FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

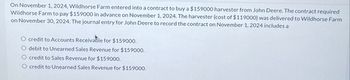

Transcribed Image Text:On November 1, 2024, Wildhorse Farm entered into a contract to buy a $159000 harvester from John Deere. The contract required

Wildhorse Farm to pay $159000 in advance on November 1, 2024. The harvester (cost of $119000) was delivered to Wildhorse Farm

on November 30, 2024. The journal entry for John Deere to record the contract on November 1, 2024 includes a

credit to Accounts Receivable for $159000.

debit to Unearned Sales Revenue for $159000.

credit to Sales Revenue for $159000.

O credit to Unearned Sales Revenue for $159000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Limited purchased a machine on account on April 1, 2021, at an invoice price of $365,470. On April 2, it paid $2,170 for delivery of the machine. A one-year, $4,120 insurance policy on the machine was purchased on April 5. On April 19, Blossom paid $7,580 for installation and testing of the machine. The machine was ready for use on April 30. Blossom estimates the machine's useful life will be five years or 6,118 units with a residual value of $87,910. Assume the machine produces the following numbers of units each year: 893 units in 2021; 1,448 units in 2022; 1,426 units in 2023; 1,222 units in 2024; and 1,129 units in 2025. Blossom has a December 31 year end. (a) Your Answer Correct Answer Your answer is correct. Determine the cost of the machine. acerarrow_forwardOn May 1. 2020, Indigo Inc entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $826 in advance on May 15, 2020. Kickapoo pays Indigo on May 15, 2020, and Indigo delivers the mower (with cost of $511) on May 31, 2020. (a) Prepare the journal entry on May 1, 2020, for Indigo. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit May 1, No Entry 2020 (b) Prepare the journal entry on May 15, 2020, for Indigo. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation May 15. Debit Credit Cash 826 2020 un (C) Prepare the journal…arrow_forwardOn January 15, 2023, Caramel Company enters into a contract to build custom equipment for Candy Company. The contract specified a delivery date of of March 1. The equipment was not delivered until March 31. the contract required full payment of $75,000 30 days after delivery. the revenue for this contract should bearrow_forward

- On May 3, 2020, Vaughn Company consigned 90freezers, costing $470each, to Remmers Company. The cost of shipping the freezers amounted to $870and was paid by Vaughn Company. On December 30, 2020, a report was received from the consignee, indicating that45freezers had been sold for $750each. Remittance was made by the consignee for the amount due after deducting a commission of6%, advertising of $180, and total installation costs of $310on the freezers sold. (Round answers to O decimal places, e.g. 5,275.) (a) Compute the inventory value of the units unsold in the hands of the consignee. Inventory value $ (b) Compute the profit for the consignor for the units sold. Profit on consignment sales $ (c) Compute the amount of cash that will be remitted by the consignee. Remittance from consignee $arrow_forwardOn February 1, 2023, Armen Inc. entered into a contract to deliver one of its specialty machines to Idris Inc. The contract requires Idris Inc to pay the contract price of $15,000 in advance on February 20, 2023. Idris Inc. pays Armen Inc on February 20, 2023, and Armen Inc delivers the machine (costing $12,600) on February 28, 2023 and Idris Inc starts using the machine on March 3, 2023. When should Armen Inc recognize revenue?arrow_forwardYellow Company purchases a truck on January 1, 2021. According to the contract Yellow will not make any payments in 2021, 2022 and 2023. Yellow is to make an annuity payment of $5,000 starting December 31, 2024 through December 31, 2028. Calculate the cost of the truck.arrow_forward

- Please list all of the journal entries for 2022 the OHIO Contract. Your company name is PP. See below information: Ohio Contract On September 7th of the current year (2022), PP signed a contract with Ohio Contract, a large city in the northeast. PP will provide Ohio with 2,470 scooters for $855 each. Each of the scooters is included in a service agreement, whereby PP will provide all maintenance on the scooters for 3 years. In addition, it will provide labor at no charge for these repairs. At the time of the repair, PP will bill Ohio for the parts needed to accomplish the repair. Ohio paid WTG on September 7th of the current year. PP will deliver 665 scooters on October 1 of the current year, 875 scooters on January 1 of next year, and 930 scooters on April 1 of the next year. Because of the size of Ohio, and its potential to buy many more scooters, PP offers them a volume discount, based on how many scooters they purchase between September 7th of the current year and December 31st of…arrow_forwardOn May 1, 2020, Culver Inc. entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $942 in advance on May 15, 2020. Kickapoo pays Culver on May 15, 2020, and Culver delivers the mower (with cost of $585) on May 31, 2020.(a) Prepare the journal entry on May 1, 2020, for Culver. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit May 1, 2020 enter an account title to record the transaction on May 1, 2017 enter a debit amount enter a credit amount enter an account title to record the transaction on May 1, 2017 enter a debit amount enter a credit amount (b) Prepare the journal entry on May 15, 2020, for Culver. (Credit account titles are automatically indented when the…arrow_forwardOn June 1, 2023, Cali Company entered into a contract to buy equipment for $15,000 from Belt Supply. The contract required Cali to pay $15,000 in advance on June 1, 2023. The equipment was delivered on July 3, 2023. The journal entry on Bolt's books to record the contract on June 1, 2023 includesarrow_forward

- Bridgeport Inc. enters into an agreement on March 1, 2020, to sell Werner Metal Company aluminum ingots. As part of the agreement, Bridgeport also agrees to repurchase the ingots on May 1, 2020, at the original sales price of $190,000 plus 3%. (a) Prepare Bridgeport's journal entry necessary on March 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles ancienter O for the amounts.) Account Titles and Explanation eTextbook and Media List of Accounts Debit Creditarrow_forwardam. 111.arrow_forwardOn December 31, 2023, Sablok Company sells production equipment to Tang Inc. for $50,000. Sablok includes a one-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on December 31, 2023. Sablok estimates the prices to be $48,800 for the equipment and $1,200 for the cost of warranty. Instructions Are the sale of the equipment and the warranty separate performance obligations within the contract? Explain. Prepare a single compound journal entry to record this transaction on December 31, 2024. Ignore any related cost of goods sold entry. Repeat the requirements for part (b), assuming that, in addition to the assurance warranty, Sablok sold an extended warranty (service-type warranty) for an additional two years (2024–2025) for $800. (Hint: Use unearned revenue).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education