Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

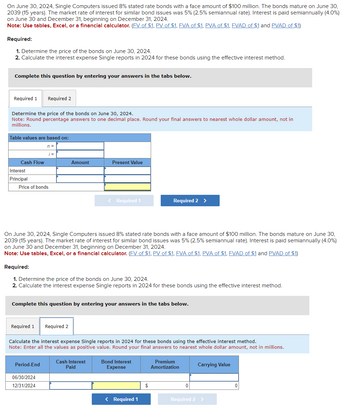

Transcribed Image Text:On June 30, 2024, Single Computers issued 8% stated rate bonds with a face amount of $100 million. The bonds mature on June 30,

2039 (15 years). The market rate of interest for similar bond issues was 5% (2.5% semiannual rate). Interest is paid semiannually (4.0%)

on June 30 and December 31, beginning on December 31, 2024.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. Determine the price of the bonds on June 30, 2024.

2. Calculate the interest expense Single reports in 2024 for these bonds using the effective interest method.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Determine the price of the bonds on June 30, 2024.

Note: Round percentage answers to one decimal place. Round your final answers to nearest whole dollar amount, not in

millions.

Table values are based on:

Cash Flow

Interest

Principal

Price of bonds

n =

i=

Required 1

Period-End

Amount

On June 30, 2024, Single Computers issued 8% stated rate bonds with a face amount of $100 million. The bonds mature on June 30,

2039 (15 years). The market rate of interest for similar bond issues was 5% (2.5% semiannual rate). Interest is paid semiannually (4.0%)

on June 30 and December 31, beginning on December 31, 2024.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

06/30/2024

12/31/2024

Required:

1. Determine the price of the bonds on June 30, 2024.

2. Calculate the interest expense Single reports in 2024 for these bonds using the effective interest method.

Present Value

Complete this question by entering your answers in the tabs below.

Required 2

< Required 1

Calculate the interest expense Single reports in 2024 for these bonds using the effective interest method.

Note: Enter all the values as positive value. Round your final answers to nearest whole dollar amount, not in millions.

Cash Interest

Paid

Required 2 >

Bond Interest

Expense

< Required 1

$

Premium

Amortization

0

Carrying Value

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- On August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardhow to calculate this? thank youarrow_forward

- On January 1, 2024, Anne Teak Furniture issued $100,000 of 12% bonds, dated January 1. Interest is payable semiannually on June 30 and December 31. The bonds mature in 4 years. The annual market rate for bonds of similar risk and maturity is 14%. What was the issue price of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Multiple Choice $89,460 $120,942 $95,460 $94,029arrow_forwardOn January 1, 2024, Cool Universe issued 10% bonds dated January 1, 2024, with a face amount of $20.1 million. The bonds mature in 2033 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the price of the bonds on January 1, 2024. 2. Prepare the journal entry to record the bond issuance by Cool on January 1, 2024. 3. Prepare the journal entry to record interest on June 30, 2024, using the straight-line method. 4. Prepare the journal entry to record interest on December 31, 2024, using the straight-line method. Complete this question by entering your answers in the tabs below. Req 1 Req 2 to 4 Check n Determine the price of the bonds on January 1, 2024. Note: Enter your answers in whole dollars not in millions (l.e., 1,000,000 not 1). Round your intermediate…arrow_forwardOn December 31, 2024, when the market interest rate is 8%, McMann Realty issues $700,000 of 5.25%, 10-year bonds payable. The bonds pay interest semiannually. Determine the present value of the bonds at issuance. (Round all currency amounts to the nearest whole dollar) (Click the icon to view Present Value of $1 table.) (Click the icon to view Future Value of $1 table.) The present value of the bonds at issuance amounts to (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) EXEarrow_forward

- On January 1, 2024, Teachers Credit Union (TCU) issued 7%, 20-year bonds payable with face value of $900,000. The bonds pay interest on June 30 and December 31. Read the requirements. Requirement 1. If the market interest rate is 5% when TCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. The 7% bonds issued when the market interest rate is 5% will be priced at a premium. They are attractive in this market, so investors will pay more than face value to acquire them. Requirement 2. If the market interest rate is 8% when TCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. The 7% bonds issued when the market interest rate is 8% will be priced at a discount. They are unattractive in this market, so investors will pay less than face value Requirement 3. The issue price of the bonds is 95. Journalize the bond transactions. (Assume bonds payable are amortized using the straight-line…arrow_forwardDiscount-Mart issues $12 million in bonds on January 1, 2024. The bonds have a ten-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: Date 01/01/2024 06/30/2024 12/31/2024 06/30/2025 12/31/2025 Interest Expense $600,000 $637,417 HIT 639,662 642,041 644,564 Cash Paid 600,000 600,000 Increase in Carrying Value 600,000 $37,417 39,662 42,041 44,564 Carrying Value $10,623,609 10,661,026 10,700,688 10,742,729 10,787,293 What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.)arrow_forwardanswer in text form please (without imagearrow_forward

- (b) Prepare an effective-interest amortization table for the first eight interest payments for these bonds. (c) The Bonds were redeemed on January 1, 2026 (after the interest had been paid and recorded) at 102. Prepare the journal entry for the redemption of the bonds.arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardThe Werner Company issued 10-year bonds on January 1, 2020. The debt has a face value of $800,000 and an annual stated interest rate of 6%. Interest payments are due semiannually beginning June 30, 2020. The market interest rate on the bonds is 6%. a.What will this bond be priced at on January 1, 2020? b.More advanced: On January 1, 2023, the market rate of interest for these bonds is 8%. What will you be willing to pay for these bonds on that date?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education