FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The Bui, Clemente, Devian, and Toussaint

| Cash | $ 27,000 | Liabilities | $ 40,000 |

| Noncash assets | 254,000 | Bui, capital (20%) | 18,000 |

| Clemente, capital (40%) | 40,000 | ||

| Devian, capital (20%) | 48,000 | ||

| Toussaint, capital (20%) | 135,000 | ||

| Total assets | $ 281,000 | Total liabilities and capital | $ 281,000 |

Required:

Prepare a predistribution plan for this partnership.

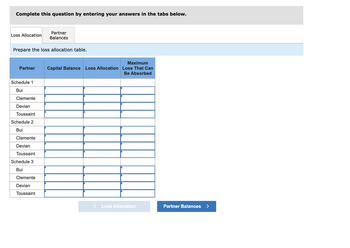

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Partner

Balances

Prepare the loss allocation table.

Loss Allocation

Maximum

Partner Capital Balance Loss Allocation Loss That Can

Be Absorbed

Schedule 1

Bui

Clemente

Devian

Toussaint

Schedule 2

Bui

Clemente

Devian

Toussaint

Schedule 3

Bui

Clemente

Devian

Toussaint

< Loss Allocation

Partner Balances >

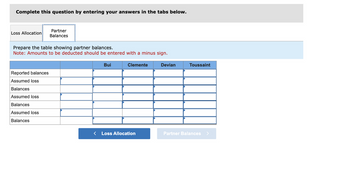

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Loss Allocation

Partner

Balances

Prepare the table showing partner balances.

Note: Amounts to be deducted should be entered with a minus sign.

Reported balances

Assumed loss

Balances

Assumed loss

Balances

Assumed loss

Balances

Bui

Clemente

< Loss Allocation

Devian

Toussaint

Partner Balances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Company at December 31 has cash $23,000, noncash assets $105,000, liabilities $57,400, and the following capital balances: Floyd $45,800 and Dewitt $24,800. The firm is liquated, and $116,000 in cash is received for the noncash assets. Floyd and Dewitt income ratios are 60% and 40%, respectively. Cullumber Company decides to liquidate the partnership Prepare the entries to record: (credit account titles are automatically indented when amount is entered . Do not indent manually.) A. The sale of noncash assets. B. The allocation of the gain or loss on realization to the partners. C. Payment of creditors. D. Distribution of cash to the partners .arrow_forwardAlex and Bess have been in partnership for many years. The partners, who share profits and losses on a 60:40 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $5,000. At the date the partnership ceases operations, the balance sheet is as follows: Cash Noncash assets Total assets Liabilities Alex, capital Bess, capital $ 200,000 Total liabilities and capital $ 50,000 150,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $30,000 of the partnership's liabilities. c. Sold noncash assets for $160,000. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $10,000. f. Paid $4,000 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. $ 40,000 90,000 70,000 $ 200,000 Part B: Prepare a final…arrow_forwardThe following account balances were available for the Perry, Quincy, and Renquist partnership just before it entered liquidation: Cash $ 90,000 Liabilities $ 170,000 Noncash assets 300,000 Perry, capital 70,000 Quincy, capital 50,000 Renquist, capital 100,000 Total $ 390,000 Total $ 390,000 Included in Perry’s Capital account balance is a $20,000 partnership loan owed to Perry. Perry, Quincy, and Renquist shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be $15,000. All partners were insolvent. For what amount would the noncash assets need to be sold in order for Quincy to receive some cash from the liquidation? Multiple Choice A. Any amount in excess of $170,000. B. Any amount in excess of $190,000. C. Any amount in excess of $260,000. D. Any amount in excess of $280,000. E. Any amount in excess of $300,000.arrow_forward

- The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash Noncash assets $ 41,000 229,000 Liabilities Drysdale, loan Drysdale, capital (50%) Koufax, capital (30%) Marichal, capital (20%) $46,500 21,000 77,500 67,500 57,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $20,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $79,000 are sold for $62,500. How is the available cash to be divided?arrow_forwardAt year-end, the Queen City partnership has the following capital balances: $ 340,000 320,000 Isabella, Capital Catherine, Capital Elizabeth, Capital Victoria, Capital 290,000 280,000 Profits and losses are split on a 3:3:2:2 basis, respectively. Elizabeth decides to leave the partnership and is paid $320,000 from the business based on the original contractual agreement. Required: The payment made to Elizabeth beyond her capital account was for Elizabeth's share of previously unrecognized goodwill. After recognizing partnership goodwill, compute Isabella's capital balance after Elizabeth withdraws. Isabella's capital before withdrawal of Elizabeth Isabella's share of goodwill recognition Isabella's capital balance after withdrawal of Elizabeth $ 0arrow_forwardThe Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 37,000 Liabilities $ 49,000 Noncash assets 209,000 Drysdale, loan 12,500 Drysdale, capital (50%) 71,500 Koufax, capital (30%) 61,500 Marichal, capital (20%) 51,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $16,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $75,000 are sold for $60,500. How is the available cash to be divided?arrow_forward

- Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: $ 65,000 240,000 $ 47,500 168,000 89,500 Cash Liabilities Noncash assets Alex, capital Bess, capital Total liabilities and capital Total assets $ 305,000 $ 305,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final…arrow_forwardOn January 1, 20x20. ACJ Partnership entered into liquidation. The partners' capital balances on this date were as follows: A (25%) P2,500,000; C (35%) P5,400,0003; J (40%) P3.700,000. The partnership has liabilities amounting to P4,400,000, including a loan from C P600.000. Cash on hand before the start of liquidation is P800,000. Noncash assets amounting to P7,400,000 were sold at book value and the rest of the noncash assets were sold al a loss of P4.200,000. How much cash will be distributed to the partners?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education