FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

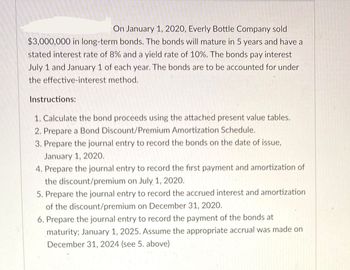

Transcribed Image Text:On January 1, 2020, Everly Bottle Company sold

$3,000,000 in long-term bonds. The bonds will mature in 5 years and have a

stated interest rate of 8% and a yield rate of 10%. The bonds pay interest

July 1 and January 1 of each year. The bonds are to be accounted for under

the effective-interest method.

Instructions:

1. Calculate the bond proceeds using the attached present value tables.

2. Prepare a Bond Discount/Premium Amortization Schedule.

3. Prepare the journal entry to record the bonds on the date of issue,

January 1, 2020.

4. Prepare the journal entry to record the first payment and amortization of

the discount/premium on July 1, 2020.

5. Prepare the journal entry to record the accrued interest and amortization

of the discount/premium on December 31, 2020.

6. Prepare the journal entry to record the payment of the bonds at

maturity; January 1, 2025. Assume the appropriate accrual was made on

December 31, 2024 (see 5. above)

![Table A-4 Present Value Interest Factors for a One-Dollar Annuity

Discounted at k Percent for n Periods: PVIFA = [1 - 1/(1+ k)n] / k

Period

1

2

3

4

6

6

7

8

9

10

Period

1

2

3

4

5

6

7

8

1%

0.9901

1.9704

2.9410

9

10

3.9020

4.8534

5.7955

6.7282

7.6517

8.5660

9.4713

1%

0.9901

0.9803

0.9706

0.9610

0.9515

2%

0.9804

1.9416

2.8839

3.8077

4.7135

0.9420

0.9327

0.9235

0.9143

0.9053

5.6014

6.4720

7.3255

8.1622

8.9826

2%

0.9804

0.9612

0.9423

Table A-3 Present Value Interest Factors for One Dollar Discounted at k

Percent for n Periods: PVIF kn = 1/(1+k) "

0.9238

0.9057

0.8880

3%

0.9709

1.9136

2.8286

3.7171

4.5797

0.8706

0.8535

0.8368

0.8203

5.4172

6.2303

7.0197

7.7861

8.5302

3%

0.9709

0.9426

0.9161

0.8885

0.8626

4%

0.9615

1.8861

2.7751

3.6299

4.4518

0.8375

0.8131

0.7894

0.7664

0.7441

5.2421

6.0021

6.7327

7.4353

8.1109

4%

0.9615

0.9246

0.8890

0.8548

0.8219

0.7903

0.7599

0.7307

5%

0.9524

1.8694

2.7232

3.5460

4.3295

0.7026

0.6756

4.9173

5.5824

6.2098

7.1078

6.8017

7.7217 7.3601

5.0757

5.7864

6.4632

5%

0.9524

0.9070

0.8638

0.8227

0.7835

6%

0.9434

1.8334

2.6730

3.4651

4.2124

0.7462

0.7107

0.6768

0.6446

0.6139

6%

0.9434

0.8900

0.8396

0.7921

0.7473

0.7050

0.6651

0.6274

0.5919

7%

0.9346

1.8080

2.6243

3.3872

4.1002

0.5584

7%

4.7665

4.6229

5.3893

5.2064

5.9713

5.7466

6.5152

6.2469

6.7101

7.0236

0.9346

0.8734

0.8163

8%

0.9259

1.7833

2.5771

3.3121

3.9927

0.7629

0.7130

0.6663

0.6227

0.5820

0.5439

0.5083

8%

0.9259

0.8573

0.7938

0.7350

0.6806

0.6302

9%

10%

0.9174

0.9091

1.7591 1.7355

2.5313

2.4869

3.2397

3.1699

3.8897

3.7908

0.5835

0.5403

0.5002

0.4632

4.4859

5.0330

5.5348

5.9952

5.7590

6.4177 6.1446

9%

4.3553

4.8684

5.3349

0.9174

0.8417

0.7722

0.7084

0.6499

0.5963

0.5470

0.5019

0.4604

0.4224

10%

0.9091

0.8264

0.7513

0.6830

0.6209

0.5645

0.5132

0.4665

0.4241

0.3856](https://content.bartleby.com/qna-images/question/d32d6cc9-9800-43be-ac45-0d98c4f2b23d/b87bda50-4040-4b96-99ed-2bed0b264cc6/5nazxte_thumbnail.jpeg)

Transcribed Image Text:Table A-4 Present Value Interest Factors for a One-Dollar Annuity

Discounted at k Percent for n Periods: PVIFA = [1 - 1/(1+ k)n] / k

Period

1

2

3

4

6

6

7

8

9

10

Period

1

2

3

4

5

6

7

8

1%

0.9901

1.9704

2.9410

9

10

3.9020

4.8534

5.7955

6.7282

7.6517

8.5660

9.4713

1%

0.9901

0.9803

0.9706

0.9610

0.9515

2%

0.9804

1.9416

2.8839

3.8077

4.7135

0.9420

0.9327

0.9235

0.9143

0.9053

5.6014

6.4720

7.3255

8.1622

8.9826

2%

0.9804

0.9612

0.9423

Table A-3 Present Value Interest Factors for One Dollar Discounted at k

Percent for n Periods: PVIF kn = 1/(1+k) "

0.9238

0.9057

0.8880

3%

0.9709

1.9136

2.8286

3.7171

4.5797

0.8706

0.8535

0.8368

0.8203

5.4172

6.2303

7.0197

7.7861

8.5302

3%

0.9709

0.9426

0.9161

0.8885

0.8626

4%

0.9615

1.8861

2.7751

3.6299

4.4518

0.8375

0.8131

0.7894

0.7664

0.7441

5.2421

6.0021

6.7327

7.4353

8.1109

4%

0.9615

0.9246

0.8890

0.8548

0.8219

0.7903

0.7599

0.7307

5%

0.9524

1.8694

2.7232

3.5460

4.3295

0.7026

0.6756

4.9173

5.5824

6.2098

7.1078

6.8017

7.7217 7.3601

5.0757

5.7864

6.4632

5%

0.9524

0.9070

0.8638

0.8227

0.7835

6%

0.9434

1.8334

2.6730

3.4651

4.2124

0.7462

0.7107

0.6768

0.6446

0.6139

6%

0.9434

0.8900

0.8396

0.7921

0.7473

0.7050

0.6651

0.6274

0.5919

7%

0.9346

1.8080

2.6243

3.3872

4.1002

0.5584

7%

4.7665

4.6229

5.3893

5.2064

5.9713

5.7466

6.5152

6.2469

6.7101

7.0236

0.9346

0.8734

0.8163

8%

0.9259

1.7833

2.5771

3.3121

3.9927

0.7629

0.7130

0.6663

0.6227

0.5820

0.5439

0.5083

8%

0.9259

0.8573

0.7938

0.7350

0.6806

0.6302

9%

10%

0.9174

0.9091

1.7591 1.7355

2.5313

2.4869

3.2397

3.1699

3.8897

3.7908

0.5835

0.5403

0.5002

0.4632

4.4859

5.0330

5.5348

5.9952

5.7590

6.4177 6.1446

9%

4.3553

4.8684

5.3349

0.9174

0.8417

0.7722

0.7084

0.6499

0.5963

0.5470

0.5019

0.4604

0.4224

10%

0.9091

0.8264

0.7513

0.6830

0.6209

0.5645

0.5132

0.4665

0.4241

0.3856

Expert Solution

arrow_forward

Step 1

Hi student

Since there are multiple subparts, we will answer only first three subparts.

Bonds is one of the form of source of finance being used in business. There can be long term bonds or short term bonds, depending on the term.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, 2020, the market interest rate is 2.4%. Colwood Enterprises issues $500,000 of 3.4%, 16-year bonds at 110.625. The bonds pay interest on June 30 and December 31. Colwood amortizes bonds by the effective-interest method. Requirements 1. Prepare a bond amortization table for the first four semi-annual interest periods. 2. Record issuance of the bonds on June 30, 2020, the payment of interest at December 31, 2020, and the semi-annual interest payment on June 30, 2021. Requirement 1. Prepare a bond amortization table for the first four semi-annual interest periods. (Round your answers to the nearest whole dollar.) A B Colwood Enterprises Amortization Table C D Interest Expense Interest Payment (1.2% of Preceding Premium Semi-Annual (1.7% of Maturity Value) Bond Carrying Amount) (A-B) Premium (D-C) Amortization Account Balance Amount ($500,000+ E Bond Carrying D) Interest Date June 30, 2020 Dec. 31, 2020 June 30, 2021 Dec. 31, 2021 June 30, 2022arrow_forward. On 1/1/21, Ehrlich Co. issued 4 year bonds with a face value of $700,000. The stated (bond) rate is 8%, payable semiannually on 1/1 and 7/1. The market rate at the time of issuance was 10%. a. Calculate the issue price of the bonds. b. Prepare the journal entry for the issuance of the bonds. c. Complete the amortization table below. Date cash paid interest expense amortization carrying value 1/1/21 7/1/21 1/1/22 7/1/22 d. Prepare the journal entries for the 7/1/21 interest payment and amortization, 12/31/21 interest accrual and amortization, and 1/1/22 interest payment. e. Prepare the journal entry for retirement of the bonds at maturity f. Assume instead that the bonds were redeemed on 7/1/22 at 102. Prepare the journal entry.arrow_forwardOn October 1, 2020, Ross Wind Energy Inc. issued a $1,610,000, 7.0%, seven-year bond. Interest is to be paid annually each October 1. Assume a November 30 year-end. (Use TABLE 14A.1 and TABLE 14A.2.). (Use appropriate factor(s) from the tables provided.) Required: a. Calculate the issue price of the bond assuming a market interest rate of 6% on the date of the bond issue. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Issue price of the bond b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Dorind Cash Period Dromium Unamortized Carringarrow_forward

- On January 1, 2023, ABC Company issued $60,000,000 of 20-year, 9.5% bonds when the market rate of interest was 10.25%. Interest is paid semi-annually on June 30 and December 31. Required: Using Excel compute the price at which the bond was issued. Using Excel and the effective interest method of bond amortization prepare an amortization table for the entire life of the bond issue. You are expected to do all calculations in Excel (What are the excel Formulas) Prepare ALL journal entries for the following dates: January 1, 2023, June 30, 2023, December 31, 2023, and December 31, 2042arrow_forward(b) Prepare an effective-interest amortization table for the first eight interest payments for these bonds. (c) The Bonds were redeemed on January 1, 2026 (after the interest had been paid and recorded) at 102. Prepare the journal entry for the redemption of the bonds.arrow_forwardOn March 1, 2020, Quinto Mining Inc. issued a $690,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. 1. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue 2. Using the effective interest method, prepare an amortization schedule. (Image attached) This question has a follow up, posted separately. Thanks!arrow_forward

- The Werner Company issued 10-year bonds on January 1, 2020. The debt has a face value of $800,000 and an annual stated interest rate of 6%. Interest payments are due semiannually beginning June 30, 2020. The market interest rate on the bonds is 6%. a.What will this bond be priced at on January 1, 2020? b.More advanced: On January 1, 2023, the market rate of interest for these bonds is 8%. What will you be willing to pay for these bonds on that date?arrow_forwardOn June 30, 2020, Wayne's Company issued $4,000,000 face value of 13%, 20-year bonds at $4,300,920, a yield of 12%.Wayne uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31. #1. Set up a schedule of interest expense and premium/discount amortization under the effective-interest method. (Hint: The eff ective-interest rate must be computed.) (Please use excel & show all formulas)arrow_forwardThe bonds mature on December 31, 2033 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. to 4. Prepare the journal entries to record their issuance by The Bradford Company on January 1, 2024, interest on June 30, 2024 (at the effective rate) and interest on December 31, 2024 (at the effective rate). Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Req 1 Req 2 to 4 Determine the price of the bonds at January 1, 2024. Note: Enter your answer in whole dollars. Price of bondsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education