FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

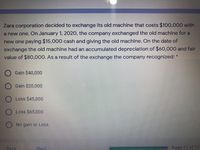

Transcribed Image Text:Zara corporation decided to exchange its old machine that costs $100,000 with

a new one. On January 1, 2020, the company exchanged the old machine for a

new one paying $15,000 cash and giving the old machine. On the date of

exchange the old machine had an accumulated depreciation of $60,000 and fair

value of $80,000. As a result of the exchange the company recognized: *

O Gain $40,000

Gain $20,000

O Loss $45,000

O Loss $65,000

No gain or Lss

Back

Next

Page 11 of 12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $15,000 (original cost of $34,000 less accumulated depreciation of $19,000) and a fair value of $9,600. Kapono paid $26,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $530,000 and a fair value of $760,000. Kapono paid $56,000 cash to complete the exchange. The exchange has commercial substance. 1. What is the amount of gain or loss that Kapono would recognize on the exchange of the land? 2. Assume the fair value of the farmland given is $424,000 instead of $760,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as Requirement 1 and that the exchange lacked…arrow_forwardMill Creek Golf Club, Inc. purchased a computer for $2,900, debiting Computer Equipment. During 2022 and 2023, Mill Creek Golf Club, Inc. recorded total depreciation of $2,300 on the computer. On January 1, 2024, Mill Creek Golf Club, Inc. traded in the computer for a new one, paying $2,700 cash. The fair market value of the new computer is $4,500. Journalize Mill Creek Golf Club, Inc.'s exchange of computers. Assume the exchange had commercial substance. Let's begin by calculating the gain or loss on the exchange of computer equipment on January 1. Market value of assets received Less: Book value of asset exchanged Cash paid Gain or (Loss) Journalize Mill Creek Golf Club, Inc.'s exchange of computers. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Jan. 1 Accounts and Explanation Debit Creditarrow_forwardCedric Company recently traded in an older model of equipment for a new model. The old model’s book value was $180,000 (original cost of $400,000 less $220,000 in accumulated depreciation) and its fair value was $170,000. Cedric paid $60,000 to complete the exchange which has commercial substance. Required: Equipment - new ___?___ Accumulated depreciation 220,000 Loss on exchange of assets 10,000 Cash 60,000 Equipment - old 400,000arrow_forward

- 1. On November 4, 2020, GT Corporation sells a piece of its equipment. GT Corporation had initially purchased the equipment for $350,000. The company had recorded $230,000 in depreciation for this piece of equipment as of the date of sale. If GT Corporation receive $150,000 cash when they sell the equipment, they will report a November 2020 Income Statement; if they instead receive $100,000 cash when they sell the equipment, they will on their report a a. $150,000 gain; $100,000 gain. b. $80,000 gain; $130,000 loss. c. $30,000 loss; $20,000 gain. d. $30,000 gain; $20,000 loss.arrow_forwardRakesharrow_forwardRizzo's Delivery Company and Overland's Express Delivery exchanged delivery trucks on January 1, 2022. Rizzo's truck cost $22,000. It has accumulated depreciation of $15,000 and a fair value of $3,000. Overland's truck cost $10,000. It has accumulated depreciation of $8,000 and a fair value of $3,000. The transaction has commercial substance. (a) Journalize the exchange for Rizzo's Delivery Company. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Include in your journal entry separate account entries for both the new and old equipment.) Account Titles and Explanation Debit Creditarrow_forward

- Bomarks acquires an equipment from a foreign supplier on credit for $6 million on 31 March 2022, when the exchange rate was $1 = GH¢ 5. The entity incurred other direct costs of GH¢1.5 million in installing the equipment. The estimated useful life of the equipment is 10 years and the entity has obligation to restore the location to its original state after usage. The estimated cost of dismantling and restoration in 10 years is GH¢3.5 million and the entity’s cost of capital is 8%. Although the equipment was available for use from 1 May 2022, the entity did not bring it into use until 1 July, 2022. Bomarks also sold goods to a foreign customer for $3.5 million on 30 April 2022, when the exchange rate was $1 = GH¢5.75. The customer paid $1 million on 1 July when the rates were $1 = GH¢5.60. On that date, Bomarks paid half of the amount owed for the equipment. At the entity’s year-end of 31 December 2022, the closing exchange rate was $1 = GH¢5.9. The entity’s functional currency is the…arrow_forwardSusan Co. has a machine that cost $810,000 on March 20, 2017. This old machine had an estimated life of ten years and a salvage value of $30,000. On December 23, 2021, the old machine is exchanged for a new machine with a fair value of $522,000. The exchange lacked commercial substance. Susan also received $58,000 cash. Assume that the last fiscal period ended on December 31, 2020, and that straight-line depreciation is used. Show the calculation of the amount of gain or loss to be recognized by Susan Co. from the exchange.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education