Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

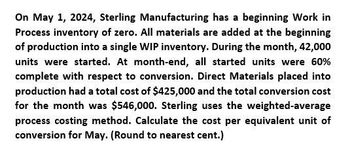

Transcribed Image Text:On May 1, 2024, Sterling Manufacturing has a beginning Work in

Process inventory of zero. All materials are added at the beginning

of production into a single WIP inventory. During the month, 42,000

units were started. At month-end, all started units were 60%

complete with respect to conversion. Direct Materials placed into

production had a total cost of $425,000 and the total conversion cost

for the month was $546,000. Sterling uses the weighted-average

process costing method. Calculate the cost per equivalent unit of

conversion for May. (Round to nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Norwood Co. had 200 units in work in process at the beginning of the month. During the month, 7,500 units were started in production, 6,800 of which, along with the beginning work in process, were completed by the end of the month. The uncompleted units were in ending inventory, one-half complete. What were the equivalent units of production for the month?arrow_forwardBy how much did the conversion cost EUP for the month of October using average method exceed the conversion EUP for the same month using FIFO method?arrow_forwardBlossom Company manufactures its product, Vitadrink, through two manufacturing processes: Mixing and Packaging. All materials are entered at the beginning of each process. On October 1, 2025, inventories consisted of Raw Materials $26,520, Work in Process- Mixing $0, Work in Process-Packaging $255,000, and Finished Goods $294,780. The beginning inventory for Packaging consisted of 10,200 units that were 50% complete as to conversion costs and fully complete as to materials. During October, 51,000 units were started into production in the Mixing Department and the following transactions were completed. 1. 2. 3. 4. 5. 6. 7. 8. 9. Purchased $306,000 of raw materials on account. Issued direct materials for production: Mixing $214,200 and Packaging $45,900. Incurred labor costs of $284,478. (Use Wages Payable.) Used factory labor: Mixing $186,150 and Packaging $98,328. Incurred $826,200 of manufacturing overhead on account. Applied manufacturing overhead on the basis of $23 per machine…arrow_forward

- Haze Company had 6,400 units of work-in-process inventory in department A on October 1, 2022. These units were 60% complete as to conversion. Direct materials are added at the beginning of the process. During the month of October, 27,200 units were started and 28,800 units were completed. Waling-Waling had 4,800 units of work-in-process inventory on October 31, 2022. These units were 20% incomplete as to conversion cost.By how much did the direct materials EUP for the month of October using average method exceed the direct materials EUP for the same month using FIFO method? By how much did the conversion cost EUP for the month of October using average method exceed the conversion EUP for the same month using FIFO method?arrow_forwardBy how much did the direct materials EUP for the month of October using average method exceed the direct materials EUP for the same month using FIFO method?arrow_forwardAxel Ltd. began operations on October 1 of the current year. Its production requires that direct materials be added at the beginning of the process, and conversion costs are incurred uniformly. Direct materials costs for October were $380,000, and conversion costs were $1,750,000. There were 80,000 units started during the month. The ending inventory was 25,000 units, which were 60% complete. What was the cost per equivalent unit for conversion? Round to the nearest cent. OA. $70.00 OB. $25.00 OC. $21.88 O D. $16.67 OE. $116.67arrow_forward

- Sandhill Company manufactures its product, Vitadrink, through two manufacturing processes: Mixing and Packaging. All materials are entered at the beginning of each process. On October 1, 2022, inventories consisted of Raw Materials $31,200, Work in Process- Mixing $0, Work in Process-Packaging $300,000, and Finished Goods $346,800. The beginning inventory for Packaging consisted of 12,000 units that were 50% complete as to conversion costs and fully complete as to materials. During October, 60,000 units were started into production in the Mixing Department and the following transactions were completed. 1. Purchased $360,000 of raw materials on account. 2. Issued direct materials for production: Mixing $252,000 and Packaging $54,000. 3. Incurred labor costs of $334,680. (Use Wages Payable.) 4. Used factory labor: Mixing $219,000 and Packaging $115,680. 5. Incurred $972,000 of manufacturing overhead on account. 6. Applied manufacturing overhead on the basis of $23 per machine hour.…arrow_forward[The following information applies to the questions displayed below.] Pacific Ink had beginning work-in-process inventory of $748,960 on October 1. Of this amount, $311,920 was the cost of direct materials and $437,040 was the cost of conversion. The 55,000 units in the beginning inventory were 25 percent complete with respect to both direct materials and conversion costs. During October, 116,000 units were transferred out and 37,000 remained in ending inventory. The units in ending inventory were 75 percent complete with respect to direct materials and 35 percent complete with respect to conversion costs. Costs incurred during the period amounted to $2,821,000 for direct materials and $3,582,720 for conversion. Exercise 8-38 (Algo) Assign Costs to Goods Transferred Out and Ending Inventory: Weighted-Average Method (LO 8-2, 3) Compute the costs of goods transferred out and the ending inventory using the weighted-average method. (Round intermediate calculations to 2 decimal places.)arrow_forward[The following information applies to the questions displayed below.] Pacific Ink had beginning work-in-process inventory of $750,960 on October 1. Of this amount, $307,920 was the cost of direct materials and $443,040 was the cost of conversion. The 51,000 units in the beginning inventory were 25 percent complete with respect to both direct materials and conversion costs. During October, 108,000 units were transferred out and 33,000 remained in ending inventory. The units in ending inventory were 75 percent complete with respect to direct materials and 35 percent complete with respect to conversion costs. Costs incurred during the period amounted to $2,556,000 for direct materials and $3,278,760 for conversion. Required: a. Compute the equivalent units for the materials and conversion cost calculations. Equivalent units for materials Equivalent units for conversion costs b. Compute the cost per equivalent unit for direct…arrow_forward

- Provide answer for this questionarrow_forwardWaling-waling Company had 6,400 units of work-in-process inventory in department A on October 1, 2022. These units were 60% complete as to conversion. Direct materials are added at the beginning of the process. During the month of October, 27,200 units were started and 28,800 units were completed. Waling-Waling had 4,800 units of work-in-process inventory on October 31, 2022. These units were 20% incomplete as to conversion cost. 1.) By how much did the conversion cost EUP for the month of October using average method exceed the conversion EUP for the same month using FIFO method? 2.) By how much did the direct materials EUP for the month of October using average method exceed the direct materials EUP for the same month using FIFO method?arrow_forwardWaling-waling Company had 6,400 units of work-in-process inventory in department A on October 1, 2022. These units were 60% complete as to conversion. Direct materials are added at the beginning of the process. During the month of October, 27,200 units were started and 28,800 units were completed. Waling-Waling had 4,800 units of work-in-process inventory on October 31, 2022. These units were 20% incomplete as to conversion cost.By how much did the direct materials EUP for the month of October using average method exceed the direct materials EUP for the same month using FIFO method?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning