Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How much is the annual amortization expense for 2019 on accounting question?

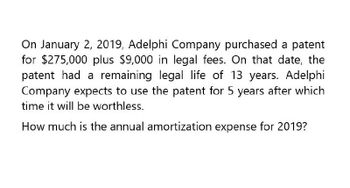

Transcribed Image Text:On January 2, 2019, Adelphi Company purchased a patent

for $275,000 plus $9,000 in legal fees. On that date, the

patent had a remaining legal life of 13 years. Adelphi

Company expects to use the patent for 5 years after which

time it will be worthless.

How much is the annual amortization expense for 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring payments of 10,000 at the beginning of each year. The machine cost 40,000 and has a useful life of 8 years with no residual value. Kerns implicit interest rate is 10%, and present value factors are as follows: Present value for an annuity due of 1 at 10% for 6 periods4.791 Present value for an annuity due of 1 at 10% for 8 periods5.868 Kern appropriately recorded the lease as a sales-type lease. At the inception of the lease, the Lease Receivable account balance should be: a. 60,000 b. 58,680 c. 48,000 d. 47,910arrow_forwardFor each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a seventeen-year remaining legal life was purchased for $850,000. The patent will be usable for another six years. B. A patent was acquired on a new tablet. The cost of the patent itself was only $12,000, but the market value of the patent is $150,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardOn January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)arrow_forward

- Ayayai Corporation purchases a patent from Blossom Company on January 1, 2025, for $63,000. The patent has a remaining legal life of 14 years. Ayayai estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Ayayai's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record purchase of patents) (To record amortization of patents) Debit Creditarrow_forwardTaylor Swift Corporation purchases a patent from Salmon Company on January 1, 2025, for $54,000. The patent has a remaining legal life of 16 years. Taylor Swift estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Taylor Swift's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Patents cash (To record purchase of patents) Amortization Expense Patents (To record amortization of patents) Debit 24,000 8400 Credit 24,000 24,000arrow_forwardOn September 1, 2019, Jordan, Inc. acquired a patent for $600,000. The patent has 16 years remaining in its legal life. However, Jordan, Inc. expects the patent's technology to have a useful life of 8 years. Prepare the journal entries to record the acquisition of the patent and the amortization expense for 2019. Date Account Debit Creditarrow_forward

- Manatee Corporation purchased a special conveyor system on December 31, 2025. The purchase agreement stipulated that Manatee should pay $50,000 at the time of purchase and $15,000 at the end of each of the next 5 years. The conveyor system should be recorded on December 31, 2025, at what amount, assuming an appropriate interest rate of 8%?arrow_forwardIndigo Corporation purchases a patent from Sandhill Company on January 1, 2020, for $54,000. The patent has a remaining legal life of 12 years. Indigo feels the patent will be useful for 10 years. Prepare Indigo’s journal entries to record the purchase of the patent and 2020 amortization.arrow_forwardOn January 1, 2021, Elle Company acquired a machine by signing a four-year lease. Annual rentals are payable at the beginning of each year starting January 1, 2021. The asset’s useful life is 6 years, at the end of which the asset’s scrap value is expected to be P80,000. Elle Company uses the straight-line method to depreciate this asset. The lessor’s implicit interest rate, known to Elle is 10%. Elle appropriately recorded the machine and the related liability on January 1, 2021, at P697,380. How much is the periodic annual rental payment in the lease contract? (Use four decimal places)arrow_forward

- On January 1, 2020, Purple Inc. purchased a patent for $33, 300. Legal fees paid in this purchase amounted to $1,700. The legal remaining life of the patent is 14 years, but Purple believes it will only help increase sales for the next 10 years. On January 1, 2023, Purple was sued for patent infringement and had to spend $4,900 of legal fees in the successful defense of this patent. What is the book value of this patent on December 31, 2023? Select one: a. $24,500 b. $21,000 c. $ 25,200 d. $30, 240 e. $19,600arrow_forwardPina Corporation purchased a special tractor on December 31, 2020. The purchase agreement stipulated that Pina should pay $19,650 at the time of purchase and $5,220 at the end of each of the next 8 years. The tractor should be recorded on December 31, 2020, at what amount, assuming an appropriate interest rate of 12%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Cost of tractor to be recorded $arrow_forwardOn January 1, 2019, Tharn Corporation leased a machinery from Type Company on a five-year lease term at P150,000 annual rental payments, paid in advance. There is a bargain purchase option on December 31, 2023 of P240,000. The economic life of the equipment is 15 years. The interest rate implicit in the lease is 12%. b. How much is the depreciation expense to be recognized in 2019 related to the right-of-use asset? A. P39,451 B. P49,451 C. P118,354 D. P148,354 a. Which of the following is part of the entry or entries to be recorded at the end of lease term assuming that Tharn fails to exercise its bargain purchase option? A. Debit Loss on Unexercised Bargain Purchase Option, P245,516 B. Debit Lease Liability, P325,236 C. Debit Interest Payable, P25,736 D. Credit Right-of-Use Asset, P741,771arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College