FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

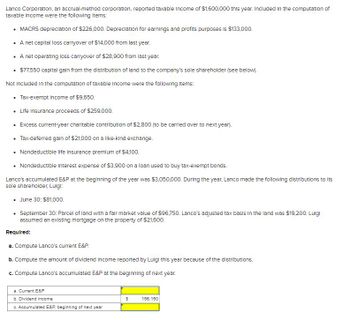

Transcribed Image Text:Lanco Corporation, an accrual-method corporation, reported taxable income of $1,600,000 this year. Included in the computation of

taxable income were the following items:

• MACRS depreciation of $226,000. Depreciation for earnings and profits purposes is $133,000.

• A net capital loss carryover of $14,000 from last year.

• A net operating loss carryover of $28,900 from last year.

• $77,550 capital gain from the distribution of land to the company's sole shareholder (see below).

Not included in the computation of taxable income were the following items:

• Tax-exempt Income of $9,650.

• Life Insurance proceeds of $259,000.

• Excess current-year charitable contribution of $2,800 (to be carried over to next year).

• Tax-deferred gain of $21,000 on a like-kind exchange.

.

• Nondeductible life insurance premium of $4,100.

• Nondeductible Interest expense of $3,900 on a loan used to buy tax-exempt bonds.

Lanco's accumulated E&P at the beginning of the year was $3,050,000. During the year, Lanco made the following distributions to its

sole shareholder, Luigt:

• June 30: $81,000.

• September 30: Parcel of land with a fair market value of $96,750. Lanco's adjusted tax basis in the land was $19,200. Luigi

assumed an existing mortgage on the property of $21,600.

Required:

a. Compute Lanco's current E&P.

b. Compute the amount of dividend Income reported by Luigi this year because of the distributions.

c. Compute Lanco's accumulated E&P at the beginning of next year.

a. Current E&P

b. Dividend income

c. Accumulated E&P, beginning of next year

S

156,150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bonita Industries reported net income of $537000 for the year ended 12/31/21. Included in the computation of net income were: depreciation expense, $90100; amortization of a patent, $48500; income from an investment in common stock of Sandhill Co., accounted for under the equity method, $71400; and amortization of a bond premium, $18400. Bonita also paid a $123000 dividend during the year. The net cash provided by operating activities would be reported at $365500. $488500. $585800. $462800.arrow_forwardPetrilli Ltd. had a taxable loss of $3,600,000 in 20X8 and a further loss of $140,000 in 20X9. The tax rate in 20X8 was 32% and in 20X9, 33%. All rates are enacted in the year to which they pertain. In the three years before the losses, the company had the following taxable income and tax rates: 20X5 20X6 20X7 Taxable income $ 1,267,200 $ 1,368,000 $ 488,400 Tax rate 36 % 38 % 40 % There are no temporary differences other than those created by income tax losses. The company was struggling due to a competitor entering the market. Required:1. What is the amount of refund that will be claimed in 20X8? 2. What is the amount of the loss carryforward in 20X8? 3. Assuming that loss carryforward usage is probable in each year, prepare a journal entry for income tax in 20X8 and 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 4. Assuming that loss carryforward usage is not probable in…arrow_forwardBramble Corporation's pre-tax accounting income of $724,000 for the year 2023 included the following items: Amortization of identifiable intangibles $147,000 Depreciation of building 114,000 Loss from discontinued operations 46,000 Unusual, non-recurring gains 157,000 Profit-sharing payments to employees 63,100 Ewing Industries Ltd. would like to purchase Bramble. In trying to measure Bramble's normalized earnings for 2023, Ewing determines that the building's fair value is triple the book value and that its remaining economic life is double the life that Bramble is using. Ewing would continue the profit-sharing payments to employees, with the payments being based on income from continuing operations before amortization and depreciation. Calculate the 2023 normalized earnings amount of Bramble that Ewing would use to calculate goodwill. Normalized earnings +Aarrow_forward

- Cass Corporation reported pretax book income of $12,870,000. During the current year, the reserve for bad debts increased by $285,000. In addition, tax depreciation exceeded book depreciation by $250,000. Cass Corporation sold a fixed asset and reported book gain of $102,750 and tax gain of $136,500. Finally, the company received $343,000 of tax-exempt life insurance proceeds from the death of one of its officers. Compute the company's current income tax expense or benefit. Note: Round your final answer to nearest whole dollar amount. Amounts to be deducted should be indicated by a minus sign. X Answer is complete but not entirely correct. Pretax book income Bad debt reserve Depreciation Fixed asset gain Tax-exempt life insurance proceeds Taxable income Current income tax expense $ 12,870,000 285,000 (250,000) $ $ 102,750 X (343,000) 250,000 X 136,500 ×arrow_forwardDuring the current year, Dale Corporation sold a segment of its business at a gain of $315,000.Until it was sold, the segment had a current period operating loss of $112,500. The company had$1,275,000 from continuing operations for the current year.Prepare the lower part of the income statement, beginning with the $1,275,000 income fromcontinuing operations. Follow tax allocation procedures, assuming that all changes in incomeare subject to a 20% income tax rate. Disregard earnings per share disclosures. (Round all calculations to nearest dollar amount.)arrow_forwardThe LD TV Corporation had taxable income of $815,000 this past year. Its cost of goodssold was $0.8 million and its operating expenses were $300,000. Interest expenses onoutstanding debts were $100,000, and the company paid $30,000 in preferred stockdividends. The company received interest income of $15,000. Determine LD TV’s sales.arrow_forward

- Shimmer Incorporated is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: Accumulated Depreciation $ 54,000 n/a Sales Price Building Sparkle Corporation stock $ 703,000 138,000 Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $820,000. What are Shimmer's taxable income and tax liability for the year? Asset Description Taxable income Tax liability S Amount 820,000 172.200 Cost $ 657,000 238,000arrow_forwardSol Limited. reported earnings of $550,000 in 20X8. The company has $95,000 of depreciation expense this year, and claimed CCA of $150,000. The tax rate was 28%. At the end of 20X7, there was a $130,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $75,000 caused by capital assets with a net book value of $1,350,000 and UCC of $1,050,000. The tax rate had been 20% in 20X7. Required: What is the amount of income tax expense in 20X8? Tax expense Prepare the income tax entry or entries. A View transaction list No 1 2 Date 20X8 20X8 View journal entry worksheet Income tax expense Deferred income tax asset Income tax payable Income tax payable Income tax expense General Journal Debit Credit 138,600arrow_forwardHafnaoui Company reported pretax net income from continuing operations of $1,104,000 and taxable income of $661,500. The book-tax difference of $442,500 was due to a $295,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $118,000 due to an increase in the reserve for bad debts, and a $265,500 favorable permanent difference from the receipt of life insurance proceeds. At the end of the year, the reserve for bad debts had a balance of $147,500; the beginning balance in the account was $29,500. Hafnaoui's beginning book (tax) basis in its fixed assets was $1,038,000 ($857,000) and its ending book (tax) basis is $1,595,000 ($1,119,000). d. Provide a reconciliation of Hafnaoui Company's effective tax rate with its hypothetical tax rate of 21 percent. Note: Amounts to be deducted should be indicated by a minus sign. Round your percentages to 2 decimal places. ETR reconciliation (in $) Income tax expense at 21% Tax benefit from permanent…arrow_forward

- t ces Hafnaoui Company reported pretax net income from continuing operations of $1,168,000 and taxable income of $695,500. The book-tax difference of $472,500 was due to a $315,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $126,000 due to an increase in the reserve for bad debts, and a $283,500 favorable permanent difference from the receipt of life insurance proceeds. At the end of the year, the reserve for bad debts had a balance of $157,500; the beginning balance in the account was $31,500. Hafnaoui's beginning book (tax) basis in its fixed assets was $1,046,000 ($869,000) and its ending book (tax) basis is $1,615,000 ($1,123,000). Problem 17-77 Part b (Algo) b. Compute Hafnaoui Company's deferred income tax expense or benefit. Note: Enter all numbers as a positive number and indicate whether a deferred tax expense or a deferred tax benefit.arrow_forwardShimmer Incorporated is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: Accumulated Depreciation $ 40,000 n/a Asset Building Sparkle Corporation stock Description Taxable income Tax liability Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $854,000. What are Shimmer's taxable income and tax liability for the year? Sales Price $ 704,000 136,000 Amount Cost $ 693,000 187,000arrow_forwardSt. George, Incorporated reported $711,800 net income before tax on this year’sfinancial statement prepared in accordance with GAAP. The corporation’s recordsreveal the following information:Four years ago, St. George realized a $283,400 gain on the sale of investmentproperty and elected the installment sale method to report the sale for taxpurposes. Its gross profit percentage is 50.12, and it collected $62,000 principaland $14,680 interest on the installment note this year.Five years ago, St. George purchased investment property for $465,000 cash froman LLC. Because St. George and the LLC were related parties, the LLC’s $12,700realized loss on the sale was disallowed for tax purposes. This year, St. George soldthe property to an unrelated purchaser for $500,000.A flood destroyed several antique carpets that decorated the floors of corporateheadquarters. Unfortunately, St. George’s property insurance does not coverdamage caused by rising water, so the loss was uninsured. The carpets’…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education