Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

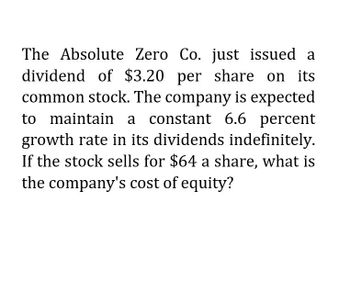

Transcribed Image Text:The Absolute Zero Co. just issued a

dividend of $3.20 per share on its

common stock. The company is expected

to maintain a constant 6.6 percent

growth rate in its dividends indefinitely.

If the stock sells for $64 a share, what is

the company's cost of equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Cost of Equity and Flotation Costs Messman Manufacturing will issue common stock to the public for $30. The expected dividend and the growth in dividends are $3.00 per share and 5%, respectively. If the flotation cost is 10% of the issue’s gross proceeds, what is the cost of external equity, re?arrow_forwardA company just paid a $3.00 dividend, expected to grow at 1.8% indefinitely. If the firm's stock can be sold for $19.25 per share with a $1.00 flotation, what is the cost of common equity? 15.81% 014.42% 025.75% 013.28% Onone of thesearrow_forwardA company just paid a $3.00 dividend, expected to grow at 1.8% indefinitely. If the firm's stock can be sold for $19.25 per share with a $1.00 flotation, what is the cost of common equity? O 15.81% O 14.42% O 25.75% O 13.28%arrow_forward

- The Evanec Company’s next expected dividend, D1, is $3.18; its growth rate is 6%; and its common stock now sells for $36.00. New stock (external equity) can be sold to net $32.40 per share.a. What is Evanec’s cost of retained earnings, rs?b. What is Evanec’s percentage flotation cost, F?c. What is Evanec’s cost of new common stock, re?arrow_forwardThe Evanec Company's next expected dividend, D1, is $2.69; its growth rate is 7%; and its common stock now sells for $35.00. New stock (external equity) can be sold to net $31.50 per share. What is Evanec's cost of retained earnings, rs? Do not round intermediate calculations. Round your answer to two decimal places. rs = % What is Evanec's percentage flotation cost, F? Round your answer to two decimal places. F = % What is Evanec's cost of new common stock, re? Do not round intermediate calculations. Round your answer to two decimal places. re = %arrow_forwardThe Evanec Company s next expected dividend, D1, is $3.18; its growth rate is 6%; and its common stock now sells for $36.00. New stock (external equity) can be sold to net $32.40 per share. What is Evanec's cost of retained earnings, rs? What is Evanec's percentage flotation cost, F? What is Evanec's cost of new common stock, re?arrow_forward

- The Evanec Company's next expected dividend, D1, is $3.08; its growth rate is 4%; and its common stock now sells for $39.00. New stock (external equity) can be sold to net $31.20 per share. a. What is Evanec's cost of retained earnings, rs? Do not round intermediate calculations. Round your answer to two decimal places. rs b. What is Evanec's percentage flotation cost, F? Round your answer to two decimal places. F = % c. What is Evanec's cost of new common stock, re? Do not round intermediate calculations. Round your answer to two decimal places. re = %arrow_forwardThe Drogon Co. just issued a dividend of $2.85 per share on its common stock. The company is expected to maintain a constant 5.9 percent growth rate in its dividends indefinitely. If the stock sells for $57 a share, what is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equityarrow_forward-arrow_forward

- The Tribiani Company just issued a dividend of $2.90 per share on Its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends indefinitely. If the stock sells for $56 a share, what is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.., 32.16.) Cost of equity 5.66 X %arrow_forwardNoGrowth Corporation currently pays a dividend of $0.52 per quarter, and it will continue to pay this dividend forever. What is the price per share of NoGrowth stock if the firm's equity cost of capital is 12.98%? The stock price is $ (Round to the nearest cent.) ...arrow_forwardThe Tribiani Company just issued a dividend of $2.60 per share on its common stock. The company is expected to maintain a constant 4 percent growth rate in its dividends indefinitely. If the stock sells for $43.40 a share, what is the company's cost of equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning