FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:On July 1 of year 1, Riverside Corporation (RC), a calendar-year taxpayer, acquired the assets of another business in a taxable

acquisition. When the purchase price was allocated to the assets purchased, RC determined it had purchased $1,620,000 of goodwill

for both book and tax purposes. At the end of year 1, RC determined that the goodwill had not been impaired during the year. In year

2, however, RC concluded that $635,000 of the goodwill had been impaired and wrote down the goodwill by $635,000 for book

purposes.

Required:

a. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or

temporary?

b. What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it permanent or

temporary?

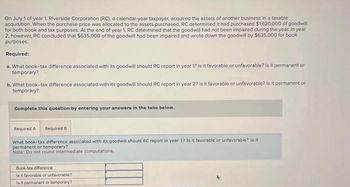

Complete this question by entering your answers in the tabs below.

Required A Required B

What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it

permanent or temporary?

Note: Do not round intermediate computations.

Book-tax difference

Is it favorable or unfavorable?

Is it permanent or temporary?

Transcribed Image Text:On July 1 of year 1, Riverside Corporation (RC), a calendar-year taxpayer, acquired the assets of another business in a taxable

acquisition. When the purchase price was allocated to the assets purchased, RC determined it had purchased $1,620,000 of goodwill

for both book and tax purposes. At the end of year 1, RC determined that the goodwill had not been impaired during the year. In year

2, however, RC concluded that $635,000 of the goodwill had been impaired and wrote down the goodwill by $635,000 for book

purposes.

Required:

a. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or

temporary?

b. What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it permanent or

temporary?

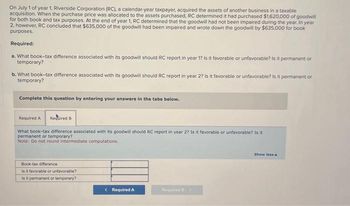

Complete this question by entering your answers in the tabs below.

Required A Required B

What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it

permanent or temporary?

Note: Do not round intermediate computations.

Book-tax difference

Is it favorable or unfavorable?

Is it permanent or temporary?

< Required A

Required >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chaz Corporation has taxable income in 2023 of $1,312,450 for purposes of computing the §179 expense and acquired the following assets during the year: Asset Placed in Service Office furniture September 12 Computer equipment February 10 Delivery truck August 21 Qualified real property (MACRS, 15 year, 150% DB) September 30 Total Basis $ 798,000 948,000 86,000 1,517,000 $ 3,349,000 What is the maximum total depreciation deduction that Chaz may deduct in 2023? (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. J'ai besoin d'aidearrow_forwardRahularrow_forwardOn July 1 of year 1, Riverside Corporation (RC), a calendar-year taxpayer, acquired the assets of another business in a taxable acquisition. When the purchase price was allocated to the assets purchased, RC determined it had purchased $1,800,000 of goodwill for both book and tax purposes. At the end of year 1, RC determined that the goodwill had not been impaired during the year. In year 2, however, RC concluded that $390,000 of the goodwill had been impaired and wrote down the goodwill by $390,000 for book purposes. Required 1. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or temporary? Book-tax difference Is it favorable or unfavorable? Is it permanent or temporary? Show Transcribed Text 2. What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it permanent or temporary? Book-tax difference Is it favorable or unfavorable? Is it permanent or…arrow_forward

- Shimmer Incorporated is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: Accumulated Depreciation $ 40,000 n/a Asset Building Sparkle Corporation stock Description Taxable income Tax liability Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $854,000. What are Shimmer's taxable income and tax liability for the year? Sales Price $ 704,000 136,000 Amount Cost $ 693,000 187,000arrow_forwardShimmer Inc. is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: Asset Sales Price Cost Accumulated Depreciation Building $752,000 $749,000 $34,000 Sparkle Corporation stock 219,000 256,000 n/a Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $847,000. What are Shimmer's taxable income and tax liability for the year? Taxable income: Tax Liability:arrow_forwardBusiness K exchanged an old asset (FMV $95,000) for a new asset (FMV $95,000). Business K's tax basis in the old asset was $113,000. Required: a. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxable transaction. b. Compute Business K's realized loss, recognized loss, and tax basis in the new asset, assuming the exchange was a nontaxable transaction. c. Six months after the exchange, Business K sold the new asset for $103,000 cash. How much gain or loss does Business K recognize if the exchange was taxable? How much gain or loss if the exchange was nontaxable? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxable transaction. Note: Losses should be indicated with a minus sign. Realized loss Recognized loss Tax basis Amountarrow_forward

- On the effective date of the Bravo Corporation's (the Company) S Corporation election (January 1, 2020) the Company had a built in gain with respect to certain real estate held by the Corporation on that date of $100,000. The Company had zero basis in the real estate and it was appraised for $100,000. One year later (January 1, 2021) this built in gain was realized when the Company sold the real estate to an unrelated party $100,000 and there were no expenses associated with the sale. For the Company's calendar year 2021, the Company has, exclusive of this gain, taxable income of $2,000,000. Required: 1. Calculate the built-in gains tax (Federal) that will be paid by Bravo Corporation with its 2021 tax return as a result of the sale of this real estate. 2. Calculate the amount of gain that will be passed through to the Company's shareholders related to this sale.arrow_forwardDavison Company determined that the book basis of its office building exceeded the tax basis by $800,000. This basis difference is properly characterized as A permanent difference A taxable temporary difference A deductible temporary difference A favorable book-tax difference Both (b) an (d) above are correct.arrow_forwardLanco Corporation, an accrual-method corporation, reported taxable income of $2,020,000 this year. Included in the computation of taxable income were the following items: MACRS depreciation of $301,000. Depreciation for earnings and profits purposes is $193,000. A net capital loss carryover of $20,100 from last year. A net operating loss carryover of $26,500 from last year. $60,600 capital gain from the distribution of land to the company’s sole shareholder (see below). Not included in the computation of taxable income were the following items: Tax-exempt income of $5,300. Life insurance proceeds of $340,000. Excess current-year charitable contribution of $2,600 (to be carried over to next year). Tax-deferred gain of $27,700 on a like-kind exchange. Nondeductible life insurance premium of $2,900. Nondeductible interest expense of $2,100 on a loan used to buy tax-exempt bonds. Lanco's accumulated E&P at the beginning of the year was $2,870,000. During the year, Lanco made the…arrow_forward

- ABC Corp calculated that it had sustained a deferred tax asset of $450,000 in respect of a tax loss and deductible temporary difference of $2.25 million but it had not recognised any such asset in the balance sheet. During the year, a business was injected to the company by themajor shareholder and the company began to derive taxable profit to offset with the loss brought forward. Required:1. Discuss the implication of the current development on ABC’s deferred tax asset.2. Suggest journal entries to effect the implication in (1).3. If the tax rate is increased to 30%, discuss and suggest journal entries.arrow_forwardMallow Incorporated, which has a 21% tax rate, purchased a new business asset. First-year book depreciation was $37,225, and first-year MACRS depreciation was $55,025. As a result of this book/tax difference, Mallow recorded a $3,738 deferred tax asset. True or False True Falsearrow_forwardHanshabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education