FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

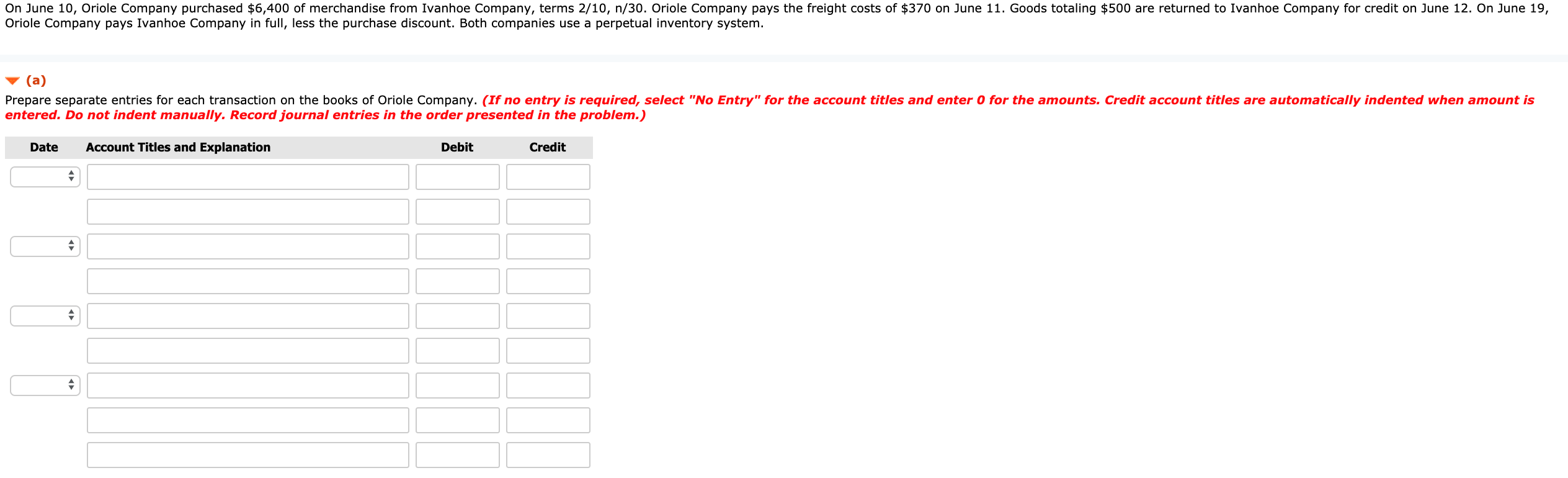

Transcribed Image Text:On June 10, Oriole Company purchased $6,400 of merchandise from Ivanhoe Company, terms 2/10, n/30. Oriole Company pays the freight costs of $370 on June 11. Goods totaling $500 are returned to Ivanhoe Company for credit on June 12. On June 19,

Oriole Company pays Ivanhoe Company in full, less the purchase discount. Both companies use a perpetual inventory system.

(a)

Prepare separate entries for each transaction on the books of Oriole Company. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is

entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Bramble Corp. uses the perpetual inventory and the gross method. On March 1, it purchased $ 54000 of inventory, terms 2/10, n/30. On March 3, Bramble returned goods that cost $ 5400. On March 9, Bramble paid the supplier. On March 9, Bramble should credit a) purchase discounts for $ 1080. b) purchase discounts for $ 972. c) inventory for $ 972. d) inventory for $ 1080.arrow_forwardOn June 10, Blue Spruce Company purchased $8,400 of merchandise on account from Ayayai Company, FOB shipping point, terms 3/10, n/30. Blue Spruce pays the freight costs of $460 on June 11. Goods totaling $700 are returned to Ayayai for credit on June 12. On June 19, Blue Spruce pays Ayayai Company in full, less the discount. Both companies use a perpetual inventory system.arrow_forwardHOW DO I PREPARE A TRANSACTION CHART? On June 10, Wildhorse Company purchased $9,500 of merchandise on account from Novak Company, FOB shipping point, terms 2/10, n/30. Wildhorse pays the freight costs of $590 on June 11. Damaged goods totaling $350 are returned to Novak for credit on June 12. The fair value of these goods is $75. On June 19, Wildhorse pays Novak Company in full, less the purchase discount. Both companies use a perpetual inventory system.arrow_forward

- The following transactions are for Wildhorse Company. 1. On December 3, Wildhorse Company sold $584,300 of merchandise to Swifty Co., on account, terms 2/10, n/30, FOB destination. Wildhorse paid $370 for freight charges. The cost of the merchandise sold was $359,300. 2. On December 8, Swifty Co. was granted an allowance of $21,300 for merchandise purchased on December 3. 3. On December 13, Wildhorse Company received the balance due from Swifty Co. 1. Prepare the journal entries to record these transactions on the books of Wildhorse Company using a perpetual inventory system 2. Assume that Wildhorse Company received the balance due from Swifty Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2.arrow_forwardPresented below are selected transactions for Flounder Company during September and October of the current year. Flounder uses a periodic inventory system. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $49,000, FOB destination, terms 1/15, n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $2,240 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $116,900, terms 2/10, n/30, FOB destination. 16 The correct company paid $2,500 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,600 for returned goods. These goods had cost Flounder Company $3,000 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the balance…arrow_forwardThe following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a perpetual inventory system. July 1 Purchased merchandise from Sabol Imports Co., $13,322, terms FOB destination, n/30. 3 Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. 5 Purchased merchandise from Schnee Co., $13,700, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Schnee Co. for merchandise with an invoice amount of $4,850 returned from purchase on July 5. 13 Paid Saxon Co. for invoice of July 3. 14 Paid Schnee Co. for invoice of July 5, less debit memo of July 6. 19 Purchased merchandise from Southmont Co., $29,840, terms FOB shipping point, n/eom. 19 Paid freight of $410 on July 19 purchase from Southmont Co. 20 Purchased merchandise from Stevens Co., $22,200, terms FOB destination, 1/10, n/30. 30 Paid…arrow_forward

- Presented here are selected transactions for the Pharoah Company during April. Pharoah uses the perpetual inventory system. April 1: Sold merchandise to Mann Company for $6,400, terms 2/10, n/30. The merchandise sold had a cost of $2,600. April 2: Purchased merchandise from Wild Corporation for $7,800, terms 1/10, n/30. April 4: Purchased merchandise from Ryan Company for $1,000, n/30. April 10: Received payment from Mann Company for purchase of April 1 less appropriate discount. April 11: Paid Wild Corporation for April 2 purchase. Journalize the April transactions for Pharoah Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)arrow_forwardOn March 1, Crunk Company sold merchandise in the amount of $5.800 to Wells Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,000. Crunk uses the perpetual inventory system and the gross method. On July 5, Wells returns some of the merchandise. The selling price of the merchandise is $500 and the cost of the merchandise returned is $350. The entry or entries that Crunk must make on July 5 is: 500 Accounts receivable Sales returns and allowances Sales returns and allowances Accounts receivable Accounts receivable Sales returns and allowances: Cost of goods sold Merchandise inventory Sales returns and allowances Accounts receivable Sales returns and allowances Accounts receivable Merchandise inventory Cost of goods sold 350 & B see 350 500 500 350 500 350 500 350 See 500 350arrow_forwardNeed all answer'sarrow_forward

- Travis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardOn March 12, Klein Company sold merchandise in the amount of $7,800 to Babson Company, with credit terms 2/10, n30. The cost of the items sold is $4,500. Klein uses PERPETUAL inventory system and the GROSS METHOD of accounting for sales. Babson pays the invoice on March 17th and takes the appropriate discount. What is the journal entry Klein makes on March 17th?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education