FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

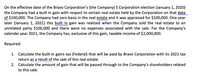

Transcribed Image Text:On the effective date of the Bravo Corporation's (the Company) S Corporation election (January 1, 2020)

the Company had a built in gain with respect to certain real estate held by the Corporation on that date

of $100,000. The Company had zero basis in the real estate and it was appraised for $100,000. One year

later (January 1, 2021) this built in gain was realized when the Company sold the real estate to an

unrelated party $100,000 and there were no expenses associated with the sale. For the Company's

calendar year 2021, the Company has, exclusive of this gain, taxable income of $2,000,000.

Required:

1. Calculate the built-in gains tax (Federal) that will be paid by Bravo Corporation with its 2021 tax

return as a result of the sale of this real estate.

2. Calculate the amount of gain that will be passed through to the Company's shareholders related

to this sale.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rahularrow_forwardAt the beginning of its 2023 tax year, Hiram owned the following business assets: Furniture Equipment Machinery Depreciation Convention Date Placed in Service Accumulated Initial Cost Depreciation Recovery Period 6/19/2021 5/2/2020 9/30/2020 $54,750 82,500 75,000 $21,232 7-year Half-year 58,740 5-year Half-year 53,400 5-year Half-year On July 8, Hiram sold its equipment. On August 18, it purchased and placed in service new tools costing $598,000; these tools are three-year recovery property. These were Hiram's only capital transactions for the year. Required: Compute Hiram's maximum cost recovery deduction for 2023. In making your computation, assume that taxable income before depreciation exceeds $1,090,000. Use Table 7-2. Note: Enter all amounts as positive values. Round your intermediate computations and final answers to the nearest whole dollar amount. Furniture Equipment Machinery Total MACRS Depreciation Section 179/bonus on new tools Maximum 2023 cost recovery deduction 2023…arrow_forwardOn July 1 of year 1, Riverside Corporation (RC), a calendar-year taxpayer, acquired the assets of another business in a taxable acquisition. When the purchase price was allocated to the assets purchased, RC determined it had purchased $1,800,000 of goodwill for both book and tax purposes. At the end of year 1, RC determined that the goodwill had not been impaired during the year. In year 2, however, RC concluded that $390,000 of the goodwill had been impaired and wrote down the goodwill by $390,000 for book purposes. Required 1. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or temporary? Book-tax difference Is it favorable or unfavorable? Is it permanent or temporary? Show Transcribed Text 2. What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it permanent or temporary? Book-tax difference Is it favorable or unfavorable? Is it permanent or…arrow_forward

- Nonearrow_forwardAnderson, Inc. acquires all of the voting stock of Kenneth, Inc. on January 4, 2020, at an amount in excess of Kenneth’s fair value. On that date, Kenneth has equipment with a book value of $90,000 and a fair value of $120,000 (10-year remaining life). Anderson has equipment with a book value of $800,000 and a fair value of $1,200,000 (10-year remaining life). On December 31, 2021, Anderson has equipment with a book value of $975,000 but a fair value of $1,350,000 and Kenneth has equipment with a book value of $105,000 but a fair value of $125,000. If Anderson applies the initial value method in accounting for Kenneth, what is the consolidated balance for the Equipment account as of December 31, 2021 A. 1,080,000 B. 1,104,000 C. 1,100,000 D. 1,468,000 E. 1,475,000arrow_forwardHeron Company purchases commercial realty on November 13, 2003, for $650,000. Straight-line depreciation of $287,492 is claimed before the property is sold on February 22, 2021, for $850,000. What are the tax consequences of the sale of realty if Heron is (a) a C corporation and (b) a sole proprietorship? a. If Heron is a C corporation, what is the amount of each type of gain recognized? If an amount is zero, enter "0". Round your answers to the nearest dollar. Character of Gain Ordinary income under § 1245 Ordinary income under § 1250 Ordinary income under § 291. § 1231 gain Total recognized gain 287,492 X § 1231 gain Total recognized gain 0 57,498 429,994 487,492 b. If Heron is a sole proprietorship, what is the amount of each type of gain recognized? Character of Gain Ordinary income under § 1245 Ordinary income under 5 1250 Ordinary income under § 291 0 0 0 487,492 487,492 ✓arrow_forward

- Heron Company purchases commercial realty on November 13, 2002, for $650,000. Straight-line depreciation of $287,492 is claimed before the property is sold on February 22, 2020, for $850,000. What are the tax consequences of the sale of realty if Heron is: A C corporation?arrow_forwardDineshbhaiarrow_forwardJerome and Shanna sold a piece of property for $300,000, claiming that their basis was $150,000 and report a taxable gain of $150,000. Their 2019 return filed in February 2020 reported gross income of $250,000. Jerome and Shanna later determine that the property’s basis was actually $50,000, not $150,000, resulting in a $100,000 under-statement of income on the 2019 return. The statute of limitations period in which the IRS may assess additional tax in this situation expires on April 15 of what year?arrow_forward

- On November 23, 2023, Hamlet acquires and places in service a 7-year class asset with a cost of $491,400 (the only asset acquired during the year). Hamlet does not elect immediate expensing under § 179. He does not claim any available additional first-year (bonus) depreciation. This is Hamlet's only tangible personal property acquisition for the year. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Calculate Hamlet's cost recovery deduction for 2023 and 2024. 2023: $ X 2024: $arrow_forwardThis year, Neil Incorporated exchanged a business asset for an investment asset. Both assets had a $932,000 appraised FMV. Neil’s book basis in the business asset was $604,600, and its tax basis was $573,000. Three years after the exchange, Neil sold the investment asset for $1,000,000 cash. Required: Compute Neil’s book gain and tax gain on sale assuming Neil acquired the investment asset in a taxable exchange. Compute Neil’s book gain and tax gain on sale assuming Neil acquired the investment asset in a nontaxable exchange.arrow_forwardOn July 1 of year 1, Riverside Corporation (RC), a calendar-year taxpayer, acquired the assets of another business in a taxable acquisition. When the purchase price was allocated to the assets purchased, RC determined it had purchased $2.115.000 of goodwill for both book and tax purposes. At the end of year 1, RC determined that the goodwill had not been impaired during the year. In year 2. however, RC concluded that $350,000 of the goodwill had been impaired and wrote down the goodwill by $350,000 for book purposes. Required: a. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or temporary? b. What book-tax difference associated with its goodwill should RC report in year 2? Is it favorable or unfavorable? Is it permanent or temporary? Complete this question by entering your answers in the tabs below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education