Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

The income statement for the current year?

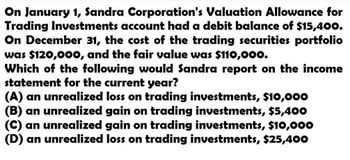

Transcribed Image Text:On January 1, Sandra Corporation's Valuation Allowance for

Trading Investments account had a debit balance of $15,400.

On December 31, the cost of the trading securities portfolio

was $120,000, and the fair value was $110,000.

Which of the following would Sandra report on the income

statement for the current year?

(A) an unrealized loss on trading investments, $10,000

(B) an unrealized gain on trading investments, $5,400

(C) an unrealized gain on trading investments, $10,000

(D) an unrealized loss on trading investments, $25,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gympa reported on its income statement a net income $647,000 for the year ended December 31 before considering the following: a. During the year, Gympa purchased trading securities b. At year-end , the fair value of the investment portfolio was $50,000 lesshan the cost c. The balance of Retained Earnings was $792,000 on January 1 d. Gympa paid $67,000 in cash dividends during the year. Using the above data, calculate the balance of Retained Earnings on Decemeber 31.arrow_forwardThe accountant preparing the financial statements has asked you to provide the fair value as of the end of the year for the investments. Present the information as it would be shown on the financial statements. Last year, The Wellington Company reported costs of $68,000 in trading investments and $82,000 in available-for-sale investments. Refer to the journal entries shown on The Wellington Company panel. Assume that all investments sold during this year were trading investments and that purchases during the year were new investments. 1. Select the correct label for each line and fill in the amount. In classifying the investments, choose a categorization which seems most likely, given the pattern of transactions in the journal entries. Enter all amounts as positive numbers. If an amount box does not require an entry, leave it blank. Trading Securities Trading investments at cost $ Plus valuation allowance for trading investments $ Trading investments at fair value $…arrow_forwardr. Pinkberry Co. reported total earnings of $240,000. Equinox Products recorded its share of Pinkberry Co. net income using the equity method. Description Debit Credit s. The Solstice Corp. bonds have a fair value of $253,630 on December 31, 2OY5. Valuation Allowance for Available-for-Sale Investments had a balance of zero on January 1, 20Y5. Description Debit Credit Feedbackarrow_forward

- The income statement for Hudson Company reported net income of $345,000 for the year ended December 31 before considering the following: During the year, the company purchased trading securities. At year-end, the fair value of the investment portfolio was $23,000 less than cost. The balance of Retained Earnings was $823,000 on January 1. Hudson Company paid $43,000 in cash dividends during the year.Compute the balance of Retained Earnings on December 31.$ fill in the blank 1arrow_forwardCain Corp. reported accrued investment interest receivable of 38,000 and 46,500 at January 1 and December 31, year 1, respectively. During year 1, cash collections from the investments included the following: Capital gains distributions= 145,000; Interest= 152,000. What amount should Cain Corp report as interest revenue from investments for year 1? *arrow_forwardBI's income for the year ended December 31, 2021 was $ 4,000,000. This was earned evenly over the year. In addition BI paid dividends of $ 300,000 each on March 31, June 30, September 30 and December 31, 2021 to their shareholders of records on that date. The inventory on July 1, 2021 was 75% sold as of December 31, 2021. Required. For the investment in AI 1. Using IFRS 9 prepare the journal entries for DC for all of 2021. 2. Using ASPE prepare the journal entries for DC for all of 2021. For the investment in BI 3. Using IFRS prepare the journal entries for DC for 2021. 4. Using ASPE prepare the joumal entries for DC for 2021 for all options available under ASPE.arrow_forward

- Stuart Corp. purchased $80,000 of Dumb Co. bonds and $120,000 of Silly Inc. bonds. Both investments are classified as trading. As of December 31, the Dumb Co. bonds are selling for $90,000 and the Silly Inc. bonds are selling for $140,000 per share. Stuart had net income of $150,000 before reporting the impact of investment transactions. Required: a. Record the December 31 adjusting entries for investments. b. What is Stuart Corp.'s net income after adjusting for investments? c. What is the appropriate balance sheet presentation for these investments?arrow_forwardOn February 15, Jewel Company buys bonds of Marcelo Corp. for $201,700. The investment is classified as available-for-sale securities. This is the company’s first and only investment in available-for-sale securities. On December 31, the bonds had a fair value of $203,700. The entry to record the year-end adjustment is:arrow_forwardVishnuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning