FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:On March 31, 2021, management of Quality Appliances committed to a plan to sell equipment. The equipment was available for

immediate sale, and an active plan to locate a buyer was initiated. The equipment had been purchased on January 1, 2019, for

$980,000. The equipment had an estimated six-year service life and residual value of $200,000. The equipment was being

depreciated using the straight-line method. Quality's fiscal year ends on December 31.

Required:

1. Calculate the equipment's book value as of March 31, 2021 (Hint: Depreciation for 2021 would include up to March 31).

2. By December 31, 2021, the equipment has not been sold, but management expects that it will be sold in 2022 for $654,000. For

what amount is the equipment reported in the December 31, 2021, balance sheet?

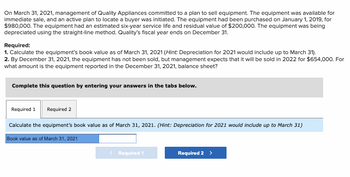

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate the equipment's book value as of March 31, 2021. (Hint: Depreciation for 2021 would include up to March 31)

Book value as of March 31, 2021

< Required 1

Required 2 >

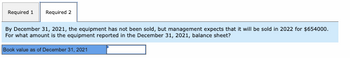

Transcribed Image Text:Required 1 Required 2

By December 31, 2021, the equipment has not been sold, but management expects that it will be sold in 2022 for $654000.

For what amount is the equipment reported in the December 31, 2021, balance sheet?

Book value as of December 31, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardOn January 1, 2025, a machine was purchased for $1,040,000 by Metlock Co. The machine is expected to have an 8-year life with no salvage value. It is to be depreciated on a straight-line basis. The machine was leased to Ivanhoe Inc. for 3 years on January 1, 2025, with annual rent payments of $260,000 due at the beginning of each year, starting January 1, 2025. The machine is expected to have a residual value at the end of the lease term of $562,500, though this amount is unguaranteed. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Your answer is correct. How much should Metlock report as income before income tax on this lease for 2025? Income before income tax $ (b) eTextbook and Media List of Accounts Date 130,000 Record the journal entries Ivanhoe would record for 2025 on this lease, assuming its incremental borrowing rate is 5% and the rate implicit in the lease is unknown. (List all debit entries…arrow_forwardChahal Company’s fiscal year-end is December 31. The company purchased a machine costing $129,000 on April 1, 2022. The machine is expected to be obsolete after five years (60 months), and thereafter no longer useful to the company. The estimated salvage value is $6,000. The company’s depreciation policy is to record depreciation for the portion of the year that the asset is in service. Compute depreciation expense for 2022 under the straight‑line depreciation method. (Round your answer to the nearest whole number. Do not include a $ sign in your answer.)arrow_forward

- The Laura Company has the following errors on its books as of December 31, 2020. The books for 2020 have not yet been closed. a. In 2020, fully depreciated equipment (with no residual value) that originally cost $8,000 was sold for $700 as scrap. The company credited the $700 proceeds to Equipment. b. On January 1, 2019, the company recorded the purchase of equipment in exchange for a three-year, noninterest-bearing note payable in the amount of $10,000. Interest rates were then 8%, but no recognition was made of this fact. The present value of $1 at 8% for three periods is 0.7938. (Ignore depreciation.) Required: Prepare journal entries to correct these errors at December 31, 2020. Ignore income taxes.arrow_forwardAt the beginning of 2018, Bridgeport Company acquired equipment costing $187,400. It was estimated that this equipment would have a useful life of 6 years and a salvage value of $18,740 at that time. The straight-line method of depreciation was considered the most appropriate to use with this type of equipment. Depreciation is to be recorded at the end of each year. During 2020 (the third year of the equipment's life), the company's engineers reconsidered their expectations, and estimated that the equipment's useful life would probably be 7 years (in total) instead of 6 years. The estimated salvage value was not changed at that time. However, during 2023 the estimated salvage value was reduced to $5,000. Indicate how much depreciation expense should be recorded each year for this equipment, by completing the following table. Depreciation Expense Accumulated Depreciation Year 2018 24 %24 2019 2020 2021 2022 2023 2024arrow_forwardSkysong Corp. purchased machinery on January 1, 2019 for $692,000. Straight-line depreciation is used. At the time management estimated that the machinery would be used over 10 years and would have a residual value of $47,000. It is now December 31, 2023 and management has determined that the machine's life is now a total of 12 years with no residual value. No adjusting journal entries have been recorded yet for the 2023 year-end.arrow_forward

- Marigold Company owns equipment that cost $79,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $7,900 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Marigold Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) (a) (b) (c) (d) (e) (A) SR. Account Titles and Explanation (a) (b) Sold for $45,000 on January 1, 2022. Sold for $45,000 on April 1, 2022. Sold for $17,000 on January 1, 2022. Sold for $17,000 on September 1, 2022 Repeat (a), assuming Marigold uses double-declining balance…arrow_forwardCyberdyne Systems sold a piece of equipment August 1, 2020 for $22,000. The original cost of the equipment was $60,000 and it was purchased on January 1, 2017. The residual value was estimated to be $3,000 and it had a 5 year useful life. Cyberdyne uses the straight-line method. Cyberdyne has a December 31 year end. Instructions Record the sale of the asset in 2020. Note: You do not need to make the journal entries for depreciation expense for 2017, 2018, 2019 and 2020. Assume that these journal entries were already made correctly.arrow_forwardLux Inc. recently purchased some production equipment that they would take possession as of February 1, 2021. The total purchase price for the equipment is $175,000 and they expect the residual value to be $25,000. The equipment is expected to have an estimated useful life of 5 years. Lux Inc. has a fiscal year end of December 31st. Required - a. What is the production equipment's depreciation expense for the year ending December 3, 2021, if they apply: i. straight-line method? ii) declining balance method for 2021 and 2022 assuming a 20% rate? b. On January 1, 2023, the company decided to make improvements to the production equipment and believe the total its estimated life will now be a total of 8 years and the residual value be $15,000. What is the depreciation expense for the year ending December 31, 2023, assuming the company uses the straight-line method? Assume that the 2021 and 2022 depreciation expenses were recorded correctly. c. On January 1, 2025 Lux Inc. sold the…arrow_forward

- Blossom Company purchased a warehouse on January 1, 2019, for $480,000. At the time of purchase, Blossom anticipated that the warehouse would be used to facilitate the expansion of its product lines. The warehouse is being depreciated over 20 years and is expected to have a residual value of $60,000. At the beginning of 2024, the company decided that the warehouse would no longer be used and should be sold for its carrying amount. At the end of 2024, the warehouse still had not been sold, and its net realizable value was estimated to be only $312,000. Prepare all the journal entries that Blossom should make during 2024 related to the warehouse. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry isrequired,select Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the Amounts. List debit entry before credit entry.)arrow_forwardVita Water purchased a used machine for $117,200 on January 2, 2020. It was repaired the next day at a cost of $4,900 and installed on a new platform that cost $1,700. The company predicted that the machine would be used for six years and would then have a $32,720 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year’s depreciation was recorded on December 31, 2020. On September 30, 2025, it was retired.Required:1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid. 2. Prepare entries to record depreciation on the machine on December 31 of its first year and on September 30 in the year of its disposal. (Round intermediate calculations to the nearest whole dollar.) 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $35,000. b. It was sold for $38,000. c.…arrow_forwardMcClain Company incurred the following expenditures during 2019: Apr. June Sept. Dec. 9 The air conditioning system in the old manufacturing facility was replaced for $80,000. The old air conditioning system had a cost of $71,750 and a book value of $1,700. The old air conditioning system had no scrap value. 29 Annual maintenance of $39,500 was performed. 12 The roof of the old manufacturing facility is replaced at a cost of $68,000. This expenditure substantially extended the life of the facility. 28 A new wing was added to the manufacturing facility at a cost of $261,000. This expenditure substantially increased the productive capacity of the plant. Required: 1. Prepare journal entries to record McClain's expenditures for 2019. 2. Next Level What is the effect on the financial statements if management had improperly accounted for the: a. addition of the new wing to the manufacturing facility b. annual maintenance expendituresarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education