FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

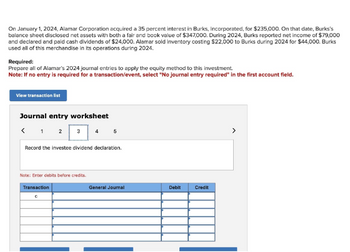

Transcribed Image Text:On January 1, 2024, Alamar Corporation acquired a 35 percent interest in Burks, Incorporated, for $235,000. On that date, Burks's

balance sheet disclosed net assets with both a fair and book value of $347,000. During 2024, Burks reported net income of $79,000

and declared and paid cash dividends of $24,000. Alamar sold inventory costing $22,000 to Burks during 2024 for $44,000. Burks

used all of this merchandise in its operations during 2024.

Required:

Prepare all of Alamar's 2024 journal entries to apply the equity method to this investment.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

< 1 2 3

Note: Enter debits before credits.

4

Record the investee dividend declaration.

Transaction

с

5

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ruiz Company puchased 30 per cent of Sim Company’s outstanding common stock for $3,000,000 and uses the equity method of accounting. Sim Company reported net income of $ 640,000 for 2018. On 2018 December 31, Sim Company paid a cash dividend of $200,000. In 2019, Sim Company incurred a net loss of $ 65,000. Prepare entries to reflect these events on Ruiz Company’s books.arrow_forwardOn January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000. On that date, Burks’s balance sheet disclosed net assets with both a fair and book value of $353,000. During 2021, Burks reported net income of $84,000 and declared and paid cash dividends of $24,000. Alamar sold inventory costing $27,000 to Burks during 2021 for $35,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar’s 2021 journal entries to apply the equity method to this investment. 4. Record the collection of dividend from investee.arrow_forwardOn January 1, 2019, Spring Co. purchased a 25% interest in Fall Inc. for $500,000. For the year ended December 31, 2019, Fall reported net income from operations of $65,000 and a loss from discontinued operations of $10,000 (net of tax). Fall paid dividends of $11,500 on December 31, 2019. Assume that Spring uses the equity method to account for its investment in Fall. Which of the following is the amount that would be reported on Spring's 2019 income statement relating to Fall? Multiple Choice Investment income of $13,750. Dividend revenue of $2,875. Investment income of $16,250 and investment loss, discontinued operations of $2,500. Investment income of $13,750 and investment loss, discontinued operations of $2,500.arrow_forward

- On January 1, 2023, Payne Company bought a 15 percent interest in Scout Company. The acquisition price of $225,500 reflected an assessment that all of Scout’s accounts were fairly valued within the company’s accounting records. During 2023, Scout reported net income of $121,900 and declared cash dividends of $36,200. Payne possessed the ability to significantly influence Scout’s operations and, therefore, accounted for this investment using the equity method. On January 1, 2024, Payne acquired an additional 80 percent interest in Scout and provided the following fair-value assessments of Scout’s ownership components: Consideration transferred by Payne for 80% interest $ 1,454,400 Fair value of Payne's 15% previous ownership 272,700 Noncontrolling interest's 5% fair value 90,900 Total acquisition-date fair value for Scout Company $ 1,818,000 Also, as of January 1, 2024, Payne assessed a $435,000 value to an unrecorded database internally developed by Scout. The database is…arrow_forwardOn August 1, 2023, Sandhill Corporation, which follows ASPE, purchased 20% of the outstanding voting shares in WLT Corporation for $1,220,000. At the time of purchase, WLT's net assets were undervalued by $70,000 and had a remaining useful life of 12 years. Both companies had a December 31 year-end. At the end of 2023, WLT reported a net income of $300,000. Also, on December 31, 2023, the fair value of the investment in WLT shares was $1,342,000. On January 10, 2024, WLT paid a cash dividend. Sandhill's ownership entitles it to $15,000 of the dividend. Prepare the journal entries on the books of Sandhill Corporation to record the transactions described above, assuming that the 20% interest in WLT does not represent significant influence, and that Sandhill elected to account for its investment following the fair value through net income (FV-NI) model. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order…arrow_forwardBuyCo, Inc., holds 20 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $11,900 per year. For 2020, Marqueen reported earnings of $117,000 and declares cash dividends of $34,000. During that year, Marqueen acquired inventory for $48,000, which it then sold to BuyCo for $80,000. At the end of 2020, BuyCo continued to hold merchandise with a transfer price of $33,000. What Equity in Investee Income should BuyCo report for 2020? How will the intra-entity transfer affect BuyCo’s reporting in 2021? If BuyCo had sold the inventory to Marqueen, would the answers to (a) and (b) have changed?arrow_forward

- Herbert, Inc., acquired all of Rambis Company’s outstanding stock on January 1, 2020, for $649,000 in cash. Annual excess amortization of $19,800 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $410,000, and Rambis reported a $226,000 balance. Herbert reported internal net income of $42,500 in 2020 and $55,400 in 2021 and declared $10,000 in dividends each year. Rambis reported net income of $28,500 in 2020 and $41,400 in 2021 and declared $5,000 in dividends each year. a. Assume that Herbert’s internal net income figures above do not include any income from the subsidiary. If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2021? What would be the amount of consolidated retained earnings on December 31, 2021, if the parent had applied either the initial value or partial equity method for internal accounting purposes? b. Under each of the following situations, what is…arrow_forwardsarrow_forwardHerbert, Inc., acquired all of Rambis Company’s outstanding stock on January 1, 2020, for $652,000 in cash. Annual excess amortization of $13,700 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $498,000, and Rambis reported a $232,000 balance. Herbert reported internal net income of $44,750 in 2020 and $58,350 in 2021 and declared $10,000 in dividends each year. Rambis reported net income of $23,300 in 2020 and $36,900 in 2021 and declared $5,000 in dividends each year. a. Assume that Herbert’s internal net income figures above do not include any income from the subsidiary. If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2021? What would be the amount of consolidated retained earnings on December 31, 2021, if the parent had applied either the initial value or partial equity method for internal accounting purposes? Equity method, initial value method and partial…arrow_forward

- On July 1, 2021, Gupta Corporation bought 25% of the outstanding common stock of VB Company for $110 million cash, giving Gupta the ability to exercise significant influence over VB’s operations. At the date of acquisition of the stock, VB’s net assets had a total fair value of $360 million and a book value of $240 million. Of the $120 million difference, $22 million was attributable to the appreciated value of inventory that was sold during the last half of 2021, $84 million was attributable to buildings that had a remaining depreciable life of 15 years, and $14 million related to equipment that had a remaining depreciable life of 5 years. Between July 1, 2021, and December 31, 2021, VB earned net income of $24 million and declared and paid cash dividends of $16 million. Required:1. Prepare all appropriate journal entries related to the investment during 2021, assuming Gupta accounts for this investment by the equity method.2. Determine the amounts to be reported by Gupta.arrow_forwardBuyCo, Inc. holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2017, Marqueen reported earnings of $100,000 and declares cash dividends of $30,000. During that year, Marqueen acquired inventory for $50,000, which it then sold to BuyCo for $80,000. At the end of 2017, BuyCo continued to hold merchandise with a transfer price of $32,000.a. What Equity in Investee Income should BuyCo report for 2017?b. How will the intra-entity transfer affect BuyCo’s reporting in 2018?c. If BuyCo had sold the inventory to Marqueen, how would the answers to (a) and (b) have changed?arrow_forwardOn January 1, 2022, Cullumber Corp. bought 31,000 shares of the available 100,000 common shares of Iceberg Inc., a publicly traded firm. This acquisition provided Cullumber with significant influence. Cullumber paid $719,000 cash for the investment. At the time of the acquisition, Iceberg reported assets of $2,507,000 and liabilities of $1,215,000. Asset values reflected fair market value, except for capital assets that had a net book value of $502,000 and a fair market value of $747,000. These assets had a remaining useful life of five years. For 2022 Iceberg reported net income of $409,000 and paid total cash dividends of $100,000. On May 16, 2023, Cullumber sold 15,500 of its shares in Iceberg for $425,000. Cullumber has no immediate plans to sell its remaining investment in Iceberg. Iceberg is actively traded, and stock price information follows: January 1, 2022 $29 December 31, 2022 $31 January 1, 2023 $32 Assuming Cullumber is using the equity method under ASPE, did the initial…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education