FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

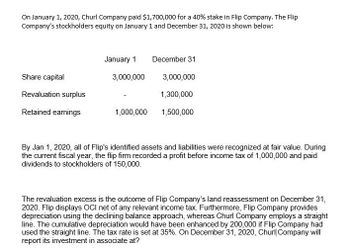

Transcribed Image Text:On January 1, 2020, Churl Company paid $1,700,000 for a 40% stake in Flip Company. The Flip

Company's stockholders equity on January 1 and December 31, 2020 is shown below:

Share capital

Revaluation surplus

Retained earnings

January 1

3,000,000

1,000,000

December 31

3,000,000

1,300,000

1,500,000

By Jan 1, 2020, all of Flip's identified assets and liabilities were recognized at fair value. During

the current fiscal year, the flip firm recorded a profit before income tax of 1,000,000 and paid

dividends to stockholders of 150,000.

The revaluation excess is the outcome of Flip Company's land reassessment on December 31,

2020. Flip displays OCI net of any relevant income tax. Furthermore, Flip Company provides

depreciation using the declining balance approach, whereas Churl Company employs a straight

line. The cumulative depreciation would have been enhanced by 200,000 if Flip Company had

used the straight line. The tax rate is set at 35%. On December 31, 2020, Churl Company will

report its investment in associate at?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 960 shares @ $ 14 each $ 13,440 Rogers Company 880 shares @ $ 20 each 17,600 Chance Company 520 shares @ $ 10 each 5,200 Equity investments @ cost 36,240 Fair value adjustment ( 7,300 ) Equity investments @ fair value $ 28,940 During 2020, the following transactions took place. 1. On March 1, Rogers Company paid a $ 2 per share dividend. 2. On April 30, Oriole, Inc. sold 320 shares of Chance Company for $ 11 per share. 3. On May 15, Oriole, Inc. purchased 100 more shares of Evers Company stock at $ 17 per share. 4. At December 31, 2020, the stocks had the following price per share values: Evers $ 18, Rogers $ 19, and Chance $ 9. During 2021, the following transactions took place. 5. On February 1, Oriole, Inc. sold the remaining Chance shares for $ 9 per share. 6. On March 1, Rogers Company paid a $ 2…arrow_forwardAs of December 31, 2021, Halaga Corporation reported the following items in its balance sheet: Cash- P520,000 Receivables- P240,000 Inventory- P350,000 Equipment- P850,000 Accounts payable- P325,650 Short-term notes payable- P524,500 Long-term debt- P1,049,850 Weighted average of outstanding shares in 2021- P250,000 Halaga Corporation contracted a third-party appraiser which has determined that the replacement value of its assets. This resulted to P14.22 calculation as its replacement value per share of the company.Based on the report of the appraiser, the property and plant have replacement cost of 125% of its reported value. On the other hand, the equipment only commands replacement cost of 70% of its value. According to the appraiser, the equipment was designed using an old technology, thus, the lower replacement cost. Other assets and liabilities are valued fairly.How much is the book value per share of Halaga Corporation as of December 31, 2021? a. Php 0.24 b. Php 14.22 c.…arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,425,000, $145,000 in the common stock account, and $2,700,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,630,000, $155,000 in the common stock account and $3,000,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,500 and the company paid out $150,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,010,000, and the firm reduced its net working capital investment by $130,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forward

- Please answer in good accounting form. Thankyou What is the retained earnings balance ending December 31, 2021?arrow_forwardFlatfish Limited reported the following items in shareholders' equity on December 31, 2020: Share capital: Preferred shares, $5 cumulative dividend, 144,000 shares issued and outstanding Share capital: Common shares, 699,000 issued and outstanding Retained earnings 2018 arrears 2019 arrears No dividends were declared in 2018 or 2019; however, in 2020, cash dividends of $4,851.150 were declared. Calculate how much would be paid to each class of shares. 2020 2018 arrears 2019 arrears Preferred 2020 Preferred $ No dividends were declared in 2018 or 2019; however, in 2020, cash dividends of $4,851.150 were declared. Calculate how much would be paid to each class of shares. Common Cash dividend per share $ $14,400,000 Common 27,960,000 $ 22,900,000 Total S Total Assuming that the number of common shares remained constant throughout 2020, what was the cash dividend per share distributed to the common shareholders? (Round answer to 2 decimal places, e.g. 4.62.) $arrow_forwardSunland Rental Corporation had the following balances in its shareholders' equity accounts at January 1, 2021: Accumulated other comprehensive income (loss) Contributed surplus-reacquisition of common shares Retained earnings Common shares (25,000 shares) Feb. 2 Sunland had the following transactions and events during 2021: Apr. 17 Oct. 29 $ (26,000) Dec. 31 559,000 1,600,000 625.000 Repurchased 1.200 shares for $57,600. Declared and paid cash dividends of $71,000. Issued 1,900 shares for $106,000 cash. Reported comprehensive income of $415,000, which included other comprehensive income of $31.000.arrow_forward

- The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,460,000, $152,000 in the common stock account, and $2,770,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,700,000, $162,000 in the common stock account and $3,070,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $100,000 and the company paid out $157,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,080,000, and the firm reduced its net working capital investment by $137,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow Prev 9 of 10 ▬▬▬ ‒‒‒ Next >arrow_forwardGary Company reported the following amounts in the equity section of its Dec. 31, 2020, statement of financial position. Share capital - Preference. 8%, P100 par (10,000 shares authorized, 2,000 shares issued) P200,000 Share capital-ordinary, P5 par (100,000 shares authorized, 20,000 shares issued) 100,000 Share premium 125,000 Retained earnings 450,000 Total 875,000 During 2021, Gary took part in the following transactions concerning equity. Paid the annual 2020 P8 per share dividend on preference shares and a P2 per share dividend on ordinary shares. These dividends had been declared on Dec. 31, 2020. Purchase 2,700 shares of its own outstanding ordinary shares for P40 per share. Gary uses the cost method. Reissued 700 treasury…arrow_forwardOriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 970 shares @ $14 each $13,580 Rogers Company 910 shares @ $18 each 16,380 Chance Company 500 shares @ $9 each 4,500 Equity investments @ cost 34,460 Fair value adjustment (7,840 ) Equity investments @ fair value $26,620 During 2020, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Oriole, Inc. sold 290 shares of Chance Company for $11 per share. 3. On May 15, Oriole, Inc. purchased 90 more shares of Evers Company stock at $17 per share. 4. At December 31, 2020, the stocks had the following price per share values: Evers $18, Rogers $17, and Chance $8. During 2021, the following transactions took place. 5. On February 1, Oriole, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend.…arrow_forward

- The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,435,000, $147,000 in the common stock account, and $2,720,000 in the additional paid-in surplus account. The December 31, 2019, balance sheet showed long-term debt of $1,650,000, $157,000 in the common stock account and $3,020,000 in the additional paid-in surplus account. The 2019 income statement showed an interest expense of $97,500 and the company paid out $152,000 in cash dividends during 2019. The firm's net capital spending for 2019 was $1,030,000, and the firm reduced its net working capital investment by $132,000. What was the firm's 2019 operating cash flow, or OCF? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Operating cash flowarrow_forwardThe Shareholders’ Equity section of Green Corporation at December 31, 2019 showed the following: 8% cumulative Preference share capital, P 100 par, liquidating value P110 - P2,000,000; Ordinary Share Capital, P50 par - P2,500,000; Additional Paid In Capital - P 500,000; Retained Earnings - P 1,000,000. During the year, the company earned profit of P 500,000. Compute the book value per share for the Preference share assuming dividends are in arrears for 3 years including the current yearUsing data, Compute the book value per share for the Ordinary Share Capitalarrow_forwardThe shareholders’ equity section of the balance sheet of TNL Systems Inc. included the following accounts at December 31, 2020: Shareholders' Equity ($ in millions) Common stock, 200 million shares at $1 par $ 200 Paid-in capital—excess of par 1,600 Paid-in capital—share repurchase 2 Retained earnings 1,000 Required: 1. During 2021, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. On February 5, 2021, TNL Systems purchased 8 million shares at $12 per share. On July 9, 2021, the corporation sold 3 million shares at $14 per share. On November 14, 2023, the corporation sold 3 million shares at $9 per share. 2. Prepare the shareholders’ equity section of TNL Systems’ balance sheet at December 31, 2023, comparing the two approaches. Assume all net income earned in 2021–2023 was distributed to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education