FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

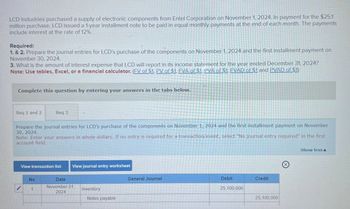

Transcribed Image Text:LCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $25.1

million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments

include interest at the rate of 12%.

Required:

1. & 2. Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on

November 30, 2024.

3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1, PVA of $1. FVAD of $1 and PVAD of $1)

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November

30, 2024.

Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.

View transaction list

View journal entry worksheet

No

1

Date

November 01,

General Journal

Debit

Credit

2024

Inventory

Notes payable

25,100,000

25,100,000

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengararrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.7 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 24%. Required: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forwardHemingway Company purchases equipment by issuing a 7-year, $350,000 non-interest-bearing note, when the market rate for this type of note is 10%. Hemingway will pay off the note with equal payments to be made at the end of each year. Required: Prepare the journal entry to record Hemingway’s acquisition of the equipmarrow_forward

- Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.4 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the…arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.8 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Required: 1. & 2. Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forwardCullumber Electronics issues a $355,500, 3%, 10-year mortgage note on December 31, 2021. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $41,675. Payments are due on December 31. (a) Prepare an installment payments schedule for the first 4 years. (Round answers to 0 decimal places, e.g. 15,250.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue Date $enter a dollar amount 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 4 enter a dollar amount…arrow_forward

- Crane Resort Corp. issued a 20-year, 4%, $298,000 mortgage note payable to finance the construction of a new building on December 31, 2021. The terms provide for semi-annual instalment payments on June 30 and December 31. a) Prepare the journal entries to record the mortgage note payable and the first two instalment payments assuming the payment is a fixed principal payment of $7,450. (Round answers to 0 decimal places, e.g. 5,276. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Issue of Note Dec. 31, 2021 (To record issuance of note.) First Instalment Payment June 30, 2022 (To record payment on note.) Second Instalment Payment Dec. 31, 2022 (To record…arrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2021. In payment for the $25.2 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 18%.(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Required:1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2021 and the first installment payment on November 30, 2021.3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2021?arrow_forward

- On May 1, 2021, Meta Computer, Inc., enters into a contract to sell 6.100 units of Comfort Office Keyboard to one of its clients, Bionics Inc., at a fixed price of $103,700, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2021. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $61,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is $19.00 per unit. Required: 1. How many performance obligations are in this contract? 2. Prepare the journal entry that Meta would record on May 1, 2021 3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to…arrow_forwardNovak Corp. receives $375,600 when it issues a $375,600, 10% mortgage note payable to finance the construction of a building at December 31, 2022. The terms provide for annual installment payments of $62,600 on December 31. Prepare the journal entries to record the mortgage loan and the first two payments.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education