Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide answer

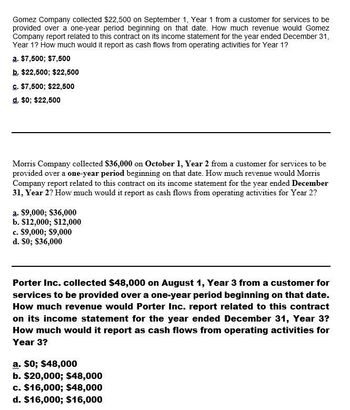

Transcribed Image Text:Gomez Company collected $22,500 on September 1, Year 1 from a customer for services to be

provided over a one-year period beginning on that date. How much revenue would Gomez

Company report related to this contract on its income statement for the year ended December 31,

Year 1? How much would it report as cash flows from operating activities for Year 1?

a. $7,500; $7,500

b. $22,500; $22,500

c. $7,500; $22,500

d. $0; $22,500

Morris Company collected $36,000 on October 1, Year 2 from a customer for services to be

provided over a one-year period beginning on that date. How much revenue would Morris

Company report related to this contract on its income statement for the year ended December

31, Year 2? How much would it report as cash flows from operating activities for Year 2?

a. $9,000; $36,000

b. $12,000; $12,000

c. $9,000; $9,000

d. $0; $36,000

Porter Inc. collected $48,000 on August 1, Year 3 from a customer for

services to be provided over a one-year period beginning on that date.

How much revenue would Porter Inc. report related to this contract

on its income statement for the year ended December 31, Year 3?

How much would it report as cash flows from operating activities for

Year 3?

a. $0; $48,000

b. $20,000; $48,000

c. $16,000; $48,000

d. $16,000; $16,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On September 1. Year 1, Western Company loaned $36,600 cash to Eastern Company. The one year note carried a 6% rate of interest. The amount of interest revenue on the income statement and the amount of cash flow from operating activities shown on Western's Year 2 financial statements would be Multiple Choice $732 interest revenue and $2196 cash inflow from operating activmes $1.464 imerest revenue and $2,196 cash inflow from operating activitiesarrow_forwardHayden Company expects to pay a 7% bonus on net income after deducting the bonus. Assume the company reports net income of $121,980 before the calculation of the bonus. The journal entry to record the accrued bonus includes OA. a debit to Employee Bonus Payable, $7,980. OB. a credit to Cash, $8,539. OC. a credit to Employee Bonus Payable, $7,980. OD. a debit to Employee Bonus Expense, $8,539.arrow_forwardOn June 1, Davis Inc. issued an $89,300, 8%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using a 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a. $1,806 Ob. $7,144 O c. $595 Od. $1,191 Barrow_forward

- On June 1, Davis Inc. issued an $76,100, 12%, 120-day note payable to Garcia Company Assume that the fiscal year of Garcia ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a.$1,522 b.$9,132 c.$761 d.$2,308arrow_forwardThe following transactions apply to Walnut Enterprises for Year 1, its first year of operations: Received $40,500 cash from the issue of a short-term note with a 6 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. Received $117,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 5 percent. Paid $70,500 cash for other operating expenses during the year. Paid the sales tax due on $97,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: Paid the balance of the sales tax due for Year 1. Received $142,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 5 percent. Repaid the principal of the note and applicable interest on April 1, Year 2. Paid $83,500 of…arrow_forwardIn November and December 20X1, Gee Company, a newly organized magazine publisher, received $36,000 for 1,000 three-year subscriptions at $12 per year, starting with the January 20X2 issue of the magazine. Required: How much should Gee report in its 20X1 income statement for subscriptions revenue on an accrual basis? What are Gee's cash receipts in 20X1? Revenue recognized Cash receiptsarrow_forward

- On September 1, Year 1, Western Company loaned $39,600 cash to Eastern Company. The one-year note carried a 6% rate of Interest. The amount of Interest revenue on the Income statement and the amount of cash flow from operating activities shown on Western's December 31, Year 1, financial statements would be: Multiple Choice O $792 Interest revenue and zero cash flow from operating activities. $1,584 Interest revenue and zero cash flow from operating activities. $1,584 Interest revenue and $2,376 cash flow from operating activities. $792 Interest revenue and $2,376 cash flow from operating activities.arrow_forwardPlease list all of the journal entries for Other Current Year Contracts. Your company name is PP. See below information: PP initiated a number of other contracts in the current year. The total dollar amount of all other contracts initiated was $5,919,700. This amount is broken down as follows: Goods and services which were delivered and for which cash was received: $3,444,429. Goods and services which were not delivered, but for which cash was received: $ 340,390. Goods and services which were delivered, but for which cash was not received: $1,538,481. Goods and services which were not delivered and for which cash was not received: $596,400. Of the total goods and services delivered, $3,267,650 was related to goods and $1,715,260 was related to services.arrow_forwardThe following transactions apply to Walnut Enterprises for Year 1, its first year of operations: Received $43,000 cash from the issue of a short-term note with a 5 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. Received $117,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent. Paid $73,000 cash for other operating expenses during the year. Paid the sales tax due on $97,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: Paid the balance of the sales tax due for Year 1. Received $142,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent. Repaid the principal of the note and applicable interest on April 1, Year 2. Paid $86,000 of other operating…arrow_forward

- The following transactions apply to Walnut Enterprises for Year 1, its first year of operations:Received $43,000 cash from the issue of a short-term note with a 5 percent interest rate and a one-year maturity. The note was made on April 1, Year 1.Received $117,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Paid $73,000 cash for other operating expenses during the year.Paid the sales tax due on $97,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2.Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2:Paid the balance of the sales tax due for Year 1.Received $142,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Repaid the principal of the note and applicable interest on April 1, Year 2.Paid $86,000 of other operating expenses…arrow_forwardThe following transactions apply to Walnut Enterprises for Year 1, its first year of operations:Received $43,000 cash from the issue of a short-term note with a 5 percent interest rate and a one-year maturity. The note was made on April 1, Year 1.Received $117,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Paid $73,000 cash for other operating expenses during the year.Paid the sales tax due on $97,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2.Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2:Paid the balance of the sales tax due for Year 1.Received $142,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Repaid the principal of the note and applicable interest on April 1, Year 2.Paid $86,000 of other operating expenses…arrow_forwardThe following transactions apply to Walnut Enterprises for Year 1, its first year of operations:Received $43,000 cash from the issue of a short-term note with a 5 percent interest rate and a one-year maturity. The note was made on April 1, Year 1.Received $117,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Paid $73,000 cash for other operating expenses during the year.Paid the sales tax due on $97,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2.Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2:Paid the balance of the sales tax due for Year 1.Received $142,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 7 percent.Repaid the principal of the note and applicable interest on April 1, Year 2.Paid $86,000 of other operating expenses…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage