FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Presented here are selected transactions for the Pharoah Company during April. Pharoah uses the perpetual inventory system.

April 1: Sold merchandise to Mann Company for $6,400, terms 2/10, n/30. The merchandise sold had a cost of $2,600.

April 2: Purchased merchandise from Wild Corporation for $7,800, terms 1/10, n/30.

April 4: Purchased merchandise from Ryan Company for $1,000, n/30.

April 10: Received payment from Mann Company for purchase of April 1 less appropriate discount.

April 11: Paid Wild Corporation for April 2 purchase.

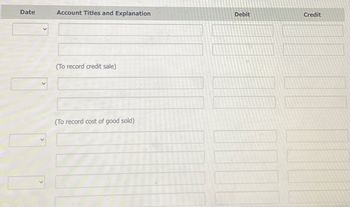

Journalize the April transactions for Pharoah Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Transcribed Image Text:Date

00

Account Titles and Explanation

(To record credit sale)

(To record cost of good sold)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Based upon the following data for a business with a periodic inventory system, determine the cost of merchandise sold for August. Merchandise inventory, August 1 $ 97,070 Merchandise inventory, August 31 102,680 Purchases 254,100 Purchases returns and allowances 12,310 Purchases discounts 5,360 Freight in 3,120 $arrow_forwardPart 1: The following merchandise transactions occurred during the month of March for Jeffries Inc. which uses a perpetual inventory system. Jeffries Inc. records discounts using the gross method. a. March,3: Jeffries Inc. sold merchandise on account to Garrabrant LLC for $48,000 on terms 4/15, n/30. b. March 6: Jeffries Inc. sold merchandise on account to Thompson Inc. for $22,500 on terms 3/15, n/45. c. Márch 6: Jeffries Inc. estimates allowances of $2,160 will be honored on the sales to Thompson Inc. and records these estimates at point of sale. d. March 15: Garrabrant LLC paid Jeffries Inc. for the amount owed. e. March 30: Thompson Inc. paid Jeffries Inc. for the amount owed. Required: Prepare the journal entries using the gross method. Round all values to the nearest dollar. (a): Prepare the journal entry for Jeffries Inc. on March 3.arrow_forwardJournalize the following inventory merchandise transactions for both Sampson and Batson, assuming that the both Sampson and Batson uses the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. Dec. 1 Sampson Co. sold merchandise to Batson Co. on account, $34,200, terms 2/15, net 45. The cost of the merchandise sold is $25,650. 6 Batson Co. paid the invoice within the discount period.arrow_forward

- Using the following data taken from Payton Inc. which uses a periodic inventory system to answer this question. Merchandise inventory, June 1 $393,250 Merchandise inventory, May 31 380,100 Purchases 1,579,600 Purchases returns and allowances 81,200 Purchases discounts 16,500 Sales 2,060,000 Freight-in 59,250 Prepare the cost of merchandise sold section of the income statement for the year ended May 31.arrow_forwardVaughn Company uses a periodic inventory system. For April, when the company sold 540 units, the following information is available. April 1 inventory April 15 purchase April 23 purchase Ending inventory Units Cost of goods sold 220 380 400 1,000 Unit Cost $25 $ 30 33 Total Cost $5,500 Compute the April 30 inventory and the April cost of goods sold using the FIFO method. 11,400 13,200 $30,100arrow_forwardBased upon the following data for a business with a periodic inventory system, determine the cost of goods sold for August. Inventory, August 1 Inventory, August 31 Purchases Purchases returns and allowances Purchases discounts Freight in Schedule of the Cost of Goods Sold For the Month Ended August 31 Line Item Description Cost of merchandise purchased: Net purchases Total cost of merchandise purchased $ 71,130 90,820 368,870 16,360 12,190 3,540 Amount Amount 1000 $arrow_forward

- On June 10, Blue Spruce Company purchased $8,400 of merchandise on account from Ayayai Company, FOB shipping point, terms 3/10, n/30. Blue Spruce pays the freight costs of $460 on June 11. Goods totaling $700 are returned to Ayayai for credit on June 12. On June 19, Blue Spruce pays Ayayai Company in full, less the discount. Both companies use a perpetual inventory system.arrow_forwardThe XZ Ltd. is a retailer and uses the Perpetual Inventory System. The below information is available regarding the purchases and sales activities: Purchase price: $4.20 Selling price: $5.70 Purchase discount (paid in 10 days): 6% Sales discount (received in 15 days): 10% Calculate the correct entries for its business activities. The XZ purchased 300 units on credit from AA on the 2nd of July. The XZ sold 200 units on credit to DSX on the 3rd of July. The XZ returned 50 defective units to AA on the 9th of July. The XZ paid cash to AA on the 11th of July. DSX paid its purchase on the 12th of July.arrow_forwardSant Summa is a retailer that purchases merchandise inventory from Lee Co. Sant Summa record inventory purchases using the gross method and the perpetual inventory system. Sant Summa started the month of July with $2,000 in inventory. Required: Record the journal entries for the following transactions Calculate Sant Summa's Cost of Goods Available for Sale based on the above information. Calculate Sant Summa's Ending Inventory based on the above information. 2-Jul Purchased $5,200 of merchandise inventory from Lee Co. with credit terms 2/15, n60 and FOB shipping point. (Inventory cost Lee $4,000) 3-Jul Paid $350 for shipping charges for the May 2 purchase. 4-Jul Sant Summa returned $200 of damaged merchandise inventory to Lee Co. (inventory cost to Lee of $170) 13-Jul Paid the appropriate amount for the Lee Co. purchases of July 2, taking all discounts. (Lee…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education