FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:On January 1, Flint Corporation had 62,900 shares of no-par common stock issued and outstanding. The stock has a stated value of $4

per share. During the year, the following transactions occurred.

Issued 18,000 additional shares of common stock for $13 per share.

Declared a cash dividend of $1.95 per share to stockholders of record on June 30.

Paid the $1.95 cash dividend.

Issued 8,000 additional shares of common stock for $13 per share.

Dec. 15 Declared a cash dividend on outstanding shares of $2.25 per share to stockholders of record on December 31.

Apr. 1

June 15.

July 10

Dec.

1

(a)

Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues

and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of

the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, eg. 5.276.)

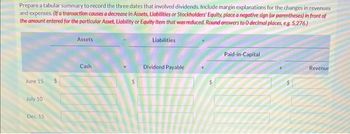

Transcribed Image Text:Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues

and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of

the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to 0 decimal places, eg. 5,276.)

June 15

July 10

Dec. 15

Assets

Cash

Liabilities

Dividend Payable

Paid-in-Capital

Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- nit.0arrow_forwardPrepare journal entries for both of the following transactions: On Jan 1, ABC Company issued 300 $10 stocks with a $5 par value. On Dec 31st, ABC Company, declared a 3% cash dividend on each share.arrow_forwardOn January 1, Michelle Corporation had 95,000 shares of no-par common stock issued and outstanding. The stock has a stated value of S5 per share. During the year, the following occurred. Apr. 1issued 55, 000 additional shares of common stock for $17 per share. Jun. 15Declared a cash dividend of $1 per share to stockholders of record on June 30. Jul. 10Paid the $1 cash dividend. Dec. 1Issued 2, 000 additional shares of common stock for $19 per share. 15Declared a cash dividend on outstanding shares of S 1.20 per share to stockholders of record on December 31. Prepare the entries, if any, on each of the dates.arrow_forward

- On January 1, Pharoah Corporation had 97,500 shares of no-par common stock issued and outstanding. The stock has a stated value of $6 per share. During the year, the following occurred. Apr. 1 Issued 23,000 additional shares of common stock for $17 per share. June 15 July 10 Dec. (a) 1 15 Declared a cash dividend of $1 per share to stockholders of record on June 30. Paid the $1 cash dividend. Issued 1,500 additional shares of common stock for $19 per share. Declared a cash dividend on outstanding shares of $2.90 per share to stockholders of record on December 31. Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forwardThe stockholders’ equity accounts of Rayburn Corporation as of January 1 appear below: Common stock, $7 par value, 400,000 shares authorized; 180,000 shares issued and outstanding $1,260,000 Paid-in capital in excess of par value 920,000 Retained earnings 513,000 During the year, the following transactions occurred: June 7 Declared a 10 percent stock dividend; market value of the common stock was $13 per share. June 28 Issued the stock dividend declared on June 7. Dec. 5 Declared a cash dividend of $1.45 per share. Dec. 26 Paid the cash dividend declared on December 5. Required a. Prepare journal entries to record the foregoing transactions. General Journal Date Description Debit Credit Jun.07 Answer Answer Answer Stock Dividends Distributable Answer Answer Answer Answer Answer Declared stock dividend. Jun.28 Answer Answer Answer Common Stock Answer Answer Issued common shares as stock dividend. Dec.05 Answer…arrow_forwardHelparrow_forward

- On January 1, Sheffield Corporation had 145000 shares of $10 par value common stock outstanding. On June 17, the company declared a 15% stock dividend to stockholders of record on June 20. Market value of the stock was $15 on June 17. The entry to record the transaction of June 17 would include a O credit to Common Stock Dividends Distributable for $326250. O credit to Cash for $326250. O credit to Common Stock Dividends Distributable for $108750. O debit to Stock Dividends for $326250.arrow_forwardThe following accounts and their balances appear in the ledger of Young Properties Inc. on November 30 of the current year: Common Stock, $15 par $168,000 Paid-In Capital in Excess of Par 13,440 Paid-In Capital from Sale of Treasury Stock 7,300 Retained Earnings 277,000 Treasury Stock 10, 450 Prepare the Stockholders' Equity section of the balance sheet as of November 30. Fifty thousand shares of common stock are authorized, and 550 shares have been reacquired.arrow_forwardpopatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education