Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Finance

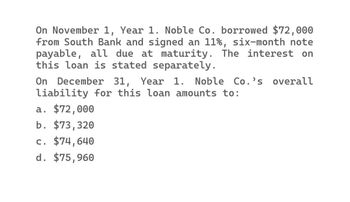

Transcribed Image Text:On November 1, Year 1. Noble Co. borrowed $72,000

from South Bank and signed an 11%, six-month note

payable, all due at maturity. The interest on

this loan is stated separately.

On December 31, Year 1. Noble Co.'s overall

liability for this loan amounts to:

a. $72,000

b. $73,320

c. $74,640

d. $75,960

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Everglades Consultants takes out a loan in the amount of $375,000 on April 1. The terms of the loan include a repayment of principal in eight, equal installments, paid annually from the April 1 date. The annual interest rate on the loan is 5%, recognized on December 31. (Round answers to the nearest cent, if needed.) A. Compute the interest recognized as of December 31 in year 1. B. Compute the principal due in year 1.arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forward

- Whirlie Inc. issued $300,000 face value, 10% paid annually, 10-year bonds for $319,251 when the market of interest was 9%. The company uses the effective-interest method of amortization. At the end of the year, the company will record ________. A. a credit to cash for $28,733 B. a debit to interest expense for $31,267 C. a debit to Discount on Bonds Payable for $1,267 D. a debit to Premium on Bonds Payable for $1.267arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forward

- On November 1, Year 1. Noble Co. borrowed $72,000 from South Bank and signed an 11%, six-month note payable, all due at maturity. The interest on this loan is stated separately. On December 31, Year 1. Noble Co.'s overall liability for this loan amounts to: a. $72,000 b. $73,320 c. $74,640 d. $75,960arrow_forwardMartinez Co. borrowed $52,557 on March 1 of the current year by signing a 60-day, 12%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a a.debit to Interest Payable for $1,051. b.debit to Interest Expense for $1,051. c.credit to Cash for $52,557. d.credit to Cash for $58,864.arrow_forwardMartinez Co. borrowed $58,220 on March 1 of the current year by signing a 60-day, 11%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a Oa. debit to Interest Payable for $1,067. b. debit to Interest Expense for $1,067. Oc. credit to Cash for $58,220. Od. credit to Cash for $64,624.arrow_forward

- Martinez Co. borrowed $56,952 on March 1 of the current year by signing a 60-day, 8%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a a. debit to Interest Payable for $759. b. debit to Interest Expense for $759. C. credit to Cash for $56,952. d. credit to Cash for $61,508. MacBook Proarrow_forwardFinancial Accountingarrow_forwardOn January 1, Year 1, Mahoney Company borrowed $165,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $41,325. What is the amount of principal repayment included in the payment made on December 31, Year 1? Multiple Choice O O оо $37,398 $40,650 $13,200 $28,125arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning