FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

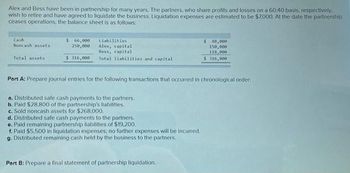

Transcribed Image Text:Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 60:40 basis, respectively.

wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $7,000. At the date the partnership

ceases operations, the balance sheet is as follows:

Cash

Noncash assets

Total assets

$ 66,000

250,000

$316,000

Liabilities

Alex, capital

Bess, capital

Total liabilities and capital

Part A: Prepare journal entries for the following transactions that occurred in chronological order.

a. Distributed safe cash payments to the partners.

b. Paid $28.800 of the partnership's liabilities.

c. Sold noncash assets for $268,000.

d. Distributed safe cash payments to the partners.

e. Paid remaining partnership liabilities of $19,200,

f. Paid $5,500 in liquidation expenses; no further expenses will be incurred.

g. Distributed remaining cash held by the business to the partners.

$ 48,000

150,000

118,000

$316,000

Part B: Prepare a final statement of partnership liquidation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The E.N.D. partnership has the following capital balances as of the end of the current year: $ 280,000 240,000 210,000 190,000 $ 920,000 Pineda Adams Fergie Gomez Total capital Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $262,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $305,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.) Capital Balance a. Pineda Adams Gomez b. Adams Fergie Gomezarrow_forwardAlex and Bess have been in partnership for many years. The partners, who share profits and losses on a 60:40 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $5,000. At the date the partnership ceases operations, the balance sheet is as follows: Cash Noncash assets Total assets Liabilities Alex, capital Bess, capital $ 200,000 Total liabilities and capital $ 50,000 150,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $30,000 of the partnership's liabilities. c. Sold noncash assets for $160,000. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $10,000. f. Paid $4,000 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. $ 40,000 90,000 70,000 $ 200,000 Part B: Prepare a final…arrow_forwardThe following account balances were available for the Perry, Quincy, and Renquist partnership just before it entered liquidation: Cash $ 90,000 Liabilities $ 170,000 Noncash assets 300,000 Perry, capital 70,000 Quincy, capital 50,000 Renquist, capital 100,000 Total $ 390,000 Total $ 390,000 Included in Perry’s Capital account balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000. All partners were insolvent. For what amount would the noncash assets need to be sold in order for Quincy to receive some cash from the liquidation? Multiple Choice A. Any amount in excess of $170,000. B. Any amount in excess of $190,000. C. Any amount in excess of $260,000. D. Any amount in excess of $280,000. E. Any amount in excess of $300,000.arrow_forward

- The Field, Brown & Snow are partners and share income and losses equality. The partner decide to liquidate the partnership when their capital balances are as follows: Field, $131,250; Brown, $165,000; and Snow, $153,750. On May 31, the liquidation resulted in a loss of $405,000. 3. Assume that the partner with a deficit does not reimburse the partnership. Prepare journal entries (a) to transfer the deficit to the other partners and (b) to record the final disbursement of cash to the partners.arrow_forwardAlex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: $ 65,000 240,000 $ 47,500 168,000 89,500 Cash Liabilities Noncash assets Alex, capital Bess, capital Total liabilities and capital Total assets $ 305,000 $ 305,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education