Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the cash balance at the end of june

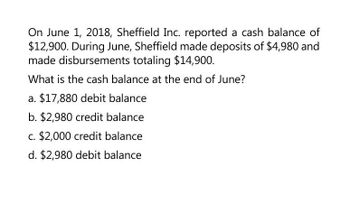

Transcribed Image Text:On June 1, 2018, Sheffield Inc. reported a cash balance of

$12,900. During June, Sheffield made deposits of $4,980 and

made disbursements totaling $14,900.

What is the cash balance at the end of June?

a. $17,880 debit balance

b. $2,980 credit balance

c. $2,000 credit balance

d. $2,980 debit balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Berry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales for the year are $924,123. The balance at the end of 2017 was $378,550. What is the number of days sales in receivables ratio for 2018 (round all answers to two decimal places)?arrow_forwardKingbird, Inc.'s bank statement from Main Street Bank at August 31, 2017, gives the following information. Balance, August 1 August deposits Checks cleared in August Bank credit memorandum: $18,770 Bank debit memorandum: 71,370 Safety deposit box fee $ 105 68,598 Service charge Balance, August 31 125 130 21,432 Interest earned A summary of the Cash account in the ledger for August shows the following: balance, August 1, $19,070; receipts $74,370; disbursements $73,49o; and balance, August 31, $19,950. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $4,880 and outstanding checks of $4,580. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40. Determine deposits in transit. Deposits in transit SHOW LIST OF ACCOUNTS LINK TO TEXT VIDEO: APPLIED SKILLS Determine outstanding…arrow_forwardThe following information is for Dylex Corporation: a Balance per the bank statement dated July 31, 2014 is $29,050. b. Balance of the Cash account on the company books as of July 31, 2014 is $15,555. c. Bank service charges for the month amount to $30. d. Included with the bank statement was a $25 credit memorandum for interest eamed on the bank account during the month. e. Bank deposit on July 31, 2014 for $1,400 does not appear on the bank statement 1. Cheque #391, for office supplies in the amount of $924, was recorded in the Cash Disbursements Journal incorrectly as $9.924 g. Included with the bank statement was an NSF cheque for $700 that had been received from a customer in payment of his account h. Cheques written that had not cleared the bank by July 31, 2014 were #412: $1,400 #401 $1,450 # 402 $1,200 #400 $1,350 #415 $1,200 Prepare a bank reconciliation statement as of July 31, 2014, as well as the necessary adjusting journal entries. Enter the transaction letter as the…arrow_forward

- Shan Enterprises received a bank statement listing its May 31, 2018, bank balance as $47,582. Shan determinedthat as of May 31 it had cash receipts of $2,500 that were not yet deposited and checks outstanding of $7,224.Calculate Shan’s correct May 31, 2018, cash balance.arrow_forwardBelow is information about Lisa Ltd’s cash position for the month of June 2019. 1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May. 2. The cash receipts journal showed total cash receipts of $292,704 for June. 3. The cash payments journal showed total cash payments of $265,074 for June. 4. The June bank statement reported a bank balance of $41,184 on 30 June. 5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70, and no. 3462, $410. 6. Cash receipts of $10,090 for 30 June were not included in the June bank statement. 7. Included on the bank statement were: a dishonored cheque is written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120 Required: a) Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for June. b) Post from cash…arrow_forwardBelow is information about Lisa Ltd’s cash position for the month of June 2019.1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.2. The cash receipts journal showed total cash receipts of $292,704 for June.3. The cash payments journal showed total cash payments of $265,074 for June.4. The June bank statement reported a bank balance of $41,184 on 30 June.5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 and no. 3462, $410.6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.7. Included on the bank statement were: a dishonoured cheque written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120Required:a) Update the cash receipts and cash payments journals by adding the necessary adjustments andcalculate the total cash receipts and cash payments for June. b) Post from cash receipts and cash…arrow_forward

- Below is information about Lisa Ltd’s cash position for the month of June 2019.1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.2. The cash receipts journal showed total cash receipts of $292,704 for June.3. The cash payments journal showed total cash payments of $265,074 for June.4. The June bank statement reported a bank balance of $41,184 on 30 June.5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 andno. 3462, $410.6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.7. Included on the bank statement were: a dishonoured cheque written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120Required:a) Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for June. b) Post from cash receipts and cash…arrow_forwardThe cash account of Sheffield Co. showed a ledger balance of $7,088.13 on June 30, 2020. The bank statement as of that date showed a balance of $7,470. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. 3. 4. 5. 6. 7. (a) There were bank service charges for June of $45. A bank memo stated that Bao Dai's note for $2,160 and interest of $64.80 had been collected on June 29, and the bank had made a charge of $9.90 on the collection. (No entry had been made on Sheffield's books when Bao Dai's note was sent to the bank for collection.) Receipts for June 30 for $6,102 were not deposited until July 2. Checks outstanding on June 30 totaled $3,844.89. The bank had charged the Sheffield Co.'s account for a customer's uncollectible check amounting to $455.76 on June 29. A customer's check for $162 (as payment on the customer's Accounts Receivable) had been entered as $108 in the cash receipts journal by Sheffield on June 15. Check no. 742 in the amount…arrow_forwardOn May 31, 2017, Reber Company had a cash balance per books of $7,051.50. The bank statement from New York State Bank on that date showed a balance of $6,674.60. A comparison of the statement with the cash account revealed the following facts. 1. The statement included a debit memo of $50.00 for the printing of additional company checks. 2. Cash sales of $632.00 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $682.00. The bank credited Reber Company for the correct amount. 3. Outstanding checks at May 31 totaled $882.25. Deposits in transit were $2,686.15. 4. On May 18, the company issued check No. 1181 for $692 to Lynda Carsen on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Reber Company for $629. 5. A $3,270.00 note receivable was collected by the bank for Reber Company on May 31 plus $90.00 interest. The bank charged a collection fee of $30.00. No…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub