FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

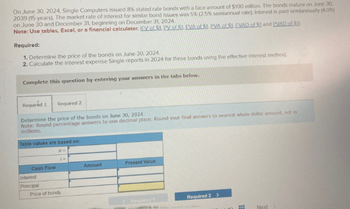

Transcribed Image Text:On June 30, 2024, Single Computers issued 8% stated rate bonds with a face amount of $100 million. The bonds mature on June 30,

2039 (15 years). The market rate of Interest for similar bond issues was 5% (2.5% semiannual rate). Interest is paid semiannually (4.0%)

on June 30 and December 31, beginning on December 31, 2024.

Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1 EVA of $1. PVA of $1 EVAD of $1 and PVAD of $1)

Required:

1. Determine the price of the bonds on June 30, 2024

2. Calculate the interest expense Single reports in 2024 for these bonds using the effective interest method.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Determine the price of the bonds on June 30, 2024.

Note: Round percentage answers to one decimal place. Round your final answers to nearest whole dollar amount, not in

millions.

Table values are based on:

Cash Flow

Interest

Principal

Price of bonds

n=

Amount

Present Value

Required

Required 2>

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- will thumb up if correct. only need (b). please show the work too (FV-PV)arrow_forward1. On January 1, 2024, Lansing Group issued $1,000,000 of 6% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in five years. The market yield for bonds of similar risk and maturity is 8%. INSTRUCTIONS: 1. Determine the price of these bonds that are issued to yield the 8% market rate using the Time Value of Money Tables. Include the table and relevant components for each factor used. 2. Record the issuance of these bonds by Lansing Group. 3. Prepare an amortization schedule that determines interest at the effective rate through the maturity date of the bonds. 4. Prepare the entries to record the interest on June 30, 2024, and December 31, 2024. 5. Assume that Lansing Group retires the bonds on January 1, 2026, paying $1,027,544. Prepare the entry to record the retirement.arrow_forwardTushar Ad explanationarrow_forward

- Need help with E.arrow_forwardOn August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forwardi need the answer quicklyarrow_forward

- BlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardOn September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $200 million. The bonds mature on September 30, 2044 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31 and September 30. Required: Determine the price of the bonds on September 30, 2024. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount, not in millions. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Time values are based on: n= i= Cash Flow Interest Principal Price of bonds S S Amount 40 5% 8,000,000 200,000,000 Present Valuearrow_forwardGive me correct answer with explanation.arrow_forward

- On January 1, 2024, Anne Teak Furniture issued $100,000 of 12% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in 4 years. The annual market rate for bonds of similar risk and maturity is 14%. What was the issue price of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Multiple Choice $89,460 $120,942 $95,460 $94,029arrow_forwardplease use P*R*T fomular as well. Thanksarrow_forwardTake me to the text On January 1, 2023, Bootic Inc. issued $3,182,000 worth of 4% redeemable bonds due in 9 years. At the time of issue, the market interest rate was 3% (interest is due annually). Calculate the discount or premium at which the bonds were issued. The company's year end is December 31. Do not enter dollar signs or commas in the input boxes. Round your answer to the nearest whole number. For bond calculations, use the PV tables at the end of Chapter 7 textbook or use a financial calculator. The bond is issued at a: Premium + Premium/Discount: $ Checkarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education