FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

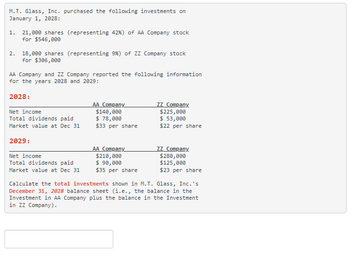

Transcribed Image Text:M.T. Glass, Inc. purchased the following investments on

January 1, 2028:

1. 21,000 shares (representing 42%) of AA Company stock

for $546,000

2. 18,000 shares (representing 9%) of ZZ Company stock

for $306,000

AA Company and ZZ Company reported the following information

for the years 2028 and 2029:

2028:

Net income

Total dividends paid

Market value at Dec 31

2029:

Net income

Total dividends paid

Market value at Dec 31

AA Company

$140,000

$ 78,000

$33 per share

AA Company

$210,000

$ 90,000

$35 per share

ZZ Company

$225,000

$ 53,000

$22 per share

ZZ Company

$280,000

$125,000

$23 per share

Calculate the total investments shown in M.T. Glass, Inc.'s

December 31, 2028 balance sheet (i.e., the balance in the

Investment in AA Company plus the balance in the Investment

in ZZ Company).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do not give answer in imagearrow_forwardPresented below is information related to the purchases of common stock by Marigold Company during 2025. Investment in Arroyo Company stock Investment in Lee Corporation stock Investment in Woods Inc. stock Total (a) (b) Cost Fair Value (at purchase date) (at December 31) $102,000 $84,000 314,000 259,000 (b) 184,000 (Assume a zero balance for any Fair Value Adjustment account at the beginning of 2025.) $545,000 No. Account Titles and Explanation (a) 193,000 $591,000 What entry would Marigold make at December 31, 2025, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? What entry would Marigold make at December 31, 2025, to record the investments in the Lee and Woods corporations, assuming that Marigold did not select the fair value option for these investments? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…arrow_forwardThe following balances were taken from the records of Sheridan Company: Common stock (1/1/20 and 12/31/20) $724, 100 Retained earnings 1/1/20 $162, 700 Net income for 2023 183, 500 Dividends declared in 2023 (43,800) Retained earnings, 12/31/20 302,400 Total stockholders' equity on 12/31/20 $1,026, 500 Windsor Company purchased 75% of Sheridan Company's common stock on January 1, 2021 for $901,200. The difference between implied value and book value is attributable to assets with a remaining useful life on January 1, 2023 of ten years. (a) Compute the difference between cost/(implied) and book value applying: 1. Parent company theory. 2. Economic unit theory. Difference 1. Parent company theory $ 2. Economic unit theory $arrow_forward

- Live Large Inc. had the following transactions involving non-strategic investments during 2020. 2020 Apr. 1 Paid $119,000 to buy a 90-day term deposit, $119,000 principal amount, 7.0%, dated April 1. 12 Purchased 4,900 common shares of Blue Balloon Ltd. at $22.50. June 9 Purchased 3,700 common shares of Purple Car Corp. at $51.50. 20 Purchased 1,650 common shares of Yellow Tech Ltd. at $16.00. July 1 Purchased for $86,894 a 9.0%, $84,000 Space Explore Inc. bond that matures in eight years when the market interest rate was 8.4%. Interest is paid semiannually beginning December 31, 2020. Live Large Inc. plans to hold this investment until maturity. 3 Received a cheque for the principal and accrued interest on the term deposit that matured on June 30. 15 Received a $0.95 per share cash dividend on the Blue Balloon Ltd. common shares. 28 Sold 2,450 of the Blue Balloon Ltd. common shares at $26.25. Sept. 1 Received a $3.00 per share cash…arrow_forwardWAG PAPALOKO Inc. has the following balance sheet on January 1, 2018, which is the date of acquisition: Assets Liabilities and Equity Accounts Receivable 79,000 Current Liabilities 145,000 Inventory 112,000 Long-term notes 100,000 Other current assets 55,000 Ordinary share, P1 par 50,000 Equipment (net) 294,000 Share premium 200,000 Goodwill 30,000 Retained earnings 75,000 Total assets 570,000 Total liabilities and equity 570,000 On January 1, 2018, WAG PAPATINAG Corp. acquired the net assets of WAG PAPALOKO Inc. by issuing 7,000 shares of its P25 par value common stock. Subsequently, WAG PAPALOKO Inc. was liquidated and its assets and liabilities merged into WAG PAPATINAG Corp. WAG PAPATINAG Corp. and WAG PAPALOKO Inc. stocks were selling for P40 per share and P6 per share, respectively on January 1, 2018. The book values of WAG PAPALOKO Inc.’s identifiable assets and liabilities equaled their…arrow_forwardA company repurchased 10,000 of its outstanding ordinary shares with par value 2$ for 6$ in 5/01/2024, at 31/01/2024 the company re-issued 5000 for 7.5, and in 28/02/2024 issued 4000 for 2.5 which recorded in the company books for: OA. debit retained earning for $6500 OB. debit premium treasury for 6500 OC. debit treasury shares for 10,000 OD. credit treasury premium for 7500arrow_forward

- The following information is available about Ayayai Corp.'s investments at December 31, 2023. This is the first year Ayayai has purchased securities for investment purposes. Securities 2,500 shares of Petra Corporation common shares 900 shares of Dugald Inc. preferred shares Ayayai follows IFRS. (a) Cost Account Titles and Explanation $25,000 18,000 $43,000 Fair Value $30,000 16,000 $46,000 Prepare the adjusting entry for December 31, 2023, assuming the investments are acquired for trading purposes and accounted for using the FV-NI model with no separate reporting of dividends and other types of FV-NI investment income and losses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Debit Creditarrow_forwardOn January 1, 2020, Churl Company paid $1,700,000 for a 40% stake in Flip Company. The Flip Company's stockholders equity on January 1 and December 31, 2020 is shown below: Share capital Revaluation surplus Retained earnings January 1 3,000,000 1,000,000 December 31 3,000,000 1,300,000 1,500,000 By Jan 1, 2020, all of Flip's identified assets and liabilities were recognized at fair value. During the current fiscal year, the flip firm recorded a profit before income tax of 1,000,000 and paid dividends to stockholders of 150,000. The revaluation excess is the outcome of Flip Company's land reassessment on December 31, 2020. Flip displays OCI net of any relevant income tax. Furthermore, Flip Company provides depreciation using the declining balance approach, whereas Churl Company employs a straight line. The cumulative depreciation would have been enhanced by 200,000 if Flip Company had used the straight line. The tax rate is set at 35%. On December 31, 2020, Churl Company will report its…arrow_forwardRahularrow_forward

- Q1: How much is the investment income on 2021? Q2: How much is the carrying amount of the Investment in Associate as of December 31, 2021?arrow_forwardH1.arrow_forwardPresented below is information related to the purchases of common stock by Bridgeport Company during 2025. Fair Value (at December 31) $68,000 306,000 194,000 $568,000 Investment in Arroyo Company stock Investment in Lee Corporation stock Investment in Woods Inc. stock Total (a) (b) Cost (at purchase date) $90,000 252,000 (Assume a zero balance for any Fair Value Adjustment account at the beginning of 2025.) 184,000 (b) $526,000 What entry would Bridgeport make at December 31, 2025, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? No. Account Titles and Explanation (a) What entry would Bridgeport make at December 31, 2025, to record the investments in the Lee and Woods corporations, assuming that Bridgeport did not select the fair value option for these investments? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education