Concept explainers

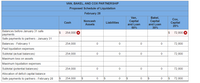

On January 1, the partners of Van, Bakel, and Cox (who share

| Debit | Credit | |||

| Cash | $ | 24,000 | ||

| 78,000 | ||||

| Inventory | 64,000 | |||

| Machinery and equipment, net | 201,000 | |||

| Van, loan | 42,000 | |||

| Accounts payable | $ | 77,000 | ||

| Bakel, loan | 32,000 | |||

| Van, capital | 124,000 | |||

| Bakel, capital | 96,000 | |||

| Cox, capital | 80,000 | |||

| Totals | $ | 409,000 | $ | 409,000 |

The partners plan a program of piecemeal conversion of the partnership’s assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month. A summary of the liquidation transactions follows:

| January | Collected $57,000 of the accounts receivable; the balance is deemed uncollectible. |

| Received $44,000 for the entire inventory. | |

| Paid $8,000 in liquidation expenses. | |

| Paid $68,000 to the outside creditors after offsetting a $9,000 credit memorandum received by the partnership on January 11. | |

| Retained $16,000 cash in the business at the end of January to cover liquidation expenses. The remainder is distributed to the partners. | |

| February | Paid $9,000 in liquidation expenses. |

| Retained $4,000 cash in the business at the end of the month to cover additional liquidation expenses. | |

| March | Received $152,000 on the sale of all machinery and equipment. |

| Paid $11,000 in final liquidation expenses. | |

| Retained no cash in the business. |

Prepare proposed schedules of liquidation on January 31, February 28, and March 31 to determine the safe payments made to the partners at the end of each of these three months.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- After the accounts are closed on February 3, prior to liquidating the partnership, the capital accounts of William Gerloff, Joshua Chu, and Courtney Jewett are $19,580, $4,020, and $22,460, respectively. Cash and noncash assets total $4,980 and $55,980, respectively. Amounts owed to creditors total $14,900. The partners share income and losses in the ratio of 2:1:1. Between February 3 and February 28, the noncash assets are sold for $36,300, the partner with the capital deficiency pays the deficiency to the partnership, and the liabilities are paid. Required: 1. Prepare a statement of partnership liquidation, indicating (a) the sale of assets and division of loss, (b) the payment of liabilities, (c) the receipt of the deficiency (from the appropriate partner), and (d) the distribution of cash. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers…arrow_forwardR.Patel, D. Amo, and S. Adams have operated their partnership for several years, sharing income and loss equally. The partners decide to liquidate. Immediately prior to the final distribution of cash, the account balances are: Cash, $21,000; R. Patel, Capital, $12,000; D Arno, Capital, $23,000; S. Adams, Capital, $(14,000). Assume that Adams cannot pay any capital deficiency owed to the partnership. In the final distribution of cash, Patel and Arno will each receive: ITEMS Item #1 Item #2 R. Patel D. Amoarrow_forwardAfter the accounts are closed on February 3, prior to liquidating the partnership, the capital accounts of William Gerloff, Joshua Chu, and Courtney Jewett are $19,580, $4,020, and $22,460, respectively. Cash and noncash assets total $4,980 and $55,980, respectively. Amounts owed to creditors total $14,900. The partners share income and losses in the ratio of 2:1:1. Between February 3 and February 28, the noncash assets are sold for $36,300, the partner with the capital deficiency pays the deficiency to the partnership, and the liabilities are paid. 1. Prepare a statement of partnership liquidation, indicating (a) the sale of assets and division of loss, (b) the payment of liabilities, (c) the receipt of the deficiency (from the appropriate partner), and (d) the distribution of cash. Be sure to complete the statement heading. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter…arrow_forward

- The Field, Brown & Snow are partners and share income and losses equality. The partner decide to liquidate the partnership when their capital balances are as follows: Field, $131,250; Brown, $165,000; and Snow, $153,750. On May 31, the liquidation resulted in a loss of $405,000. 3. Assume that the partner with a deficit does not reimburse the partnership. Prepare journal entries (a) to transfer the deficit to the other partners and (b) to record the final disbursement of cash to the partners.arrow_forwardThe Bui, Clemente, Devian, and Toussaint partnership has terminated operations and is undergoing liquidation. Sales commissions and other liquidation expenses are expected to total $19,000. The partnership’s balance sheet prior to the commencement of liquidation is as follows: Cash $ 27,000 Liabilities $ 40,000 Noncash assets 254,000 Bui, capital (20%) 18,000 Clemente, capital (40%) 40,000 Devian, capital (20%) 48,000 Toussaint, capital (20%) 135,000 Total assets $ 281,000 Total liabilities and capital $ 281,000 Required: Prepare a predistribution plan for this partnership.arrow_forwarda. The total restricted interest in the month of April amounted to:b. The cash received by Lawrence in the 1st month amounted to:arrow_forward

- At year-end, the Queen City partnership has the following capital balances: $ 340,000 320,000 Isabella, Capital Catherine, Capital Elizabeth, Capital Victoria, Capital 290,000 280,000 Profits and losses are split on a 3:3:2:2 basis, respectively. Elizabeth decides to leave the partnership and is paid $320,000 from the business based on the original contractual agreement. Required: The payment made to Elizabeth beyond her capital account was for Elizabeth's share of previously unrecognized goodwill. After recognizing partnership goodwill, compute Isabella's capital balance after Elizabeth withdraws. Isabella's capital before withdrawal of Elizabeth Isabella's share of goodwill recognition Isabella's capital balance after withdrawal of Elizabeth $ 0arrow_forwardAlex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: $ 65,000 240,000 $ 47,500 168,000 89,500 Cash Liabilities Noncash assets Alex, capital Bess, capital Total liabilities and capital Total assets $ 305,000 $ 305,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final…arrow_forwardTri Fecta, a partnership, had revenues of $363,000 in its first year of operations. The partnership has not collected on $46,800 of its sales and still owes $39,200 on $205,000 of merchandise it purchased. There was no inventory on hand at the end of the year. The partnership paid $29,000 in salaries. The partners invested $44,000 in the business and $25,000 was borrowed on a five-year note. The partnership paid $2,250 in interest that was the amount owed for the year and paid $9,000 for a two-year insurance policy on the first day of business. Ignore income taxes. Compute the cash balance at the end of the first year for Tri Fecta. Multiple Choice $179,150 $191,250 $183,650 $186,750arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education