purchased a building in February 2018 for $26,000,000. In March 2019, the company spent $2,800,000 to install solar panels for electricity in the building. The building was sold for $40,000,000 in 2021. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,200,000. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle was sold in 2021 for $4.5 million. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021 for 1million. Purchased a government bond for $5,000,000 in 2018 and sold it for $7,500,000 in 2021. The company is entitled to an Annual Exemption of $500,000. Capital losses as of 1 January 2021 was $1,500,000. Calculate the capital gains tax in 2021, assuming a capital gain tax of 20%. $2,000,000 $1,400,000 $1,100,000 $600,000arrow_forwardOn March 20, 2020, FineTouch Corporation purchased two machines at auction for a combined total cost of $214,000. The machines were listed in the auction catalogue at $110,000 for machine X and $155,000 for machine Y. Immediately after the auction, FineTouch had the machines professionally appraised so it could increase its insurance coverage. The appraisal put a fair value of $107,100 on machine X and $130,900 on machine Y.On March 24, FineTouch paid a total of $4,800 in transportation and installation charges for the two machines. No further expenditures were made for machine X, but $5,600 was paid on March 29 for improvements to machine Y. On March 31, 2020, both machines were ready to be used.The company expects machine X to last five years and to have a residual value of $3,600 when it is removed from service, and it expects machine Y to be useful for eight more years and have a residual value of $14,580 at that time. Due to the different characteristics of the two machines,…arrow_forwardIn January 2021, Blossom Corporation purchased a patent for a new consumer product for $558900. At the time of purchase, the patent was valid for fifteen years. Due to the competitive nature of the product, however, the patent was estimated to have a useful life of only ten years. In 2026 the product was determined to be obsolete due to a competitor's new product. What amount should Blossom report on the income statement during 2026 related to the patent, assuming straight-line amortization is recorded at the company's December 31 year-end? $35890 O $279450 O $578900 O $179450arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education