FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

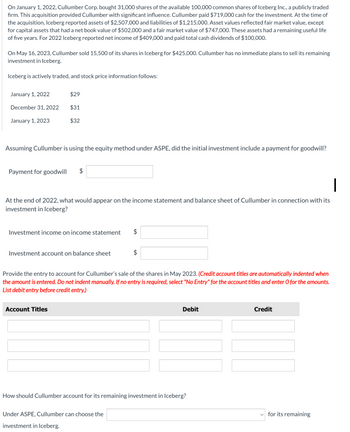

Transcribed Image Text:On January 1, 2022, Cullumber Corp. bought 31,000 shares of the available 100,000 common shares of Iceberg Inc., a publicly traded

firm. This acquisition provided Cullumber with significant influence. Cullumber paid $719,000 cash for the investment. At the time of

the acquisition, Iceberg reported assets of $2,507,000 and liabilities of $1,215,000. Asset values reflected fair market value, except

for capital assets that had a net book value of $502,000 and a fair market value of $747,000. These assets had a remaining useful life

of five years. For 2022 Iceberg reported net income of $409,000 and paid total cash dividends of $100,000.

On May 16, 2023, Cullumber sold 15,500 of its shares in Iceberg for $425,000. Cullumber has no immediate plans to sell its remaining

investment in Iceberg.

Iceberg is actively traded, and stock price information follows:

January 1, 2022

$29

December 31, 2022

$31

January 1, 2023

$32

Assuming Cullumber is using the equity method under ASPE, did the initial investment include a payment for goodwill?

Payment for goodwill

$

At the end of 2022, what would appear on the income statement and balance sheet of Cullumber in connection with its

investment in Iceberg?

Investment income on income statement

$

Investment account on balance sheet

$

Provide the entry to account for Cullumber's sale of the shares in May 2023. (Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.

List debit entry before credit entry.)

Account Titles

Debit

Credit

How should Cullumber account for its remaining investment in Iceberg?

Under ASPE, Cullumber can choose the

investment in Iceberg.

for its remaining

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define 'Investments':

VIEW Step 2: Determine if the initial investment include a payment for goodwill:

VIEW Step 3: Determine the amounts reported on income statement and balance sheet at the end of 2022:

VIEW Step 4: Provide the entry to account for sale of the shares in May 2023:

VIEW Step 5: Provide the treatment for remaining investment:

VIEW Solution

VIEW Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Company for $360 million cash, giving Cameron the ability to exercise significant influence over Lake's operations. At the date of acquisition of the stock, Lake's net assets had a fair value of $800 million. Its book value was $700 million. The difference was attributable to the fair value of Lake's buildings and its land exceeding book value, each accounting for one-half of the difference. Lake's net income for the year ended December 31, 2021, was $180 million. During 2021, Lake declared and paid cash dividends of $25 million. The buildings have a remaining life of 10 years. Required: 2. Determine the amounts to be reported by Cameron.arrow_forwardOn January 1, 2018, Morey, Inc., exchanged $178,000 for 25 percent of Amsterdam Corporation. Morey appropriately applied the equity method to this investment. At January 1, the book values of Amsterdam’s assets and liabilities approximated their fair values.On June 30, 2018, Morey paid $560,000 for an additional 70 percent of Amsterdam, thus increasing its overall ownership to 95 percent. The price paid for the 70 percent acquisition was proportionate to Amsterdam’s total fair value. At June 30, the carrying amounts of Amsterdam’s assets and liabilities approximated their fair values. Any remaining excess fair value was attributed to goodwill.Amsterdam reports the following amounts at December 31, 2018 (credit balances shown in parentheses):Amsterdam’s revenue and expenses were distributed evenly throughout the year and no changes in Amsterdam’s stock have occurred.Using the acquisition method, compute the following:a. The acquisition-date fair value of Amsterdam to be included in…arrow_forwardOn May 1, Freeman Company agreed to sell the assets of its Footwear Division to Albanese Incorporated for $97 million. The sale was completed on December 31, 2024. The following additional facts pertain to the transaction: • The Footwear Division qualifies as a component of the entity according to GAAP regarding discontinued operations. • The book value of Footwear's assets totaled $65 million on the date of the sale. • Footwear's operating income was a pre-tax loss of $14 million in 2024. . Freeman's income tax rate is 25%. In the income statement for the year ended December 31, 2024, Freeman Company would report income from discontinued operations of:arrow_forward

- An acquiring company pays $45 million in cash, and issues new no-par stock with a fair value of $75 million, to the acquired company's former owners, for the assets and liabilities of the acquired company. Registration fees associated with the new stock issuance are $300,000, paid in cash. Consulting fees for the acquisition are $1 million, paid in cash. The fair value of the acquired company's identifiable net assets is $65 million. The entry or entries the acquiring company makes to record the acquisition have what net effect on its account balances? Select one: O A. Capital stock increases by $75 million. O B. Expenses increase by 1.3 million. C. Goodwill increases by $55 million. O D. Cash decreases by $46 million.arrow_forwardThe Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Incorporated, for $6.40 per share on January 1, 2023. The remaining 20 percent of Devine's shares also traded actively at $6.40 per share before and after Holtz's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine's underlying accounts except that a building with a 5-year future life was undervalued by $62,000 and a fully amortized trademark with an estimated 10-year remaining life had a $67,000 fair value. At the acquisition date, Devine reported common stock of $100,000 and a retained earnings balance of $260,000. Following are the separate financial statements for the year ending December 31, 2024: Holtz Corporation $ (787,000) 282,000 346,000 (16,000) Accounts Sales Cost of goods sold Operating expenses Dividend income Net income $ (175,000) Retained earnings, 1/1/24 $ (727,000) Net income (above) Dividends declared…arrow_forwardOn January 1, 2023, Payne Company bought a 15 percent interest in Scout Company. The acquisition price of $225,500 reflected an assessment that all of Scout’s accounts were fairly valued within the company’s accounting records. During 2023, Scout reported net income of $121,900 and declared cash dividends of $36,200. Payne possessed the ability to significantly influence Scout’s operations and, therefore, accounted for this investment using the equity method. On January 1, 2024, Payne acquired an additional 80 percent interest in Scout and provided the following fair-value assessments of Scout’s ownership components: Consideration transferred by Payne for 80% interest $ 1,454,400 Fair value of Payne's 15% previous ownership 272,700 Noncontrolling interest's 5% fair value 90,900 Total acquisition-date fair value for Scout Company $ 1,818,000 Also, as of January 1, 2024, Payne assessed a $435,000 value to an unrecorded database internally developed by Scout. The database is…arrow_forward

- On July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $785,225 in cash and equity securities. The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $336,525 both before and after Truman's acquisition. In reviewing its acquisition, Truman assigned a $128.500 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary's income was earned uniformly throughout the year. The subsidiary declared dividends quarterly. Revenues Operating expenses Income of subsidiary Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Current assets Investment in Atlanta Land Buildings Total assets Liabilities…arrow_forwardOn January 1, 2022, Oriole Corp. bought 28,000 shares of the available 100,000 common shares of Iceberg Inc., a publicly traded firm. This acquisition provided Oriole with significant influence. Oriole paid $722,000 cash for the investment. At the time of the acquisition, Iceberg reported assets of $2,493,000 and liabilities of $1,192,000. Asset values reflected fair market value, except for capital assets that had a net book value of $505,000 and a fair market value of $753,000. These assets had a remaining useful life of five years. For 2022 Iceberg reported net income of $390,000 and paid total cash dividends of $100,000. On May 16, 2023, Oriole sold 14,000 of its shares in Iceberg for $425,000. Oriole has no immediate plans to sell its remaining investment in Iceberg. Iceberg is actively traded, and stock price information follows: January 1, 2022 $29 December 31, 2022 $31 January 1, 2023 $32 (a) Assuming Oriole is using the equity method under ASPE. did the initial investment…arrow_forwardOn January 1, 2024, Pine Company owns 40 percent (124,000 shares) of Seacrest, Incorporated, which it purchased several years ago for $700,600. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2024, is $905,200. Excess patent cost amortization of $37,200 is still being recognized each year. During 2024, Seacrest reports net income of $846,000 and a $372,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 24,800 shares of Seacrest on August 1, 2024, for $236,528 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2023, Pine sold $71,000 in inventory (which it had originally purchased for only $42,600) to Seacrest. At the end of that fiscal year, Seacrest's inventory retained $12,800 (at sales price) of this merchandise, which was subsequently sold in the first…arrow_forward

- On January 1, 2020, Doone Corporation acquired 80 percent of the outstanding voting stock of Rockne Company for $544,000 consideration. At the acquisition date, the fair value of the 20 percent noncontrolling interest was $136,000, and Rockne's assets and liabilities had a collective net fair value of $680,000. Doone uses the equity method in its internal records to account for its investment in Rockne. Rockne reports net income of $230,000 in 2021. Since being acquired, Rockne has regularly supplied inventory to Doone at 25 percent more than cost. Sales to Doone amounted to $290,000 in 2020 and $390,000 in 2021. Approximately 30 percent of the inventory purchased during any one year is not used until the following year. What is the noncontrolling interest's share of Rockne's 2021 income? Prepare Doone's 2021 consolidation entries required by the intra-entity inventory transfers.arrow_forwardOn January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal…arrow_forwardOn January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education