Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

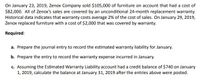

Transcribed Image Text:On January 23, 2019, Zenox Company sold $105,000 of furniture on account that had a cost of

$82,000. All of Zenox's sales are covered by an unconditional 24-month replacement warranty.

Historical data indicates that warranty costs average 2% of the cost of sales. On January 29, 2019,

Zenox replaced furniture with a cost of $2,000 that was covered by warranty.

Required:

a. Prepare the journal entry to record the estimated warranty liability for January.

b. Prepare the entry to record the warranty expense incurred in January.

c. Assuming the Estimated Warranty Liability account had a credit balance of $740 on January

1, 2019, calculate the balance at January 31, 2019 after the entries above were posted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019arrow_forwardSpath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardArvan Patel is a customer of Banks Hardware Store. For Mr. Patels latest purchase on January 1, 2018, Banks Hardware issues a note with a principal amount of $480,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Banks Hardware Store for the following transactions. A. Note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019.arrow_forward

- Resin Milling issued a $390,500 note on January 1, 2018 to a customer in exchange for merchandise. The merchandise had a cost to Resin Milling of $170,000. The terms of the note are 24-month maturity date on December 31, 2019 at a 5% annual interest rate. The customer does not pay on its account and dishonors the note. Record the journal entries for Resin Milling for the following transactions. A. Initial sale on January 1, 2018 B. Dishonored note entry on January 1, 2020, assuming interest has not been recognized before note maturityarrow_forwardAssurance-Type Warranty Clean-All Inc. sells washing machines with a 3-year assurance-type warranty. In the past, Clean-All has found that in the year after sale, warranty costs have been 3% of sales; in the second year after sale, 5% of sales; and in the third year after sale, 7% of sales. The following data are also available: Required: 1. Prepare the journal entries for the preceding transactions for 20192021. Closing entries are not required. 2. What amount would Clean-All report as a liability on its December 31, 2021, balance sheet, assuming the liability had a balance of 88,200 on December 31, 2018? 3. Next Level How would the failure to recognize a contingent liability affect the financial statements?arrow_forwardplease help me to solve this questionarrow_forward

- On August 1, 2019, Pereira Corporation has sold 1,600 Wiglows to Mendez Company at $450 each. Mendez also purchased a 1-year service-type warranty on all the Wiglows for $12 per unit. In 2019, Pereira incurred warranty costs of $9,200. Costs for 2020 were $7,000. Required: 1. Prepare the journal entries for the preceding transactions. 2. Show how Pereira would report the items on the December 31, 2019, balance sheet.arrow_forwardhello, I need help pleasearrow_forwardCasio Co. sells calculators that carry a one- year warranty against manufacturer's defects. Based on company experience, warranty costs are estimated at P 300 per calculator. During 2019, Casio sold 24,000 calculators and paid warranty costs of P 170,000. In its income statement for the year ended Dec. 31, 2019, how much should Casio report as warranty expense? * A.P 5,500,000 B.P 2,400,000 C.P 1,700,000 D.P 7,200,000arrow_forward

- Stellar Company sold 201 color laser copiers on July 10, 2025, for $4,230 apiece, together with a 1-year warranty. Maintenance on each copier during the warranty period is estimated to be $333. Prepare entries to record the sale of the copiers, the related warranty costs, and any accrual on December 31, 2025. Actual warranty costs (inventory) incurred in 2025 were $16,250. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entries.) Date Account Titles and Explanation (To record sales) (To record payment for warranty costs incurred) (To record estimated warranty expense and warranty liability for expected warranty claims) Debit Creditarrow_forwardFarrow_forwardConcord Factory provides a 2-year warranty with one of its products which was first sold in 2020. Concord sold $930,400 of products subject to the warranty. Concord expects $124,050 of warranty costs over the next 2 years. In that year, Concord spent $70,460 servicing warranty claims. Prepare Concord's journal entry to record the sales (ignore cost of goods sold) and the December 31 adjusting entry, assuming the expenditures are inventory costs. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date 2020 During 2020 12/31/20 Account Titles and Explanation Cash Sales Revenue (To record sales) Warranty Expense Warranty Liability (To record warranty claims) Warranty Liability Cash Debit 930400 il 70460 124050 Credit 930400 lil 70460 124050arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning