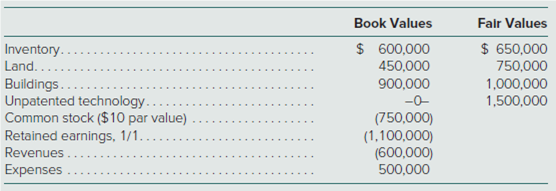

On February 1, Piscina Corporation completed a combination with Swimwear Company. At that date, Swimwear’s account balances were as follows:

Piscina issued 30,000 shares of its common stock with a par value of $25 and a fair value of $150 per share to the owners of Swimwear for all of their Swimwear shares. Upon completion of the combination, Swimwear Company was formally dissolved.

Prior to 2002, business combinations were accounted for using either purchase or pooling of interests accounting. The two methods often produced substantially different financial statement effects. For the scenario above,

a. What are the respective consolidated values for Swimwear’s assets under the pooling method and the purchase method?

b. Under each of the following methods, how would Piscina account for Swimwear’s current year, but prior to acquisition, revenues and expenses?

• Pooling of interests method.

• Purchase method.

c. Explain the alternative impact of pooling versus purchase accounting on performance ratios such as return on assets and earnings per share in periods subsequent to the combination.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- On June 1, 2023, Sheffield Company and Tamarisk Company merged to form Vaughn Inc. A total of 764,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2025, the company issued an additional 579,000 shares of stock for cash. All 1,343,000 shares were outstanding on December 31, 2025. Vaughn Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 40 shares of common at any interest date. None of the bonds have been converted to date. Vaughn Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,408,000. (The tax rate is 20%.) Determine the following for 2025. a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.) 1. 2. 1. Basic earnings per share 2. Diluted earnings per share b. The earnings figures…arrow_forwardWooden Reed Inc. (WRI) issued 30,000 voting common shares to acquire all of the assets and liabilities of Creative Instrument Ltd. (CIL). On the acquisition date, WRI's shares were trading at $21.83 per share. After the transaction, CIL owned 20% of WRI's outstanding shares. Below are the statements of financial position of both companies immediately before the transaction, along with the fair values of CIL's assets and liabilities: WRI CIL Cash Accounts receivable Inventory Property, plant, equipment (net) Current liabilities Long-term debt Common shares Retained earnings $754,900 ■ $919,900 $265,000 O $100,000 S carrying value 75,000 CA 180,000 220,000 880,000 $ 1,355,000 $ 75,000 235,000 100,000 945,000 $ 1,355,000 If the consolidated statement of financial position was created immediately after the acquisition, the consolidated 2. common share account will be: A TTİNEN carrying value $ 35,000 TRT- 67,500 10 125,000 S climi 1 temagam de - SAM A TRILOŽ B 350,000 $ 577,500 $ 25,000…arrow_forwardOn January 1, 2020, Ridge Road Company acquired 25 percent of the voting shares of Sauk Trail, Inc., for $3,700,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the investment to gain access to Sauk Trail’s board of directors and thus facilitate future cooperative agreements between the two firms. Ridge Road quickly obtained several seats on Sauk Trail’s board, which gave it the ability to significantly influence Sauk Trail’s operating and investing activities. The January 1, 2020, carrying amounts and corresponding fair values for Sauk Trail’s assets and liabilities follow: Carrying Amount Fair Value Cash and receivables $ 160,000 $ 160,000 Computing equipment 5,450,000 6,500,000 Patented technology 150,000 4,100,000 Trademark 200,000 2,100,000 Liabilities (235,000 ) (235,000 ) Also, as of January 1, 2020, Sauk Trail’s computing equipment had a…arrow_forward

- On January 1, 2013, Peach Company issued 1,390 of its $20 par value common shares with a fair value of $62 per share in exchange for the 1,820 outstanding common shares of Swartz Company in a purchase transaction. Registration costs amounted to $1,752, paid in cash. Just prior to the acquisition, the balance sheets of the two companies were as follows: Peach Company Swartz Company Cash $71,250 $13,190 Accounts receivable (net) 99,260 20,070 Inventory 63,300 26,980 Plant and equipment (net) 99,340 39,970 Land 27,990 21,440 Total assets $361,140 $121,650 Accounts payable $64,130 $16,800 Notes payable 85,460 20,800 Common stock, $20 par value 108,400 36,400 Other contributed capital 58,280 23,800 Retained earnings 44,870 23,850 Total equities $361,140 $121,650 Any difference between the book value of equity and the value implied by the purchase price relates to goodwill.…arrow_forwardOn June 1, 2018, Bramble Company and Sunland Company merged to form Coronado Inc. A total of 761,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis.On April 1, 2020, the company issued an additional 652,000 shares of stock for cash. All 1,413,000 shares were outstanding on December 31, 2020.Coronado Inc. also issued $600,000 of 20-year, 7% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 40 shares of common at any interest date. None of the bonds have been converted to date.Coronado Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,390,000. (The tax rate is 20%.)Determine the following for 2020.(a) The number of shares to be used for calculating: (1) Basic earnings per share (2) Diluted earnings per share (b) The earnings figures to be used for calculating:…arrow_forwardOn June 1, 2018, Indigo Company and Sweet Company merged to form Pharoah Inc. A total of 870,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis.On April 1, 2020, the company issued an additional 543,000 shares of stock for cash. All 1,413,000 shares were outstanding on December 31, 2020.Pharoah Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 38 shares of common at any interest date. None of the bonds have been converted to date.Pharoah Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,613,000. (The tax rate is 20%.)Determine the following for 2020. a) - Basic Earnings per share - Diluted Earnings per share b) the earnings used to calculate: - Basic Earnings per share - Diluted Earnings per sharearrow_forward

- Based on the information provided below, prepare appropriate consolidation journal entries for possible account adjustment or elimination. Reference appropriate accounting standards to explain the approach which needs to be taken for the adjusting journals. Parent paid $110 000 on 30 June for all the shares of Subsidiary, whose equity at that date is share capital $72 000 and retained profits $28 000. However, the assets of Subsidiary are not all recorded at their fair value. Assume that all companies adopt the revaluation model under AASB 116. The discrepancies are: Carrying Amount $ Fair Value Investments 26 000 54 000 Accounts receivable 14 000 8 000 PPE 26 000 12 000 Inventory 70 000 76 000 Franchise Nil 10 000arrow_forwardOn June 1, 2023, Swifty Company and Nash Company merged to form Crane Inc. A total of 826,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2025, the company issued an additional 653,000 shares of stock for cash. All 1,479,000 shares were outstanding on December 31, 2025. Crane Inc. also issued $600,000 of 20-year, 9% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 38 shares of common at any interest date. None of the bonds have been converted to date. Crane Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,407,000. (The tax rate is 20%.) Determine the following for 2025. a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.) 1. 2. 1. Basic earnings per share 2. Diluted earnings per share b. The earnings figures to be used…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education