Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

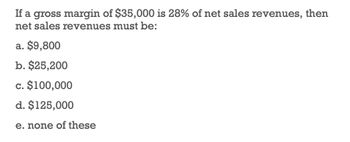

Transcribed Image Text:If a gross margin of $35,000 is 28% of net sales revenues, then

net sales revenues must be:

a. $9,800

b. $25,200

c. $100,000

d. $125,000

e. none of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardThe following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and Allowances: $34,890; COGS: $120,470; Sales Discounts: $44,760. Given this information, what is the Gross Profit Margin Ratio for Sunrise Motors? (Round to the nearest whole percentage.)arrow_forwardThe following is select account information for August Sundries. Sales: $850,360; Sales Returns and Allowances: $148,550; COGS: $300,840; Operating Expenses: $45,770; Sales Discounts: $231,820. If August Sundries uses a multi-step income statement format, what is their gross margin?arrow_forward

- A product has a sales price of $175 and a per-unit contribution margin of $75. What is the contribution margin ratio?arrow_forwardWhat would be the net income for Floress Catering? a. 45,500 b. 16,800 c. 19,800 d. 10,800arrow_forwardIf a firm has a contribution margin of $78M90 and a net income of $13,700 for the current month, what is their degree of operating leverage? 0.21 1.21 2.4 5.7arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardIf a company has three lots of products for sale, purchase 1 (earliest) for $17, purchase 2 (middle) for $15, purchase 3 (latest) for $12, which of the following statements is true? A. This is an inflationary cost pattern. B. This is a deflationary cost pattern. C. The next purchase will cost less than $12. D. None of these statements can be verified.arrow_forwardMargin of safety Jorgensen Company has sales of 380,000,000, and the break-even point in sales dollars is 323,000,000. Determine Jorgensen Companys margin of safety as a percent of current sales.arrow_forward

- Calculate the ROI for Gardner Chemical given the following information: A. 25% B. 24% C. 60% D. 40%arrow_forwardProfit margin, investment turnover, and ROI Briggs Company has operating income of 36,000, invested assets of 180,000, and sales of 720,000. Use the DuPont formula to compute the return on investment and show (A) the profit margin, (B) the investment turnover, and (C) the return on investment.arrow_forwardIf a firm has a contribution margin of $59,690 and a net income of $12,700 for the current month, what is their degree of operating leverage? A. 0.18 B. 1.18 C. 2.4 D. 4.7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub