FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

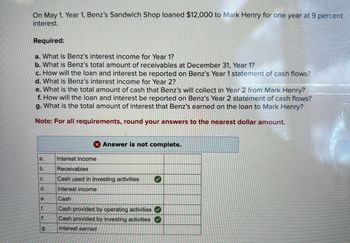

Transcribed Image Text:On May 1, Year 1, Benz's Sandwich Shop loaned $12,000 to Mark Henry for one year at 9 percent

interest.

Required:

a. What is Benz's interest income for Year 1?

b. What is Benz's total amount of receivables at December 31, Year 1?

c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows?

d. What is Benz's interest income for Year 2?

e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry?

f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows?

g. What is the total amount of interest that Benz's earned on the loan to Mark Henry?

Note: For all requirements, round your answers to the nearest dollar amount.

a.

b.

ذان

C.

e

f.

f.

g.

× Answer is not complete.

Interest income

Receivables

Cash used in investing activities

Interest income

Cash

Cash provided by operating activities

Cash provided by investing activities

Interest earned

P

✔

>>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joseph Simpson, a student at State College, has an average balance of $250 on his retail charge card; if the store levies a finance charge of 22 percent per year, how much monthly interest will be added to his account? Assume that the balance is computed by the average daily balance method. Round the answer to 2 decimal places. $arrow_forwardSRJ Corporation entered into the following transactions: The accrual of interest expense on a six-month note payable. • Collected cash for services to be provided within the next six months. The reclassification of short-term debt to long-term debt. Which of the transactions for SRJ Corporation resulted in a decrease in working capital? Multiple Cholce Collecting cash on accounts recelvable. Collecting cash for servlces to be provided In the future. The accrual of Interest expense. Both the accrual of Interest expense and collecting cash for services to be provided In the future.arrow_forwardMr. VanJergen's credit card uses the average daily balance method for calculating interest. His balance for the first 12 days of October was $850.00. His balance for the rest of October was $2,495.00. What was his average daily balance?arrow_forward

- On September 14, Jennifer Rick went to Park Bank to borrow $3,000 at 8.5% interest. Jennifer plans to repay the loan on January 27. Steven Linden met Jennifer Rick at Park Bank and suggested she consider the loan on exact interest. Calculate the loan for Jennifer under this assumptionarrow_forward10) Furniture Co. owed $880.00 for merchandise plus $20.00 for insurance. The bill was due on May 6 and the owner found he was unable to pay it. To keep a good credit rating, he decided to borrow the necessary amount from a bank that charged 9% discount. The maturity date for the loan was July 5. a) How much must he repay the bank? b) What was the cost of borrowing?arrow_forwardRiley Company borrowed $50,000 on April 1, Year 1 from Titan Bank. The note issued by Riley carried a one-year term and a 7% annual interest rate. Riley earned cash revenues of $1,160 during Year 1 and $1,800 during Year 2. Assume no other transactions. Based on this information alone, what is the amount of net income (loss) that will be reported on the Year 2 income statement? Multiple Choice O O $875 $925 $(50) O $2,675arrow_forward

- Carla borrowed $1010.00 from the Central Bank at 8.8% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $220.00 per month. Construct a complete repayment schedule for the loan including totals for Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Payment Number Balance Before Payment Amount Paid Interest Paid Principal Repaid Balance After Payment S1010.00 1 $1010.00 $220.00arrow_forwardDevelop a cash flow statement Majed is preparing a statement of cash flows for his second year of trading. Majed's bank decided to charge 10% interest on his loan to the business of JD 500 starting year 2. Majed paid this amount in cash during the year. The following information is available: Year 2 (JD) Year 1 (JD) Trade receivables 1,120 600 Prepayments 243 243 Trade payables 645 45 Accruals 420 270 Inventories 1000 400 Profit before tax 3,750 1,115 Depreciation expense Interest paid 150 75 50 Profit on disposal of asset 45 Required: • Determine the Cash flows from operating activities (year 2)arrow_forwardNeed answer step by step......arrow_forward

- The financial statements of the Tigger Manufacturing Company reports net sales of $560,000 and net accounts receivable of $132,000 and $92,000 at the beginning of the year and end of year, respectively. If Tigger normally extends credit terms of 2/10, n/45 to his customers, is Tigger doing a good job of collecting cash payments from his customers? no O yesarrow_forward1. What is the current balance that Joe Doe owes? $1270.54 2.What is the total amount that Joe charged for this billing cycle? a. List the purchases that Joe made. 3. How much did Joe pay for his last payment? 4. Why was Joe charged $35 by the credit card company? 5. How much interest was Joe charged for this month? 6. What is the credit limit that Joe has for this credit card? a. What is Joe’s available credit? 7. What is APR for purchases for this credit card? 8. What is the minimum payment amount that Joe must make? 9. When is the due date for Joe to make a payment? 10. Did Joe take a cash advance on this credit card? 11.Why did you think the federal government requires that financial institutions place a “Total Minimum Payment Warning” on all credit card statements?arrow_forwardCasio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following: 1. Purchased land for $275,000 cash. 2. Borrowed $275,000 from the bank on a long-term note. 3. Sold long-term investments for $250,000. 4. Accounts receivable decreased by $50,000. 5. Paid cash dividends of $300,000. 6. Issued 1,000 common shares for $125,000. 7. Purchased machinery and equipment for $62,500 cash. 8. Accounts payable increased by $100,000. The cash used in investing activities for 2020 was $(337,500). $(25,000). O $(187,500). O s(87,500).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education