FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

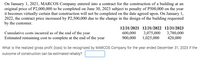

Transcribed Image Text:On January 1, 2021, MARCOS Company entered into a contract for the construction of a building at an

original price of P2,000,000 to be completed on June 30, 2023 subject to penalty of P500,000 on the year

it becomes virtually certain that construction will not be completed on the date agreed upon. On January 1,

2022, the contract price increased by P2,500,000 due to the change in the design of the building requested

by the customer.

12/31/2021 12/31/2022 12/31/2023

Cumulative costs incurred as of the end of the year

600,000

900,000

3,075,000

1,025,000

3,780,000

420,000

Estimated remaining cost to complete at the end of the year

What is the realized gross profit (loss) to be recognized by MARCOS Company for the year ended December 31, 2023 if the

outcome of construction can be estimated reliably?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Diamond Construction which has a calendar year end, has entered into a non-cancellable fixed priced contract of $4,200,000 beginning May 1, 2019 to build a road for a municipality. It has been estimated that the road will be complete by April 2021. The following data pertains to the construction period: 2019 2020 2021 Costs during the year 1,850,000 1,700,000 500,000 Estimated costs to complete 2,050,000 700,000 - Total Required Assuming the company uses the percentage of completion method based on input, calculate and record the revenue and profit for each year (i.e. prepare only the annual journal entry reporting the revenue / profit for the year).arrow_forwardCurtiss Construction Company, Incorporated, entered into a fixed-price contract with Axelrod Associates on July 1, 2024, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,480,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Percentage of completion Costs incurred to date Estimated costs to complete Billings to Axelrod, to date At 12-31-2024 At 12-31-2025 $367,000 3,303,000 728,000 $ 2,856,000 1,904,000 2,330,000 Ren 1 and 2 10% Dan 3 60% Answer is not complete. Complete this question by entering your answers in the tabs below. Required: 1. Compute gross profit or loss to be recognized as a result of this contract for each of the three…arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2021, for a three-year period ending December 31, 2023. The lease agreement specified annual payments of $32,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2022. The company had the option to purchase the machine on December 30, 2023, for $41,000 when its fair value was expected to be $56,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor’s implicit rate of return was 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forward

- Elton Electronics leases testing equipment to Startup Corporation. The equipment is not specialized and is delivered on January 1, 2023. The fair value of the equipment is $118,000. The cost of the equipment to Elton is $113,000 and the expected life of the testing equipment is 8 years. Elton incurs initial direct costs of $10,000, which they elect to expense. The lease term for the equipment is 8 years, with the first payment due upon delivery, and seven subsequent annual payments beginning on December 31, 2023 and ending on December 31, 2029. Elton's implicit rate is 5% and they expect that collection of the $14,500 lease payments is probable.What is the principal balance in the Net Investment in Lease — Sale Type account after the second payment on December 31, 2023? Group of answer choices $98,402 $83,902 $113,000 $73,597arrow_forwardGarnet Corporation enters into a 4-year construction contract worth $100 million with Gold company on January 1, 2022. At the end of 2022, construction costs totaled $20 million and Garnet estimates $60 million of construction costs remain. If Garnet uses the percent of completion method to determine revenues, how much revenue will Garnet recognize in 2022 related to the construction contract?arrow_forwardOn January 1, 2024, Nguyen Electronics leased equipment from Nevels Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Nevels. The equipment cost Nevels $779,677 and has an expected economic life of five years. Nevels expects the residual value on December 31, 2027, will be $103,000. Negotiations led to the lessee guaranteeing a $146,000 residual value. Equal payments under the lease are $203,000 and are due on December 31 of each year with the first payment being made on December 31, 2024. Nguyen is aware that Nevels used a 8% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for both Nguyen and Nevels on January 1, 2024, to record the lease. Prepare all appropriate entries for both Nguyen and Nevels on December 31, 2024, related to the lease.arrow_forward

- On January 1, 2021, Central Industries leased a high-performance conveyer to Dynamic Company for a four-year period ending December 31, 2021, at which time possession of the leased asset will revert back to Central. The equipment cost Central $1,912,000 and has an expected useful life of five years. Central expects the residual value at December 31, 2025, will be $600,000. Negotiations led to the lessee guaranteeing a $680,000 residual value. Equal payments under the finance/sales-type lease are due on December 31 of each year with the first payment being made on December 31, 2021. Dynamic is aware that Central used a 5% interest rate when calculating lease payments.What is the amount that the lessee will record as Right-of-use-Asset and Lease Liability ?arrow_forwardOn January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of $100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is $2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswell’s incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of $7,000 annually,…arrow_forwardOn February 1, 2023, Armen Inc. entered into a contract to deliver one of its specialty machines to Idris Inc. The contract requires Idris Inc to pay the contract price of $15,000 in advance on February 20, 2023. Idris Inc. pays Armen Inc on February 20, 2023, and Armen Inc delivers the machine (costing $12,600) on February 28, 2023 and Idris Inc starts using the machine on March 3, 2023. When should Armen Inc recognize revenue?arrow_forward

- Assume that Crane Construction Company has a non-cancellable contract to construct a $4,640,000 bridge at an estimated cost of $4,176,000. The contract is to start in July 2023, and the bridge is to be completed in October 2025. The following data pertain to the construction period. (Note that, by the end of 2024, Crane has revised the estimated total cost from $4,176,000 to $4,228,200.) Assume that progress billings are non-refundable. Costs to date (12/31) Estimated costs to complete (12/31) Progress billings during the year Cash collected during the year (a1) Account Titles and Explanation (To record cost of construction) (To record progress billings) (To record collections) (To record revenues) 2023 (To record construction expense) 3,173,760 $1,002,240 $2,959,740 $4,228,200 994,000 2024 834,960 1,268,460 2,483,000 Prepare all journal entries required for Crane to account for this contract for 2023. (Credit account titles are automatically indented when the amount is entered. Do not…arrow_forward1. During 2020, Bay Construction started a new construction job with a contract price of $750 million. Bay has a 12/31 fiscal year end. Bay has determined that the contract does not qualify for revenue recognition over time. The contract was completed on 12/31/22 with the following information ($ in millions): Costs incurred in the period (paid in cash) Estimated costs to complete at 12/31 Billings on contract in the period Cash collected in the period 2020 180.0 2021 2022 432.0 150.0 540.0 153.0 -0- 150 350 250 200 400 150 What is the amount of gross profit (loss) on the contract that Bay would recognize on the Income Statement in 2020, 2021 and 2022? You must show supporting work (calculations/explanations) to receive credit for your answers. Gross Profit (Loss) 2020 2021 2022arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education