FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

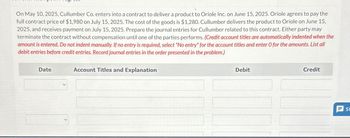

Transcribed Image Text:On May 10, 2025, Cullumber Co. enters into a contract to deliver a product to Oriole Inc. on June 15, 2025. Oriole agrees to pay the

full contract price of $1,980 on July 15, 2025. The cost of the goods is $1,280. Cullumber delivers the product to Oriole on June 15,

2025, and receives payment on July 15, 2025. Prepare the journal entries for Cullumber related to this contract. Either party may

terminate the contract without compensation until one of the parties performs. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all

debit entries before credit entries. Record journal entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

SI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On November 1, 2021, Sheridan Farm entered into a contract to buy a $155000 harvester from John Deere. The contract required Sheridan Farm to pay $155000 in advance on November 1, 2021. The harvester (cost of $115000) was delivered on November 30, 2021. The journal entry to record the delivery of the equipment includes a credit to Cost of Goods Sold for $115000. debit to Unearned Sales Revenue for $155000. debit to Inventory for $115000. credit to Unearned Sales Revenue for $155000.arrow_forwardOn May 1. 2020, Indigo Inc entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $826 in advance on May 15, 2020. Kickapoo pays Indigo on May 15, 2020, and Indigo delivers the mower (with cost of $511) on May 31, 2020. (a) Prepare the journal entry on May 1, 2020, for Indigo. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit May 1, No Entry 2020 (b) Prepare the journal entry on May 15, 2020, for Indigo. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation May 15. Debit Credit Cash 826 2020 un (C) Prepare the journal…arrow_forwardOn February 1, 2023, Armen Inc. entered into a contract to deliver one of its specialty machines to Idris Inc. The contract requires Idris Inc to pay the contract price of $15,000 in advance on February 20, 2023. Idris Inc. pays Armen Inc on February 20, 2023, and Armen Inc delivers the machine (costing $12,600) on February 28, 2023 and Idris Inc starts using the machine on March 3, 2023. When should Armen Inc recognize revenue?arrow_forward

- Carla Vista Inc., a registered broker, enters into a finder's fee agreement with Wildhorse Homes Ltd. on June 15, 2023. Carla Vista will find leads in the form of buyers potentially interested in purchasing Wildhorse's real estate holdings. Along with finding potential buyers, Carla Vista helps negotiate the selling price and provides advice on contract details. If and when Wildhorse closes a sale, Carla Vista will be paid within 30 days of the closing date, based on the following formula: 5% of any transaction value up to and including $1 million, plus 4% of any transaction value greater than $1 million and less than and including $2 million, plus 3% of any transaction value greater than $2 million and less than and including $3 million, plus 2% of any transaction value greater than $3 million and less than and including $4 million, plus 1% of any transaction value in excess of $4 million. If Carla Vista uses another broker and this information is not shared with Wildhorse, the fee is…arrow_forwardPlease list all of the journal entries for 2022 the OHIO Contract. Your company name is PP. See below information: Ohio Contract On September 7th of the current year (2022), PP signed a contract with Ohio Contract, a large city in the northeast. PP will provide Ohio with 2,470 scooters for $855 each. Each of the scooters is included in a service agreement, whereby PP will provide all maintenance on the scooters for 3 years. In addition, it will provide labor at no charge for these repairs. At the time of the repair, PP will bill Ohio for the parts needed to accomplish the repair. Ohio paid WTG on September 7th of the current year. PP will deliver 665 scooters on October 1 of the current year, 875 scooters on January 1 of next year, and 930 scooters on April 1 of the next year. Because of the size of Ohio, and its potential to buy many more scooters, PP offers them a volume discount, based on how many scooters they purchase between September 7th of the current year and December 31st of…arrow_forwardOn May 1, 2020, Culver Inc. entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $942 in advance on May 15, 2020. Kickapoo pays Culver on May 15, 2020, and Culver delivers the mower (with cost of $585) on May 31, 2020.(a) Prepare the journal entry on May 1, 2020, for Culver. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit May 1, 2020 enter an account title to record the transaction on May 1, 2017 enter a debit amount enter a credit amount enter an account title to record the transaction on May 1, 2017 enter a debit amount enter a credit amount (b) Prepare the journal entry on May 15, 2020, for Culver. (Credit account titles are automatically indented when the…arrow_forward

- On June 1, 2023, Cali Company entered into a contract to buy equipment for $15,000 from Belt Supply. The contract required Cali to pay $15,000 in advance on June 1, 2023. The equipment was delivered on July 3, 2023. The journal entry on Bolt's books to record the contract on June 1, 2023 includesarrow_forwardOn May 1, 2021, Meta Computer, Inc., enters into a contract to sell 6.100 units of Comfort Office Keyboard to one of its clients, Bionics Inc., at a fixed price of $103,700, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2021. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $61,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.00 per unit. Required: 1. How many performance obligations are in this contract? 2. Prepare the journal entry that Meta would record on May 1, 2021 3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education