FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

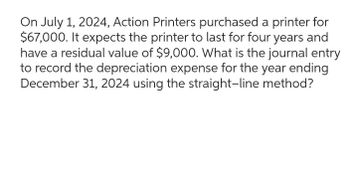

Transcribed Image Text:On July 1, 2024, Action Printers purchased a printer for

$67,000. It expects the printer to last for four years and

have a residual value of $9,000. What is the journal entry

to record the depreciation expense for the year ending

December 31, 2024 using the straight-line method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Basalt Inc bought a new vehicle on September 1, 2021 for $50,000. The vehicle is estimated to have a residual value of $5,000 at the end of its life and will last 7 years. Using straight-line depreciation, what is the depreciation expense at the year end of December 31, 2021 and 2022, respectively?arrow_forwardCheers Delivery Company purchased a new delivery truck for $48,000 on April 1, 2019. The truck is expected to have a service life of 5 years or 120,000 miles and a residual value of $3,000. The truck was driven 10,000 miles in 2019 and 16,000 miles in 2020. Cheers computes depreciation expense to the nearest whole month. See attached questions.arrow_forwardCheyenne Corp. purchased a new machine on October 1, 2022, at a cost of $131,000. The company estimated that the machine will have a salvage value of $18,500. The machine is expected to be used for 10,000 working hours during its 5-year life. Straight-line method for depreciation expense for 2022 is 5625 My question is "Compute the depreciation expense under units-of-activity for 2022, assuming machine usage was 1,900 hours." The answer should be a depreciation expense this is for a study guide on wiley plusarrow_forward

- Paint Pro purchased a spray painter on August 1, 2025 for $8,400 and estimated the salvage value at $600, along with an estimated useful life of 4 years and 5,500 spray hours. 1,500 spray hours were used in 2025. 1,800 spray hours were used in 2026 How much is depreciation expense in 2025 and 2026 using the double-declining-balance method? (Round intermediate calculations and final answers to O decimal places, e.g. 5,275.) 2025 expense $ 2026 expense $arrow_forwardCounselors of Atlanta purchased equipment on January 1, 2023, for $20,000. Counselors of Atlanta expected the equipment to last for four years and have a residual value of $2,000. Suppose Counselors of Atlanta sold the equipment for $8,000 on December 31, 2025, after using the equipment for three full years. Assume depreciation for 2025 has been recorded. Journalize the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment. Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss)arrow_forwardFreedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $48,000. The machine has an estimated life of five years and an estimated salvage value of $6,600. Required: a. Calculate the depreciation expense for each year of the asset's life using: 1. Straight-line depreciation. 2. Double-declining-balance depreciation. b. How much depreciation expense should be recorded by Freedom Co. for its fiscal year ended December 31, 2019, under each method? (Note: The machine will have been used for one-half of its first year of life.) c. Calculate the accumulated depreciation and net book value of the machine at December 31, 2020, under each method. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Required C Calculate the depreciation expense for each year of the asset's life using Straight-line depreciation. Depreciation Expense Year 1 2 3 4 5arrow_forward

- Vaughn Company purchased a new machine on September 1, 2022, at a cost of $134,000. The company estimated that the machine will have a salvage value of $13,000. The machine is expected to be used for 10,000 working hours during its 5-year life. (a) Compute the depreciation expense under the Straight-line method for 2022, 2023, and 2024. (Round answers to O decimal places, eg. 15250) Depreciation expense for: 2022 $ (b) Your answer is correct. 2023 (c) $ 2024 $ eTextbook and Media List of Accounts Your answer is correct. eTextbook and Media Compute the depreciation expense under the Units-of-activity for 2022, assuming machine usage was 830 hours. List of Accounts Depreciation expense for 2022 $ 8067 Depreciation expense for: 2022 $ 24200 2023 $ 24200 2024 $ Attempts: 1 of 3 used 10043 Compute the depreciation expense under the Declining-balance using double the straight-line rate for 2022, 2023, and 2024. (Round answers to 0 decimal places, eg. 15250) Attempts: 1 of 3 usedarrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forwardOn May 1, 2025, Crane Company purchased factory equipment for $739700. The asset's useful life in hours is estimated to be 190000. The estimated salvage value is $35000 and the estimated useful life in years is 9. The machine was used for 19000 hours in the first year. If the activity method is used, what is depreciation expense for 2025? (Round the depreciation rate to 4 decimal places e.g. 15.2578.) $52200 $70469 $78300 O $74269arrow_forward

- A company purchased a piece of equipment for $50,000 on January 1, 2022. The equipment has an estimated useful life of 5 years and a residual value of $5,000. The company uses the straight-line method for depreciation. Calculate the annual depreciation expense for the equipment and its book value at the end of each year from 2022 to 2025.arrow_forwardThe Depreciators Inc purchases and begins using equipment costing $175 on Sept 1, 2020. There was an additional cost of $15 for delivery and installation. The Depreciators expects to use the equipment over a 3 year useful life and estimates the salvage value to be $10. DI uses the straight line method for calculating depreciation. Determine the following. Pay attention to the dates being asked!: a) Net Book Value of the equipment as of December 31, 2020 $ b) Depreciation Expense for the year ending Dec 31, 2021 $ c) Accumulated Depreciation for the year ending Dec 31, 2023 You must show your work on your PDF upload to receive credit. You may prepare journals, TAccounts, or a table to determine your answers. The choice is yours, but your calculations should be logically presented so I can follow what you have done.arrow_forwardOn September 30, 2017, Foley Distribution Service purchased a copy machine for $36,800. Foley Distribution Service expects the machine to last for four years and to have a residual value of $2,000. Compute depreciation expense on the machine for the year ended December 31, 2017, using the straight-line method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education