FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

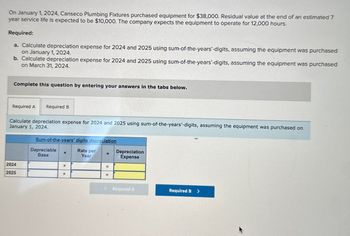

Transcribed Image Text:On January 1, 2024, Canseco Plumbing Fixtures purchased equipment for $38,000. Residual value at the end of an estimated 7

year service life is expected to be $10,000. The company expects the equipment to operate for 12,000 hours.

Required:

a. Calculate depreciation expense for 2024 and 2025 using sum-of-the-years'-digits, assuming the equipment was purchased

on January 1, 2024.

b. Calculate depreciation expense for 2024 and 2025 using sum-of-the-years'-digits, assuming the equipment was purchased

on March 31, 2024.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Calculate depreciation expense for 2024 and 2025 using sum-of-the-years'-digits, assuming the equipment was purchased on

January 1, 2024.

Sum-of-the-years' digits depreciation

2024

2025

Depreciable

Base

x

Rate per

Year

=

Depreciation

Expense

x

x

=

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Burger Chef acquired a delivery truck on March 1, 2021, for $31,600. The company estimates a residual value of $2,400 and a six-year service life. It expects to drive the truck 73,000 miles. Actual mileage was 10,700 miles in 2021 and 14,600 miles in 2022. Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a December 31 year-end. (Do not round intermediate calculations.) Depreciation Expense Year 2021 2022arrow_forwardMountain View Resorts purchased equipment at the beginning of 2021 for $40,000. Residual value at the end of an estimated four- year service life is expected to be $8,200. The machine operated for 1,900 hours in the first year and the company expects the machine to operate for a total of 11,000 hours over its four-year life. Calculate depreciation expense for 2021, using each of the following depreciation methods: (1) straight-line, (2) double-declining- balance, and (3) activity-based. (Round your intermediate calculations to 2 decimal places.) Depreciation Expense Straight-line Double-declining-balance Activity-basedarrow_forwardA company purchased equipment for $70,000 on January 1, 2022. The equipmtment is expected to have a five-year service life, with a residiual value of $15,000 at the end of five years. Using the straight line method, depreciation expense for 2023 and the book value at December 31, 2023 would be: $______ and $__________arrow_forward

- On July 1, 2018, Mundo Corporation purchased factory equipment for $50,000. Residual value was estimated at $2,000. The equipment will be depreciated over 10 years using the doubledeclining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depreciation expense of:arrow_forwardRehearsal Corporation purchased equipment on Jan 1, 2020, for $250,000. The equipment was expected to have a useful life of three years , or12,000 operating hours, and a residual value of $10,000. The equipment was used for 3,500 hours during 2020, 3,500 hours during 2021, and 5,000 hours in 2022.Instructions:Determine the amount of depreciation expense for the years ended December 31, 2020, 2021, and 2022, by (a) the straight-line method,(b) the units-of-production method, and ( c ) the double-declining-balance method. Round DDB Rate to two decimal places. Round final answers to the nearest dollar.SHOW YOUR WORK:Depreciation ExpenseYear Staight-Linearrow_forwardVisahnoarrow_forward

- On July 1, 2023, Yorkton Company purchased for $431,000 equipment having an estimated useful life of ten years with an estimated residual value of $33,000. Depreciation is calculated to the nearest month. The company has a December 31 year-end. Required: Complete the following schedules: (Amount to be deducted should be indicated by a minus sign.) 1. Assuming the purchase was made on January 1, 2023. 1. Double-declining-balance method: Equipment Less: Accumulated depreciation Year-end book value Depreciation expanse for the year 2. Straight-line method: Equipment Less: Accumulated depreciation Year-end book value Depreciation expense for the year $ $ $ $ $ $ 2023 431,000 $ 431,000 $ 86,200 $ 431,000 $ 431,000 $ 39,800 $ 2024 431,000 $ 431,000 431,000 $ 68,960 S 431,000 $ 2025 431,000 $ 39,800 $ 431,000 55,168 431,000 ww 431,000 39,800 Check my workarrow_forwardOn January 2, 2021, Morales Paint Company purchased a truck that cost $60,000 with a residual value of $2,500. The expected useful life of the truck is 4 years and 100,000 miles. It is expected to be driven 13,000 miles in the first year; 40,000 miles the second year; 27,000 miles in the third year and 20,000 miles in the fourth year. A. Prepare a depreciation schedule for the asset’s entire useful life using each of the following methods: Straight Line Production (Units of Production) Double Declining Balance B. Prepare the journal entry to record depreciation expense for year 2 for each of the Depreciation Methods (a total of 3 journal entries). C. Assume that the company decided to sell the equipment in year 3 for $15,000 in cash. Prepare the required journal entry for each of the Depreciation Methods (a total of 3 journal entries).arrow_forwardTasty Subs acquired a delivery truck on October 1, 2021, for $25,800. The company estimates a residual value of $2,400 and a six- year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a December 31 year-end. 2021 2022 Depreciation expensearrow_forward

- On September 1, 2018, Gabe's Brewing Co. purchased equipment for $168,000. Residual value at the end of an estimated 8-year useful life is expected to be $18,000. The company expects the machine to operate for 20,000 hours. The machine operated for 1,500 and 3,500 hours in 2018 and 2019, respectively. REQUIRED: 1. Calculate depreciation expense for 2018 and 2019 using the straightline method. 2. Calculate depreciation expense for 2018 and 2019 using the 150% declining balance method. 3. Calculate depreciation expense for 2018 and 2019 using the units-of-production method. 4. Now, assume the company sells the equipment on December 31, 2019, for $135,000 cash. Prepare the journal entry for the sale of the equipment assuming the company has used the straight-line method of depreciating the equipment.arrow_forwardOn January 1, 2018, the Allegheny Corporation purchased machinery for $150,000. The estimated service life of the machinery is 10 years and the estimated residual value is $7,000. The machine is expected to produce 300,000 units during its life. Required: Calculate depreciation for 2018 and 2019 using each of the following methods. 1. Straight line. 2. Sum-of-the-years'-digits. 3. Double-declining balance. 4. One hundred fifty percent declining balance. 5. Units of production (units produced in 2018, 41,000; units produced in 2019, 36,000). Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate depreciation for 2018 and 2019 using sum-of-the-years' digits. 2018 2019 Sum-of-the-years' digits depreciation Rate per Year Depreciable Base X X X = = Required 5 Depreciation Expensearrow_forwardnaruarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education