Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

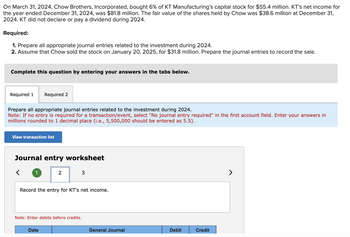

Transcribed Image Text:On March 31, 2024, Chow Brothers, Incorporated, bought 6% of KT Manufacturing's capital stock for $55.4 million. KT's net income for

the year ended December 31, 2024, was $81.8 million. The fair value of the shares held by Chow was $38.6 million at December 31,

2024. KT did not declare or pay a dividend during 2024.

Required:

1. Prepare all appropriate journal entries related to the investment during 2024.

2. Assume that Chow sold the stock on January 20, 2025, for $31.8 million. Prepare the journal entries to record the sale.

Complete this question by entering your answers in the tabs below.

Required 1

Prepare all appropriate journal entries related to the investment during 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in

millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).

View transaction list

Required 2

Journal entry worksheet

<

1

2

Date

Record the entry for KT's net income.

Note: Enter debits before credits.

3

General Journal

Debit

Credit

>

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardRuiz Company puchased 30 per cent of Sim Company’s outstanding common stock for $3,000,000 and uses the equity method of accounting. Sim Company reported net income of $ 640,000 for 2018. On 2018 December 31, Sim Company paid a cash dividend of $200,000. In 2019, Sim Company incurred a net loss of $ 65,000. Prepare entries to reflect these events on Ruiz Company’s books.arrow_forwardBlue Spruce Corporation purchased 300 common shares of Burke Inc. for $22,830 and accounted for them using FV-OCI. During the year, Burke paid a cash dividend of $3.45 per share. At year end, Burke shares had a fair value of $72.50 per share. (a) Prepare Blue Spruce's journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forward

- (Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike)arrow_forwardOn January 1, 2020, Pharoah Corporation purchased 40% of the common shares of Novak Company for $201,000. During the year, Novak earned net income of $77,000 and paid dividends of $19,250.Prepare the entries for Pharoah to record the purchase and any additional entries related to this investment in Novak Company in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (To record purchase of stock.) (To record receipt of dividends.) (To record revenue.)arrow_forwardConcord Corporation purchased 360 shares of Sherman Inc. common stock for $11,900 (Concord does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $37.50 per share. Prepare Concord' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forward

- Please include each step of calculations for my reference. Thanks!arrow_forwardOn January 2, 2020, Black Company purchased 17% of Rock Company's common stock for $51,000. Rock's net income for the years ended December 31, 2020, and December 31, 2021, were $15,000 and $59,000, respectively. During 2020, Rock declared and paid a dividend of $67,500. On December 31, 2020, the fair value of the Rock stock owned by Black had increased to $69,000. How much should Black show in the 2020 income statement as income from this investment? Multiple Choice $29,475. There is no correct answer. $24,000. $11,475. $18,000. ME MacBook Airarrow_forwardMiller Corporation acquired 30% of the outstanding common stock of Crowell Corporation for $170,000 on January 1, 2018, and obtained significant influence. The purchase price of the shares was equal to their book value. During 2018, the following information is available for Crowell: Mar. 31 Declared and paid a cash dividend of $50,000. June 30 Reported semiannual earnings of $120,000 for the first half of 2018. Sept. 30 Declared and paid a cash dividend of $50,000. Dec. 31 Reported semiannual earnings of $140,000 for the second half of 2018. Required: 1. Prepare journal entries for Miller to reflect the preceding information. 2. What is the balance in Miller’s investment account on December 31, 2018?arrow_forward

- Blanton Corporation purchased 15% of the outstanding shares of common stock of Worton Corporation as a long-term investment. Subsequently, Worton Corporation reported net income and declared and paid cash dividends. What journal entry would Blanton Corporation use to record the dividends it receives?arrow_forward#13 YOO-YOO Company purchased 200 of the 1000 outstanding shares of WEBUL Company's common stock for $710000 on January 2, 2021. In 2021, WEBUL Company declared dividends of $155000 and reported earnings for the year of $510000.If YOO-YOO Company used the fair value method of accounting for its investment in WEBUL Company, its Equity Investments (WEBUL) account on December 31, 2021, should be $812000. $710000. $679000. $781000.arrow_forwardNeed answer in proper format with explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education